Interview with Rob McEwen, Chairman & Chief Owner of McEwen Mining (NYSE: MUX, TSX: MUX): Rapidly Growing Gold and Silver Producer in the Americas

|

Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a growing gold and silver producer in the Americas, with operations in Argentina, Mexico, Nevada, and Canada. The Company's goal is to qualify for inclusion in the S&P 500. We learned from Mr. Rob McEwen, Chairman & Chief Owner of McEwen Mining, that in 2019 the company will be producing 200,000 ounces gold equivalent. It’s internal growth pipeline could add another 50% to the company's annual production over the next four years, bringing it to 300,000 ozs. According to Mr. McEwen, in order to qualify for the S & P, they need to get to an annual production rate in excess of 600,000 ounces a year and have a credible growth pipeline to 1 million ozs. per year. Plans for 2019 include commencing commercial production at the company's Gold Bar mine in Nevada, as well as cost-reduction and exploration work in Timmins, and innovative in pit tailings disposal in Mexico. McEwen Mining is incorporated in the state of Colorado.

Mr. Rob McEwen, Chairman & Chief Owner of McEwen Mining

Biography of an Outstanding Contributor to the Mining Industry, Mr. Rob McEwen

Mr. Rob McEwen is the Chairman and Chief Owner of McEwen Mining Inc. He is the founder and former Chairman and CEO of Goldcorp Inc., one of the largest gold producers in the world. In 1990, Rob jumped from the investment industry into the mining industry. By 1993, he had begun a consolidation of five companies that would take eight years to complete. The resulting company was Goldcorp Inc., which has become a gold mining powerhouse. During the last thirteen years of Mr. McEwen being Goldcorp's CEO, the company’s market capitalization grew from $50 million to over $8 billion and its share price grew at a compound annual rate of 31%. Mr. Rob McEwen was awarded the Order of Canada in 2007 and the Queen Elizabeth's Diamond Jubilee Award in 2013. He holds an Honorary Doctor of Laws and an MBA from York University and a BA from the University of Western Ontario. Also, he received the 2001 PDAC Developer of the Year Award, and was inducted into The Canadian Mining Hall of Fame in 2017 and received the 2018 Bryden Alumni Award for Outstanding Contribution.

Interview

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Rob McEwen, the Chairman and Chief Owner of McEwen Mining. Could you tell our readers/investors your thoughts on what's happening in the gold market?

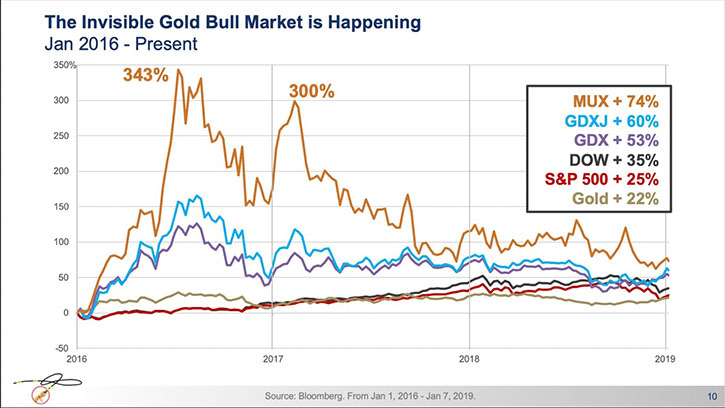

Mr. Rob McEwen: Most investors believe the price of gold is not going higher any time soon! The media has said that gold wasn't worth looking at, but I can tell you in the last 24 months, from the beginning of 2016 to January 7, 2019, prices of gold equities have performed very well against the broad market. The S&P 500 is up 25%, the Dow is up 35% and while gold is only up 22 %, gold equities have delivered significant gains. The GDX, the index of senior gold stocks, increased 53%, the GDXJ, the index of Junior Gold stocks increased 60% and our own share price, MUX, was up 74%.

At some point, the popular and broad media is going to stop talking about making money with crypto, cannabis and biotech stocks, and start talking about making money in gold stocks

I believe we are today in the late cycle stage of a bull market where commodities start to increase in value. We are in the early stage of a bull market for precious metals.

Dr. Allen Alper: That sounds very good! Also, I understand there's a disconnect between America's thoughts on gold and the Europeans?

Mr. Rob McEwen: The European investors seem to be more receptive to adding gold to their portfolio right now. Because they once had global empires, they watch the other markets and currencies more closely. Gold is performing strongly in other parts of the world. Take a look at the price of gold in USD, it’s up 22% but in Turkish lira, gold is up 124% and in the Argentinian peso, gold has increased 250% since January of 2016.

I think Europeans are closer to these other markets than most Americans. Therefore, they're seeing these early changes occurring and they're investing in response to those changes.

Dr. Allen Alper: That sounds like American awareness should be coming in the next quarter or two.

Mr. Rob McEwen: Yes. I would agree.

Dr. Allen Alper: Could you give our readers/investors an overview of what's happening with McEwen Mining and your vision for the Company?

Mr. Rob McEwen: Yes, one of McEwen Mining’s overreaching goals is to qualify for the S & P 500. Our gold equivalent production forecast for 2019 is 200,000 ozs. In order to qualify for the S & P, we need to get to an annual production rate of 600,000 ounces a year with production costs in the bottom half of the industry’s cost curve and have an average mine life in excess of nine years. So we're working on that. We have internal growth prospects which if we go ahead with would increase our annual production by 50% over the next four years. But to get to 600,000 ozs of annual production will require us to do some serious M & A. There's opportunity out there, consolidation is happening in the industry and we plan to be part of that process.

Dr. Allen Alper: That sounds very good.

Mr. Rob McEwen: Thank you.

Dr. Allen Alper: Could you tell our readers/investors what progress is being made in Argentina, Mexico, Nevada, and Canada with your production development and exploration properties?

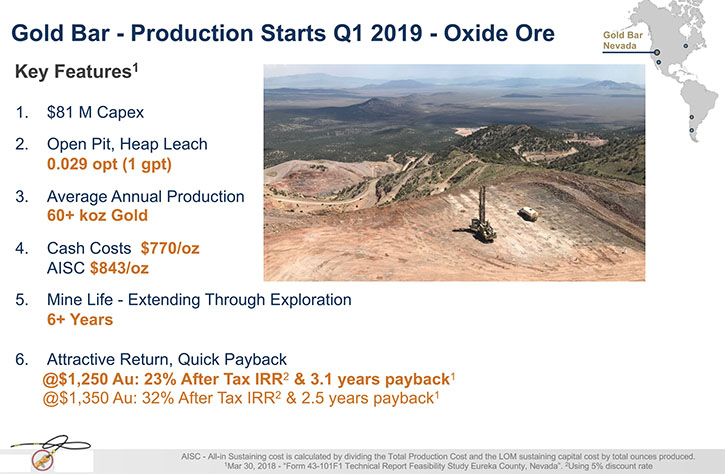

Mr. Rob McEwen: Certainly. We have operations in four countries. In Nevada, we began construction on our Gold Bar Mine in November 2017, right after we received our permit to start construction. It's largely built right now, and we're loading ore onto the pads. It'll be an open pit, heap leach mine and we expect to be in commercial production by the end of the first quarter of this year.

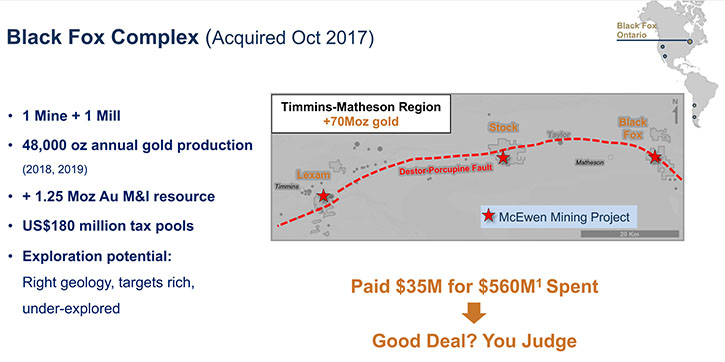

In Timmins, we're working on the Black Fox Mine that we bought in October 2017. It was a high cost, short life mine. We feel we've made good progress reducing costs, which should become apparent in Q2 of this year.

We've also invested heavily in exploration in Timmins. In 2018the exploration budget was 15 million dollars and we plan a similar budget for this year. We raised 15 million dollars by way of what's called a “flow through financing” in Canada, which is a tax driven instrument, where the market pays a premium to buy shares where the investor ends up with a large tax deduction. Utilizing the vehicle we were able to raise 15 million dollars at a 26% premium to the market to fund the 2019 exploration program. We expect our aggressive exploration program will be able to extend the mine life.

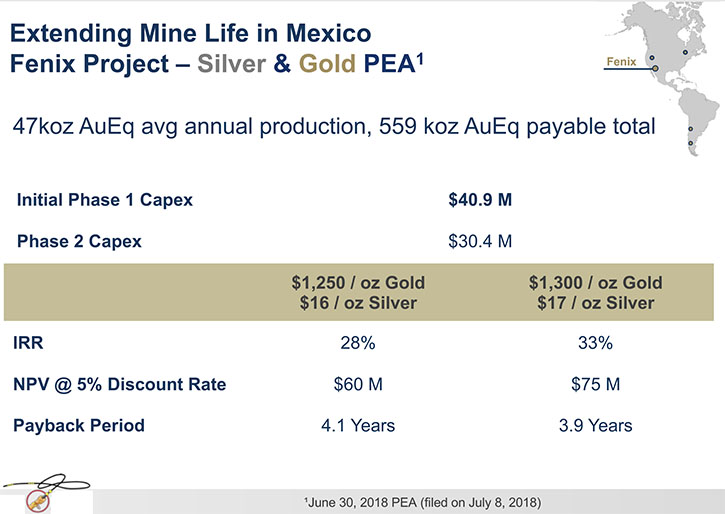

In Mexico, we are working with its government and environmental agencies to amend the permit we have to build our silver mine, which we initially called El Gallo Two. It's now called Fenix. We received the approval to build the mine in 2015, but the timing was bad because the price of gold and silver was very low as was our share price. We saw no point in raising money and unnecessarily diluting out share owners at the bottom of the market. So we decided to wait for better silver and gold prices before going forward. We're asking the Mexican government to allow us to fill the pit that we created at our gold mine, with the tailings or the waste product of our new Fenix mine. While this method of tailings disposal is not common in Mexico, it is common in Australia, where there are at least 40 examples. It's quite an elegant way of dealing with capital and environmental issues.

One, it reduces our capital cost. Two, it reduces our usage of water and three, it reduces the capital required to reclaim the land because we're filling in a pit. We expect to get an answer from the government in the first half of this year. With an amended permit approved we will be able to start construction later this year. This mine is expected to produce approximately 4 million ozs. of silver per year, equivalent to approximately 50,000 ozs. of gold, and have a mine life of twelve years. Production costs are forecast to be in the bottom half of the industry cost curve and capex is low at approximately $70 million to be invested over 3 years.

In Argentina, our San Jose mine joint venture keeps producing gold and silver. It's been operating since 2007. It's a high grade, silver and gold underground mine. It has five years reserves in front of it. In 2018, approximately four million dollars was invested in exploration. Results will be released in Q1. Unfortunately, Argentina reinstated an export tax on mineral exports which has reduced our forecast cash flow from this mine

Dr. Allen Alper: Sounds like excellent progress has been made in the last year, and it looks like great things are going to happen in 2019 to increase your production and profitability. Could you tell our readers/investors a bit about your capital structure and your personal investment and remuneration?

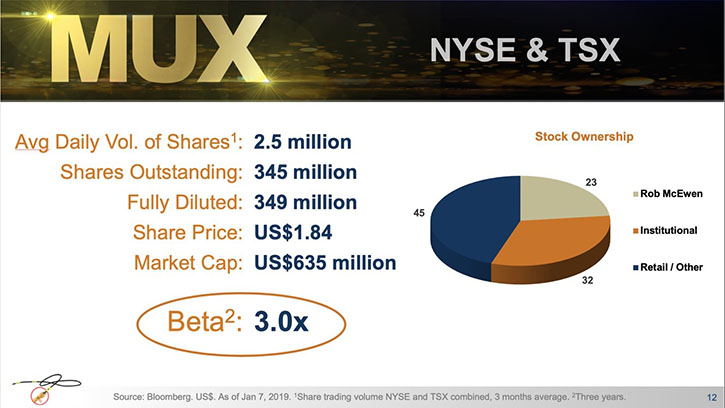

Mr. Rob McEwen: Happy to. We have currently 343 million shares outstanding after completing the $15 million flow through financing in December. I own 23% of the company. My cost base of my equity position is $136 million dollars plus I have lent the company $25 million as part of the $50 million debt financing completed in August 2018. We did the debt financing rather than equity to reduce diluting when our share price was low and we expected better gold and share prices in 2019. So my total investment in the company is 161 million dollars.

Dr. Allen Alper: Well that sounds like you have great faith in the Company. I understand your rewards are the same as your other investors. You are not receiving any salary. When the stock increases that will be your reward. Is that correct?

Mr. Rob McEwen: Pretty much. I did get a salary raise two years ago. I now get a dollar a year. In addition, by my choice, I don't receive any bonus or stock options.

Dr. Allen Alper: That's excellent. It shows you have great faith in the Company and you're willing to share your rewards with your investors, so that's excellent.

Mr. Rob McEwen: Absolutely. Furthermore, I believe that management of the precious metals industry has paid themselves too much given the dismal performance of the industry. They should be sharing some of the pain that their shareholders have felt during that period. They should be more closely aligned financially. That's why I elected to go with a dollar a year salary and have $161 million invested. As you said, the only way I'm going to make money is exactly the same way as my shareholders do, through a higher share price. Very motivating!

Dr. Allen Alper: Well that's excellent, and your shareholders have a great deal of faith in what you and your team are doing. Could you say a few words about your management team and board?

Mr. Rob McEwen: Yes. We've made some changes this year. We brought in a new President, who was instrumental in turning Kirkland Lake Gold’s Macassa mine around, from an operational standpoint. He's a strong operations person and he brought in a talented management group with him.

Our Head of Exploration joined us several years ago. He was formerly heading up Kinross's global exploration. He brings a wealth of knowledge from around the world and he's built a strong team under him.

If any of your readers would like more information on our management team and operations, on September 6, 2018, we recorded a two-hour session which is on our website: “https://mcewenmining.com”. It has an index, so you don't have to watch the full two hours, but if you wanted to look at any one of our properties you could go and just click on that and you'd hear from the management that is involved with each of those properties.

We're an active explorer. Our corporate exploration budget for 2018 totalled $25 million. Exploration is the R & D of the mining industry. It was through exploration success that I was able to build Goldcorp Inc. We have good trading liquidity, McEwen Mining , MUX actively trades on the New York Stock Exchange. In addition, according to Bloomberg, we have one of the highest betas to gold of any company in the gold mining industry. If you have readers that think gold's going higher, they may be able to get better return buying shares of MUX rather than some of the producers with a lower beta.

Of course, a high beta can be like a double edged sword as it can also exaggerate the downside. So you need to be aware of your tolerance for risk.

Dr. Allen Alper: You have an outstanding history of success in the gold mining industry. Goldcorp is testament to that. Your approach to organizing and planning McEwen Mining Inc. and choosing and developing your projects is excellent. Sounds like an opportunity for our high-net-worth readers/investors, depending on the market in the future. Could you tell our high-net-worth readers/investors why they should consider investing in McEwen Mining?

Mr. Rob McEwen: Certainly. Large insider ownership, 23%. And it wasn't free stock. My investment came with a price tag of $161 million. Our annual gold and silver production is growing. We'll be going from a 170,000 ounces this year to 200,000 next year. We have a diversified production base in Canada, Argentina, Mexico and soon to be Nevada. Our compensation levels are low relative to the rest of the industry. And our balance sheet is conservative. We only have 50 million dollars’ worth of debt. The debt is straight debt and has a three year term. We have good trading liquidity.

We also have a high beta so for those people looking for a play that will give them an oversized return, the beta suggests that McEwen Mining can offer that.

Dr. Allen Alper: Well, that's excellent. These are excellent, very strong reasons to consider investing in McEwen Mining. Rob, is there anything else you'd like to add?

Mr. Rob McEwen: Merry Christmas. Happy New Year, a golden New Year.

Dr. Allen Alper: Merry Christmas and a Happy Golden New Year to you too.

Mr. Rob McEwen: Thanks Al, for your interest.

Dr. Allen Alper: You’re very welcome. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

Rob and Cheryl’s Wonderful Contributions to Society

Rob and his wife, Cheryl have donated in excess of $60 million to encourage excellence and innovation in healthcare and education. Their donations have led to the establishment of the McEwen Stem Cell Institute at University Health Network, McEwen School of Architecture at Laurentian University and of the McEwen Leadership Program at St. Andrew’s College. In addition, significant donations were made to the Schulich School of Business, the Margaret Cochenour Memorial Hospital, Lakefield College and Red Lake Regional Heritage Centre to further their efforts to be the best in their respective fields.

https://mcewenmining.com/

Mihaela Iancu

Investor Relations

(647)-258-0395 ext 320

info@mcewenmining.com

Disclosure: The Alper family owns stock in McEwen Mining Inc.

|

| More in Leadership Spotlight

|

Leadership Spotlight: Scott Mclean President and CEO of Transition Metals Corp. (XTM -TSX.V) Interview by Allen Alper Jr.

While at the Sprott Natural Resource Symposium in Vancouver, Canada, we met with Scott McLean, HBSc. P.Geo. and President and CEO of Transition Metals Corp. (XTM -TSX.V), a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into discoveries. Mr. McLean won the Prospector of the Year Award, from the Prospectors and Developers Association of Canada (PDAC), back in 2004, and in 2014 the Transition Metals team won The Ontario Discoverers of the Year, for their Sunday Lake platinum palladium discovery in Thunder Bay.

Scott has over 30 years of experience including 23 years with Falconbridge Limited in exploration and management resulting in the discovery of various mineral deposits including the 17 million tonne Nickel Rim South deposit in Sudbury, Ontario. He was also appointed to the transitional board of the Association of Professional Geoscientists of Ontario and has represented the profession as President. In addition to Transition Metals, Mr. McLean sits on the boards of Tesoro Minerals Corp, Sudbury Platinum Corporation (private), Carolina Gold Resources Inc. (private) and Canadian Gold Miner (private).

|

Rob McEwen Chairman and Chief Owner of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) Interview with Dr. Allen Alper

Rob McEwen, Chairman and Chief Owner of McEwen Mining Inc., is the founder and former Chairman and CEO of Goldcorp Inc., which is one of the largest gold producers in the world. During the last thirteen years, when Mr. McEwen was Goldcorp's CEO, the company’s market capitalization grew from $50 million to over $8 billion and its share price grew at a compounded annual rate of 31%. Mr. McEwen was awarded the Order of Canada in 2007 and the Queen Elizabeth's Diamond Jubilee Award in 2013. He holds an Honorary Doctor of Laws and an MBA from York University and a BA from the University of Western Ontario. Also, he received the 2001 PDAC Developer of the Year Award and was inducted into The Canadian Mining Hall of Fame in 2017. Rob and his wife, Cheryl, have donated more than $60 million to encourage excellence and innovation in healthcare and education. |

Joseph Grosso, Executive Chairman, President and CEO of Golden Arrow Resources (TSX-V: GRG, FSE: GAC, WKN: A0B6XQ, OTCQB: GARWF): A Pioneer in the Development of Argentina Mining

Golden Arrow Resources Corporation (TSX-V: GRG, FSE: GAC, WKN: A0B6XQ, OTCQB: GARWF) is an exploration company earning production income. The company has a successful track record of creating value by making precious and base metal discoveries and advancing them into exceptional deposits. Golden Arrow owns a 25% share of Puna Operations Inc., a joint venture operated by SSR Mining, with more than 8 years of forecast production and upside potential at the Pirquitas -Chinchillas silver mining project. We learned from Joseph Grosso, Executive Chairman, President and CEO of Golden Arrow Resources, that he has been the pioneer in Argentina at a very early stage in 1993 and now holds close to 500,000 acres of a lease land, and has made three discoveries. According to Mr. Grosso, the 25% that Golden Arrow owns in Puna Operation has an income potential, for decades to come, and he feels that their shareholders will be drawing great values from this income |

Interview with Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF)

Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF), a Canadian mining exploration and development company, focused on its 100% owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon Territory, Canada. Based on 2015 PEA, the Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit producer of platinum, palladium, gold, nickel and copper. Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF), a Canadian mining exploration and development company, focused on its 100% owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon Territory, Canada. Based on 2015 PEA, the Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit producer of platinum, palladium, gold, nickel and copper. |

McEwen Mining, Inc. (MUX on NYSE & TSX) Achieves Positive Improvements in Silver and Gold Production and Cash Flow in Mexico, a new pro mining government in Argentina and Getting Ready to build Gold Bar in Gold Rich Nevada

I met with Rob McEwen, founder of Goldcorp, and founder, Chairman and Chief Owner of McEwen Mining (MUX on NYSE & TSX) during the PDAC Conference in Toronto. McEwen Mining is doing very well. Production, Cash Flow and the Treasury are increasing and costs are decreasing. “Let me first tell you about my view of the gold market and then about McEwen Mining.” |

Click here for all Leadership Spotlight articles...

|

|