Interview with Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF)

|

Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

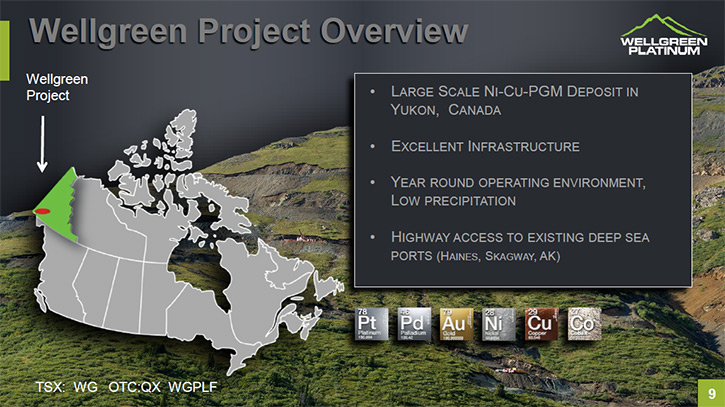

Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF), a Canadian mining exploration and

development company, focused on its 100% owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon

Territory, Canada. Based on 2015 PEA, the Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit

producer of platinum, palladium, gold, nickel and copper.

Dr. Diane R. Garrett has more than 20 years of senior management and financial expertise, in the field of natural resources. Most

recently, she held the position of President and CEO of Romarco Minerals Inc., taking the multi-million ounce Haile Gold Mine

project from discovery to construction. Romarco was a very big success. Dr, Garrett and her team took that company from 20 million

market cap to over $1 billion. Romarco was ultimately acquired by OceanaGold in 2015. Prior to that, Dr. Garrett held numerous

senior positions in public mining companies including; Vice President, Corporate Development of Dayton Mining Corporation, Vice

President, Corporate Development of Beartooth Platinum Corporation. Earlier in her career Dr. Garrett was the Senior Mining Analyst

and Portfolio Manager in the precious metals sector, with US Global Investors.

Dr. Garrett is also a director of OceanaGold Corporation, a global gold producer and TriStar Gold, an exploration company, focused

in Brazil.

Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF) is a Canadian mining exploration and development company, focused on its 100%

owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon Territory, Canada. Based on 2015 PEA, the

Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit producer of platinum, palladium, gold,

nickel and copper. Dr. Garrett holds a PhD in Engineering in addition to a Master of Arts in Mineral Economics from the University

of Texas at Austin.

Diane R. Garrett (Ph.D.) President and Chief Executive Officer

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Diane Garrett, President and CEO

of Wellgreen Platinum. Could you tell me a bit more about your background, your management team, your board?

Dr. Diane Garrett: Sure. My background is engineering. I started out on the buy side, with U.S. Global Investors. I

have been with Dayton Mining and Romarco Minerals. Both companies developed projects such as this and put them into production.

Romarco was a very big success, with the Haile gold mine in South Carolina. We took that company from 20 million market cap to over

$1 billion. We were ultimately acquired by OceanaGold in 2015.

I looked at a number of CEO opportunities and found Wellgreen Platinum to be extremely fascinating. It checks all the

boxes: large scale, base and precious metals, excellent infrastructure and a mining friendly jurisdiction. It is, in my opinion,

very undervalued. I feel, with the skillset I bring to the table of project development and putting a good team together, we can

add some real value here. That's the track we're taking. We know commodity prices are down from when the PEA was published in 2015

but I’d rather be de-risking the project and moving it towards production in this environment than chasing a rising commodity price

environment, without having filed for permits yet. We feel bullish on the metals.

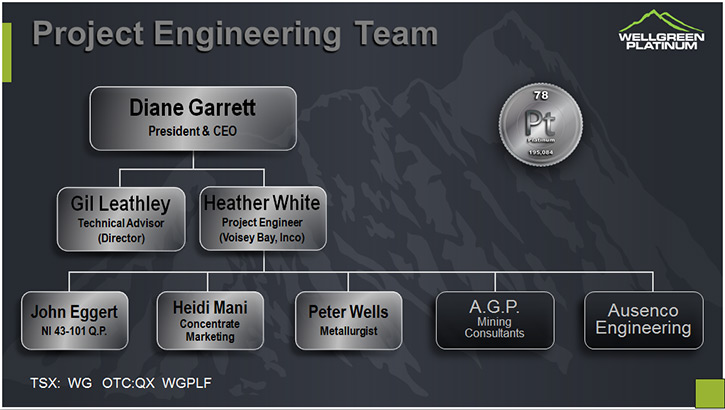

I also brought in Joe Romagnolo, who worked for me in finance at Romarco Minerals. He's now our CFO. For the moment, I’ve

built a team of consultants to complete the current studies. We'll plan to start layering-in a full-time development team, once we

get the next few months behind us in our studies.

Dr. Allen Alper: Diane, could you give our readers/investors an overview of Wellgreen Platinum?

Dr. Diane Garrett: Wellgreen Platinum is developing our flagship asset, the Wellgreen Project, located in the Yukon,

Canada. It's a very large polymetallic deposit, but it also has a substantial PGM content, which makes it nearly unique and

different from your typical polymetallic project. We're located in the Yukon, with excellent infrastructure, right off the Canada-

Alaska Highway. We're currently in the process of doing the necessary work to take the project through to the pre-feasibility

stage.

Dr. Allen Alper: Sounds great! Could you elaborate a bit more on your plans for 2017?

Dr. Diane Garrett: Sure. We've just completed all of the metallurgical test work, which essentially takes that work to

the pre-feasibility level. Now we’re in the process of updating the geologic model, the block model and our resource. We anticipate

having a new 43-101 resource update available in the third quarter of this year. We are also taking a new look at the mine plan,

looking at various throughput rates and optimizing the economics of the project. We intend to initiate an infill drilling program

this summer, to continue moving ounces into the measured and indicated category, and then also the reserve category.

Dr. Allen Alper: That sounds great. Could you tell me some of the metals present in your project?

Dr. Diane Garrett: We're quite unique in that we do have six payable metals. Approximately half our revenue will come

from nickel, roughly 30% from the platinum group metals and gold, about 20% from copper. We also have some silver and cobalt. So it

is a very unique project with a lot of significant metal content.

Dr. Allen Alper: That's excellent. Could you tell me a bit about how you're revitalizing Wellgreen Platinum?

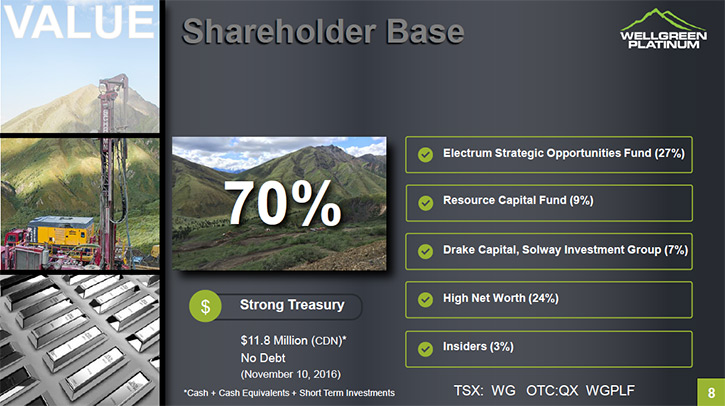

Dr. Diane Garrett: Coming in with the new management team last year, were two very significant private equity

funds, Electrum Strategic Opportunities Fund, which owns 27% of the company and Resource Capital Funds, which owns 9% of the

company. We are now in a position to have the kind of financial support we need in order to advance the project properly. In

addition, we’ve added to the depth and expertise of the Board of Directors.

Our new strategic initiative is getting all of the baseline permitting information completed. We're on a fast track to get

our permits in a position to be filed next year, probably towards the second half of the year. Also, there are some key components

you need when you take a project forward and get it ready for permitting and construction. That starts with metallurgy, so we've

done that. Now we're doing the resource work. Our new strategic initiative is looking at the project in terms of what provides the

best cashflow up front. The ore body will typically tell you exactly the rate at which it needs to be mined. We're taking a whole

new look at the mine planning. We think we can implement some efficiencies and cost savings. It's a new team taking a fresh look

and having the financial resources and the backing to be able to take it all the way through development.

Dr. Allen Alper: That's excellent. It's great to have the financial backing of two big financial groups. Could you tell me a

bit more about your consulting team?

Dr. Diane Garrett: Our consulting team is led by Heather White, who's a project engineer. She designed and built the

Voisey's Bay Mine. She's been in nickel for about 15 years and is a very, very talented mining engineer. We're also using Ausenco

Engineering and AGP Mining Consultants, who are very well recognized in mine planning studies and optimization of projects.

Dr. Allen Alper: That sounds great. Could you tell me a little bit more about the mineral resources?

Dr. Diane Garrett: Sure. The Measured and Indicated category, from the 2014, NI 43-101 resource study, demonstrated

1.9 billion pounds of nickel, a billion pounds of copper, and 5 and a half million ounces of PGM’s and gold. In the inferred

category, it was over 4 billion pounds of nickel, just under 3 billion pounds of copper, and another 14 million ounces of PGM’s and

gold. A staggeringly sizable deposit!

Now we're in the process of taking a new, fresh look at that mine plan. We’re using all the detailed studies we've

completed, and certainly looking at various commodity prices.

Dr. Allen Alper: That's a huge deposit with many very, very valuable metals.

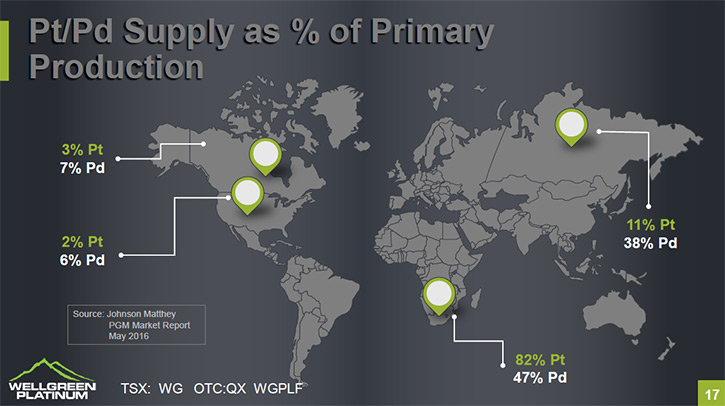

Dr. Diane Garrett: And it's in the Western Hemisphere, which makes it very unusual having PGMs in the Western

Hemisphere. And it's very unusual to have a PGM deposit open-pit. It's also very unique to have a platinum-palladium ratio of 1 to

1. That's virtually unheard of in PGM deposits. So this deposit really has a lot of things going for it.

Dr. Allen Alper: Well, that's really excellent. Could you say a bit more about your share structure and where you're listed?

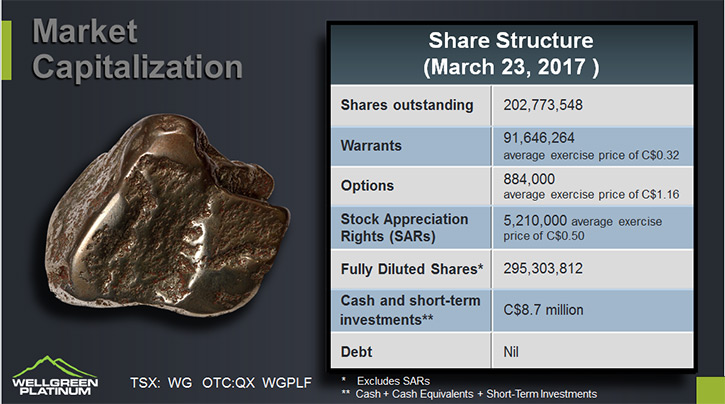

Dr. Diane Garrett: Sure. We are listed on the Toronto Stock Exchange under the symbol WG. We are also listed on the

OTCQX under the symbol WGPLF. We have about 200 million shares outstanding. We have approximately $9 million Canadian in the bank.

We have no debt. We have about 95 million warrants outstanding. Those are, predominantly, with our two largest shareholders, with a

strike price of 34 cents, another million and a half in options and some stock appreciation rights of 5 million. On a fully-diluted

basis, we're just shy of 300 million shares outstanding.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider

investing in Wellgreen Platinum?

Dr. Diane Garrett: There are very, very few nickel sulfide plays out there. If you believe that commodity prices are

going to turn, and they always do, they're cyclical - always have been, always will be. We just don't know when. We do know, when

nickel turns, it turns very quickly. For a play to have something very unique, which is a nickel sulfide deposit in North America,

in a mining-friendly jurisdiction, with excellent infrastructure and something of huge size is very important. But then, you layer

on the precious metals component with the gold and also the PGMs, rare to find in the Western Hemisphere and it becomes an even

more strategic play. We've seen the issues that South Africa's having with the PGM production and their mines. The opportunity to

have a precious metals and base metals play of such significant size, in a great, safe political jurisdiction, is really quite

rare. There're not many opportunities like this.

Plus if you don't know the management team and are not familiar with any of us, look where two of the biggest private equity funds

have put their money. They're clearly in this story in a big way and they're very pleased with the work we're doing. That should be

a good incentive for shareholders to want to participate as well.

Dr. Allen Alper: Those seem like excellent reasons to consider investing in Wellgreen Platinum. Is there anything else you

would like to add, Diane?

Dr. Diane Garrett: We'll have a number of catalysts coming up during the year. So I would just encourage investors to

follow our news and see the progress we're making. We intend to make this company very successful.

Dr. Allen Alper: That sounds excellent!

http://www.wellgreenplatinum.com/

Diane Garrett

President & Chief Executive Officer

1-416-304-9318

dgarrett@wellgreenplatinum.com

info@wellgreenplatinum.com

|

| More in Leadership Spotlight

|

Interview with Rob McEwen, Chairman & Chief Owner of McEwen Mining (NYSE: MUX, TSX: MUX): Rapidly Growing Gold and Silver Producer in the Americas

McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a growing gold and silver producer in the Americas, with operations in Argentina, Mexico, Nevada, and Canada. The Company's goal is to qualify for inclusion in the S&P 500. We learned from Mr. Rob McEwen, Chairman & Chief Owner of McEwen Mining, that in 2019 the company will be producing 200,000 ounces gold equivalent. It’s internal growth pipeline could add another 50% to the company's annual production over the next four years, bringing it to 300,000 ozs. According to Mr. McEwen, in order to qualify for the S & P, they need to get to an annual production rate in excess of 600,000 ounces a year and have a credible growth pipeline to 1 million ozs. per year. Plans for 2019 include commencing commercial production at the company's Gold Bar mine in Nevada, as well as cost-reduction and exploration work in Timmins, and innovative in pit tailings disposal in Mexico. McEwen Mining is incorporated in the state of Colorado. |

Leadership Spotlight: Scott Mclean President and CEO of Transition Metals Corp. (XTM -TSX.V) Interview by Allen Alper Jr.

While at the Sprott Natural Resource Symposium in Vancouver, Canada, we met with Scott McLean, HBSc. P.Geo. and President and CEO of Transition Metals Corp. (XTM -TSX.V), a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into discoveries. Mr. McLean won the Prospector of the Year Award, from the Prospectors and Developers Association of Canada (PDAC), back in 2004, and in 2014 the Transition Metals team won The Ontario Discoverers of the Year, for their Sunday Lake platinum palladium discovery in Thunder Bay.

Scott has over 30 years of experience including 23 years with Falconbridge Limited in exploration and management resulting in the discovery of various mineral deposits including the 17 million tonne Nickel Rim South deposit in Sudbury, Ontario. He was also appointed to the transitional board of the Association of Professional Geoscientists of Ontario and has represented the profession as President. In addition to Transition Metals, Mr. McLean sits on the boards of Tesoro Minerals Corp, Sudbury Platinum Corporation (private), Carolina Gold Resources Inc. (private) and Canadian Gold Miner (private).

|

Rob McEwen Chairman and Chief Owner of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) Interview with Dr. Allen Alper

Rob McEwen, Chairman and Chief Owner of McEwen Mining Inc., is the founder and former Chairman and CEO of Goldcorp Inc., which is one of the largest gold producers in the world. During the last thirteen years, when Mr. McEwen was Goldcorp's CEO, the company’s market capitalization grew from $50 million to over $8 billion and its share price grew at a compounded annual rate of 31%. Mr. McEwen was awarded the Order of Canada in 2007 and the Queen Elizabeth's Diamond Jubilee Award in 2013. He holds an Honorary Doctor of Laws and an MBA from York University and a BA from the University of Western Ontario. Also, he received the 2001 PDAC Developer of the Year Award and was inducted into The Canadian Mining Hall of Fame in 2017. Rob and his wife, Cheryl, have donated more than $60 million to encourage excellence and innovation in healthcare and education. |

Joseph Grosso, Executive Chairman, President and CEO of Golden Arrow Resources (TSX-V: GRG, FSE: GAC, WKN: A0B6XQ, OTCQB: GARWF): A Pioneer in the Development of Argentina Mining

Golden Arrow Resources Corporation (TSX-V: GRG, FSE: GAC, WKN: A0B6XQ, OTCQB: GARWF) is an exploration company earning production income. The company has a successful track record of creating value by making precious and base metal discoveries and advancing them into exceptional deposits. Golden Arrow owns a 25% share of Puna Operations Inc., a joint venture operated by SSR Mining, with more than 8 years of forecast production and upside potential at the Pirquitas -Chinchillas silver mining project. We learned from Joseph Grosso, Executive Chairman, President and CEO of Golden Arrow Resources, that he has been the pioneer in Argentina at a very early stage in 1993 and now holds close to 500,000 acres of a lease land, and has made three discoveries. According to Mr. Grosso, the 25% that Golden Arrow owns in Puna Operation has an income potential, for decades to come, and he feels that their shareholders will be drawing great values from this income |

McEwen Mining, Inc. (MUX on NYSE & TSX) Achieves Positive Improvements in Silver and Gold Production and Cash Flow in Mexico, a new pro mining government in Argentina and Getting Ready to build Gold Bar in Gold Rich Nevada

I met with Rob McEwen, founder of Goldcorp, and founder, Chairman and Chief Owner of McEwen Mining (MUX on NYSE & TSX) during the PDAC Conference in Toronto. McEwen Mining is doing very well. Production, Cash Flow and the Treasury are increasing and costs are decreasing. “Let me first tell you about my view of the gold market and then about McEwen Mining.” |

Click here for all Leadership Spotlight articles...

|

|