Abraham Drost, P. Geo and CEO and Director of Clean Air Metals Inc. (TSXV: AIR, OTCQB: CLRMF, FRA: CKU) Discusses Exploring and Developing the High-Grade Thunder Bay North Platinum, Palladium, Copper, and Nickel Project in Ontario

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/25/2022

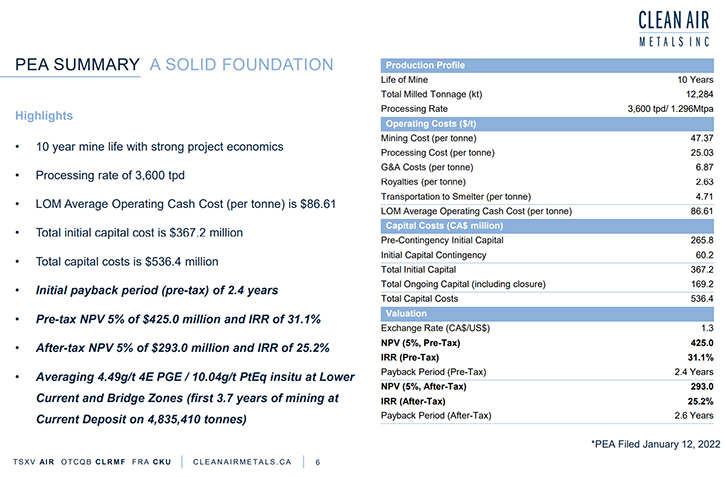

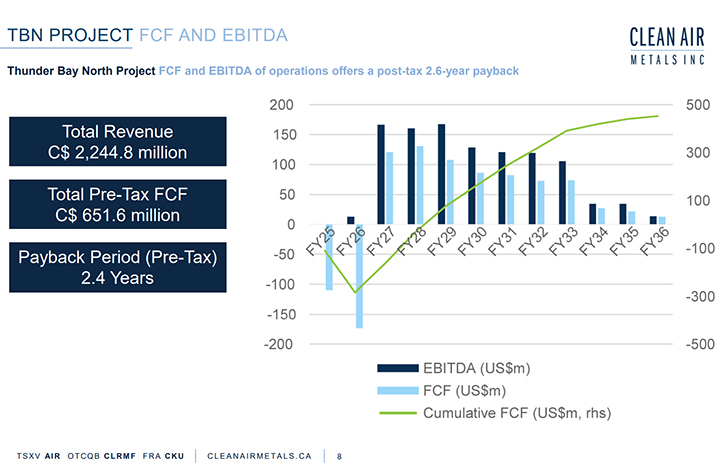

We spoke with Abraham Drost, who's a professional geologist and CEO and Director of Clean Air Metals Inc. (TSXV: AIR, FRA: CKU, OTCQB: CLRMF). Clean Air Metals' flagship asset is the 100% owned, high grade Thunder Bay North platinum, palladium, copper, and nickel project, located near the City of Thunder Bay, Ontario and the Lac des Iles Mine, owned by Impala Platinum. The robust PEA, filed January 12, 2022, highlights a solid foundation, with a 10-year mine life, a processing rate of 3,600 tpd, LOM average operating cash cost of $86.61 per tonne, $536.4 million in total capital costs, pre-tax NPV 5% of $425.0 million and IRR of 31.1%, total revenue of C$ 2,244.8 million, and initial payback period (pre-tax) of 2.4 years. Near-term plans include completing prefeasibility studies in Q2 2023, for a low-carbon, all-electric sustainable mining operation, at Thunder Bay North. The construction decision is expected in Q4 2024.

Clean Air Metals Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Abraham Drost, who's a Professional Geologist and CEO and Director of Clean Air Metals.

Abraham, could you give us an overview of your Company, and also tell us how your Company connects with the green revolution that's going on, and electrification of the world?

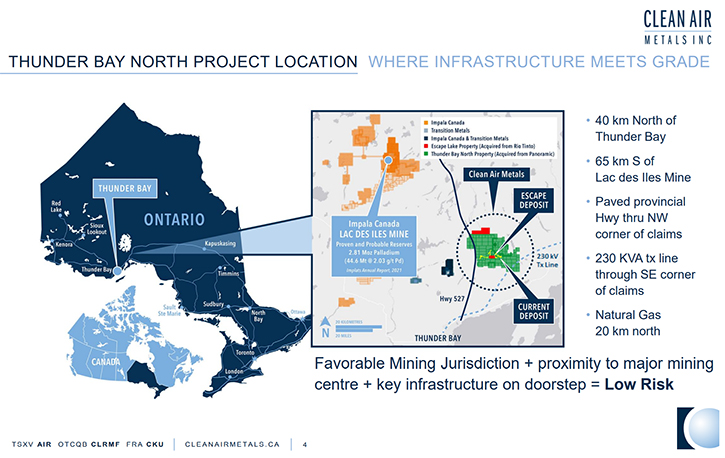

Abraham Drost: Certainly, Allen. Thank you for the opportunity. The project was founded two and a half years ago, around the consolidation of two very promising platinum-palladium-copper-nickel assets here in Northwestern Ontario, specifically in the Thunder Bay region. I live in Thunder Bay, and the project is about a half hour from my home.

Not having to travel to a remote project location, was a real boost for the technical team during COVID. It has worked out extremely well for us, in the sense that we were able to, within two and a half years, take this project to a pre-feasibility study level. And that was partially made possible because the vendors of the two projects, Rio Tinto and Panoramic Resources of Australia, had collectively spent close to $100 million Canadian on the two assets before we purchased them for $15 million total, which is 15 cents on the dollar in terms of sunk costs.

Abraham Drost: What we have are two magma conduits, hosting the Current Deposit and the Escape Deposit, genetically related to the Mid-Continent Rift that underlies Lake Superior. These are preserved in a graben structure, between two through going regional faults, called the Quetico fault and the Escape Lake fault. I'll come back to those particular structures, but we have a graben structure, a fault bounded basin that preserves the Proterozoic platinum-palladium-copper-nickel mineralization.

A robust NI 43-101 PEA economic and underground mine model was published on January 12th, 2022. It's available on our website at www.cleanairmetals.ca

Abraham Drost: Since the original purchase, two and a half years ago, we've put 140 additional drill holes into the Escape deposit and have now brought it and its twin Current Deposit, fully through the PEA mine model into pre-feasibility.

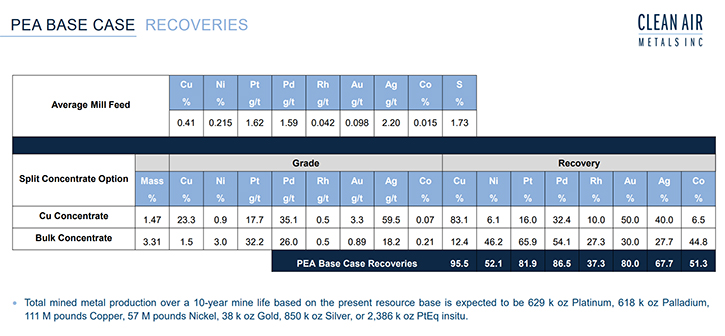

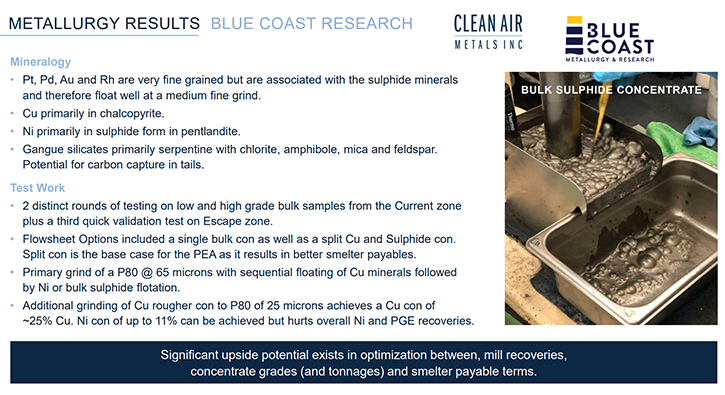

The Escape Deposit has held up extremely well to scrutiny. Instead of having feed from the single Current deposit feeding a mill, we now have two deposits feeding a single mill. So that's given us opportunity for scale. And the robust economics of the PEA, demonstrate this. Additionally, metallurgical testing by Blue Coast Research of Victoria BC achieved a breakthrough, when it was recognized that a significant amount of platinum and palladium associated with barren sulfides was going out to tails. Platinum and palladium recoveries improved by 10% to mid-80’s percent recoveries from the 77% achieved by our predecessors.

Abraham Drost: We realized that in addition to a clean copper concentrate, with PGE’s, a bulk sulfide concentrate, with elevated nickel, was the way to go, because it was optimal to capture every bit of sulfide that we could. Indicative Terms quoted on Thunder Bay North concentrate grade, from three smelter concerns in Sudbury and Germany, have generated the economics that we published in the PEA report. At the end of the day, we've come up with a fundamentally economic project here, based on some very strong Management oversight and direction.

I'll just point out that in addition to myself as CEO, we have Mr. Jim Gallagher, as Executive Chairman. Jim was formerly the CEO of North American Palladium, that led the NAP Team on the turnaround at the Lac des Iles mine and the subsequent sale to Impala Platinum of South Africa, who now runs the mine full-time, 24/7, about 60 kilometers northwest. Mr. Mike Garbutt, Chief Operating Officer of the Company, was former Deputy General Manager of the Côté mine build project. Both gentlemen are experienced mining engineers and both are convinced that we have the potential for a very strong operation at Thunder Bay North.

Dr. Allen Alper: Well, you have a fantastic project acquired at a great price. That was a great business deal. Also, you have a great Team, experienced and successful. And all poised to do it again, which sounds great!

Abraham Drost: Yeah!

Dr. Allen Alper: Could you tell us a few more details of your robust PEA study?

Abraham Drost: We were able to come up with a 10-year mine life on initial capital of $367 million Canadian.

On the basis of a cashflow model, built on projected revenues of a phased, 10-year development and production approach, the project achieves a fully discounted, net asset value of project cash flows, based on an NPV5% discount rate, of $425 million, with an internal rate of return of 31% on initial capital. On a post-tax basis, incorporating Ontario mining tax at 10% and also federal and provincial income tax at 26%, the project returns an average of $293 million, with an internal rate of return of 25%.

Abraham Drost: So that's a pretty good start. And we would very much consider this to be the base case, because we've subsequently been able to fully drill off and add approximately 55,000m of new drilling to the Escape Deposit internal mineral resource, since publication of the PEA. We believe now that the continuity of mineralization at Escape, which will be shown in the pre-feasibility study mine model, has been enhanced significantly from the PEA metrics. PFS level mineable reserves have the potential to be at or better than the PEA numbers.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers and investors how your metals tie in with green hydrogen and how platinum is key to green hydrogen production?

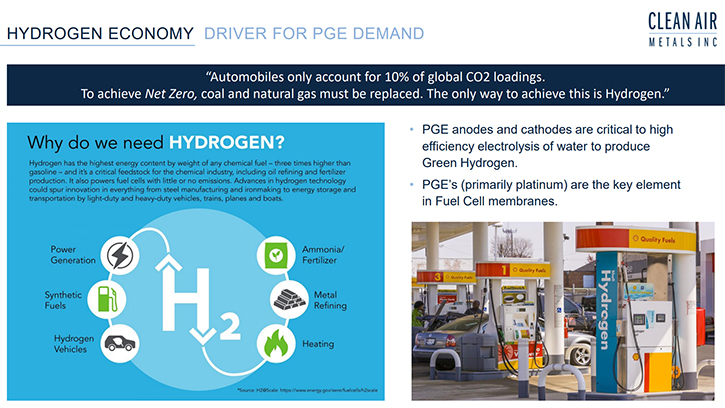

Abraham Drost: I want to preface my remarks, on the utility of this metal suite, in the clean energy transition. And by clean energy, of course, we mean battery electric utilizing the copper and nickel, and also hydrogen hybrid incorporating platinum. And what not many people know, and I don't think the linkage has been clearly drawn by the popular media, is that green hydrogen produced by electrolysis, can only be produced efficiently in the presence of platinum-infused proton exchange membranes (PEMs).

Research demonstrates that it's only certain noble metals in the platinum-group elements, that can be used in that application efficiently. Specifically, platinum, ruthenium and osmium freely give up an electron and are catalytic. They facilitate, but are not themselves used up in a chemical reaction.

In electrolysis, water is separated to form hydrogen gas and oxygen gas at anode and cathode. The hydrogen gas can be recovered and stored and used in green energy applications. The oxygen, by the way, can also be used if it makes economic sense to recover it. But hydrogen is the focus. Hydrogen is in turn combined with atmospheric oxygen in a hydrogen fuel cell. There is significant research for example into fuel cell use in heavy transport applications such as ships, transport trucks, large mining trucks, buses, airplanes.

In the hydrogen fuel cell, the recombination of hydrogen and oxygen releases an electron to a much smaller battery than would be required in a battery electric vehicle, a standard BEV. The waste product that I mentioned in that case, is H2O. Now, if any other metal than platinum is used in that application, there's a risk that that waste product becomes H202 and not H20. And as we may recognize, H202 is hydrogen peroxide out the tail pipe, and that is not a desirable outcome.

Hydrogen fuel cells are being developed that are about the same size as a diesel engine and can produce 600 horsepower for example.

So, this is serious. We're at the point now where we have highly efficient hydrogen hybrid engines, available for multiple applications. And scale is the issue. But the research today towards the clean energy transition, is really focused on heavy transport. And the reason for that is because in larger or heavy transport applications, battery weight now becomes the controlling factor. The weight of the battery becomes the payload. If you want to put a battery in a transport truck, or a battery on a train, or a battery on a plane, or in a mine truck and just run it as a battery electric vehicle, you have a problem, because your battery is your payload. But, if you have a much smaller battery, being continuously fed electricity from a controlled reaction of the combination of hydrogen and oxygen, you now have a system that can efficiently replace fossil fuels and still have something in the tank, which is very similar to what we do now with the internal combustion engine vehicles, only carbon free.

What this comes down to over time is hydrogen distribution, which is something we'll see increasingly and more efficiently over time. And I do believe Allen that it will be the big oil companies using their well-developed distribution networks that will become the champions of the clean energy revolution, led by bulk transport hydrogen-hybrid vehicles and smaller passenger automobile battery-electric vehicles. And again, the linkage to platinum of green hydrogen production and copper and nickel to battery electric is immutable.

Dr. Allen Alper: Ah, it sounds exciting. How do you get around the safety issue with hydrogen? Could you say a couple words about that?

Abraham Drost: Well, look, I'm a geologist. I work with a very competent Team of mining engineers. Hydrogen chemistry is the subject of intensive ongoing research. The technology is proven and it is scalable. But I'll give you an example. I think the safety piece is of paramount importance, whether you're dealing with hydrogen fuel systems or fossil fuel systems. At the end of the day, we're talking about volatile vapor that can combust. And there are some indications that hydrogen might be even more volatile than hydrocarbon vapor, for example.

At Los Alamos Laboratories in New Mexico, their principal research project today is bulk transport hydrogen fuel cell technology. This is in part driven by the mandate from the Biden administration reducing the use of fossil fuels in the federal fleet and upcoming limitations on the future manufacture of internal combustion engines. So, this research is ongoing. It's well funded. And of course, Los Alamos has a place in the national psyche around Oppenheimer and the whole development of the atomic bomb and so forth. These days, their considerable research prowess is being directed to hydrogen electrolysis and hydrogen fuel cell technology.

Dr. Allen Alper: That's excellent. Well, Los Alamos is of course a fantastic outstanding laboratory, so that research is in great hands.

Abraham Drost: Yes.

Dr. Allen Alper: Abraham, could you tell us a little bit about your plans for the pre-feasibility study?

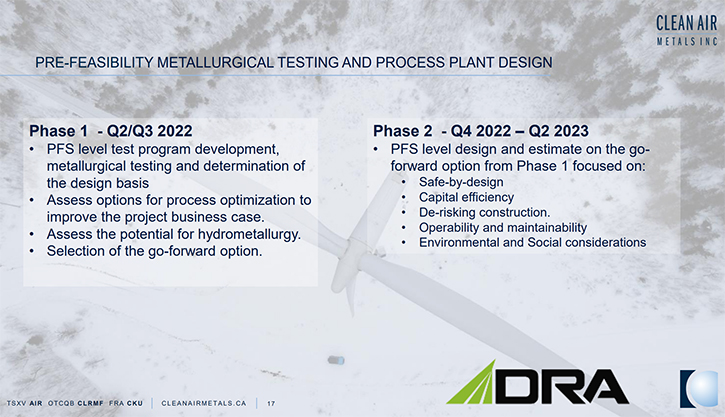

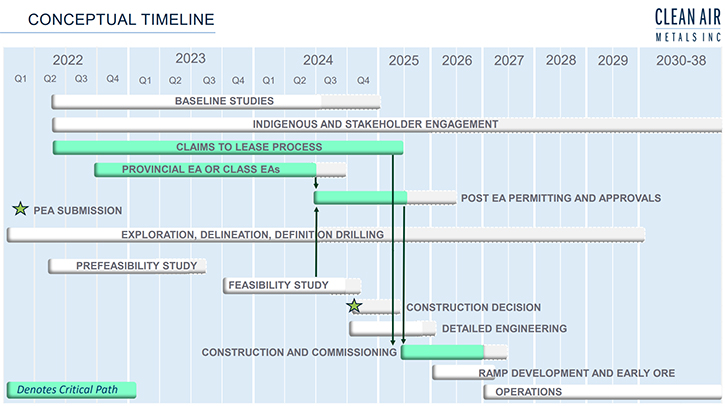

Abraham Drost: Yes. Thanks Allen. We're into it now. We have a fully engineered timeline, to a construction decision, expected in Q4 of 2024. I'll refer you to the body of technical disclosure in press releases that we've made over the past two and a half years, on our website at www.cleanairmetals.ca and more particularly summary announcements, such as the one we just made two days ago on the back of our Q2/22 financial filings. But fundamentally, the roadmap is set pursuant to a conceptual timeline below, from the detailed Gantt chart, constructed by Mike Garbutt. The summary timeline can also be found in the online PowerPoint technical presentation of Clean Air Metals. We are going through a process of resource optimization, metallurgical optimization and mine design and environmental sampling to support the commencement of an environmental assessment to support regulatory mine permitting on the property.

Abraham Drost: We are fully committed to First Nation engagement and partnership, and we've made several announcements in that context. We're also anticipating commencement of a public consultation process in due course. We are in the hands of experienced mine builders in the persons of Mike Garbutt and Jim Gallagher. My background is geology and exploration and I work closely with our Vice President of Exploration, Dr. Geoff Heggie, who is an expert in mid-continent rift geology. We have some exciting massive sulphide exploration targets that we plan to drill this winter. Mr. Kris Tuuttila is an environmental scientist and our Director of Permitting, Sustainability and Community Relations, having a 12-year history with the Thunder Bay North Project and our predecessors, through DST Consulting Engineers, now Englobe.

The early indications, from the PEA work, are that we're dealing with a project that is financially robust, on a suite of metals that will become increasingly in demand as we move forward through the clean energy transition.

And I want to emphasize, as well, that the provincial and federal governments, here in Canada, are very focused on the supply chain of what they call the Critical Minerals, which include the platinum group metals and copper and nickel. This may involve tax relief and other incentives to ensure an adequate domestic supply chain for new battery plants that are being constructed in Windsor, Ontario and also in Kingston, Ontario.

The focus of the provincial and federal governments is also indigenous economic reconciliation, which we fully support. Canada is in the process of undoing 300 years of colonialism by ensuring that the affected First Nations and Metis have a strong voice in resource development and also share profoundly and fundamentally in the economic benefits therefrom.

And so that ties directly into the First Nation partnerships that we have been able to achieve to date. The three First Nations that we're involved with are the Fort William First Nation, the Red Rock Indian Band, and the Rocky Bay First Nation, also known as BZA, or Biinjitiwaabik Zaaging Anishinaabek. They are fully supportive of this project, in writing, and they're looking forward to the economic opportunities that will flow from this operation.

Dr. Allen Alper: That sounds excellent!

Abraham, could you tell our readers and investors the primary reasons they should consider investing in Clear Air Metals?

Abraham Drost: Well, we have 222 million shares issued today. On a 1x NAV basis post tax, that would equate to about a $1.35 a share. We're trading today at 14 cents a share, so we're actually trading at about 0.1x NAV. A company in pre-feasibility, or having delivered a minable reserve will normally be trading at 0.3 times NAV or higher. According to the timeline that I mentioned, we're projecting to be in minable reserves by May or June of next year. This suggests that there could be a significant re-rating of the Company at or before that time.

Abraham Drost: We also believe that there could be significant M&A pressure, brought to bear at that time, when mid-tier and senior companies realize that Thunder Bay North has 10+ years of mineable reserves. When the market comes to understand that this Management Team can deliver on the financing requirements, necessary to bring the project to that stage, things could rerate quickly. Check out the track record of myself, Jim Gallagher and Mike Garbutt. On the assumption that PFS level mineral reserves will be delivered and that a rerating will take place, there is an opportunity in the resource stocks like Clean Air Metals, particularly resource stocks that are focused on the clean energy transition, with commodities like platinum, palladium, copper, nickel that are in play at the Thunder Bay North Project.

Dr. Allen Alper: All those sound-like compelling reasons for readers and investors to consider investing in Clear Air Metals. It looks like you have the right green metals, in a great location, and an experienced Team, a successful Team with outstanding track records.

Abraham Drost: Yes! Exactly Allen! We are working hard for our shareholders, indigenous partners and stakeholders. We do believe we have a very strong project in the wings here.

Dr. Allen Alper: Well, that sounds excellent.

Abraham, is there anything else you'd like to add?

Abraham Drost: Jim Gallagher, Dean Chambers, who was one of our independent Directors and I took over the Board, by RTO, in February 2020. And we built it up to the Board that it is today, including Ms. MaryAnn Crichton, who is also Director of PDAC, Mr. Ewan Downie, who is the CEO of I-80 Gold and Mr. Shannin Metatawabin, who is the CEO of the National Aboriginal Capital Corporation. Shannin is an indigenous leader and banker and has made some great contributions to our progress.

I want to emphasize there was no founder stock available on this transaction. Every share that the insiders own or control here, which is close to 5% of the Company, was purchased on the open market or in the financing that the Company has undertaken. And in my personal case, I've paid between 16 cents and 51 cents a share for my over 3 three million share stake, in the Company. And I've been adding to it over time. The point is, we are committed.

Dr. Allen Alper: Well, it's great to see that the insiders and the Management Team and the Board are aligned for shareholders and have skin in the game. That's fantastic!

Abraham Drost: Exactly! Yes! The underlying shell is gone. It's sold off. It's history. And quite frankly, Clean Air Metals Inc. is its own Company at this point.

Dr. Allen Alper: Ah, well. That sounds excellent!

https://cleanairmetals.ca/

Abraham Drost

Chief Executive Officer

Clean Air Metals Inc.

Phone: 807-252-7800

Email: adrost@cleanairmetals.ca

|

|