Marc Henderson, President & CEO, Laramide Resources Ltd. (TSX: LAM, ASX: LAM) Discusses Developing United States and Australia Uranium Deposits to Help Feed Nuclear Power Plants and Generate Clean Electricity

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/9/2022

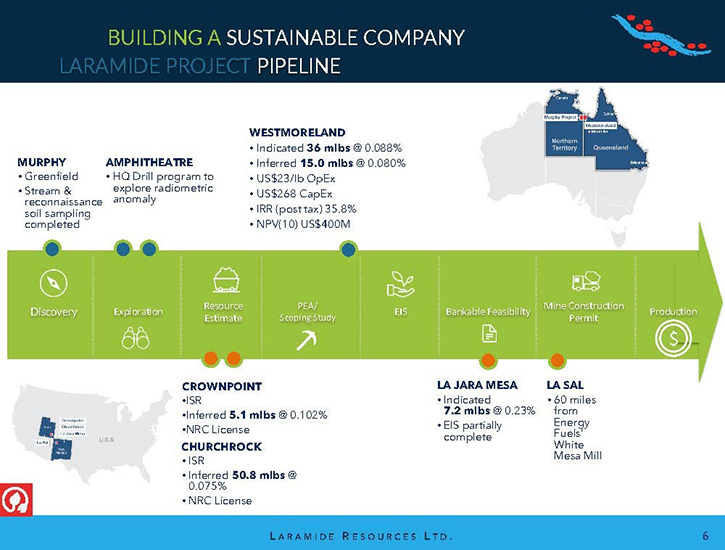

We spoke with Marc Henderson, who is President, CEO and Director of Laramide Resources Ltd. (TSX: LAM, ASX: LAM), a Canadian-based Company, with diversified uranium assets, strategically positioned, in the United States and Australia, to deliver uranium, to an increasingly energy dependent world. Laramide’s portfolio, of advanced uranium projects, has been chosen for their production potential. Its flagship project, Westmoreland, in Queensland, Australia, is one of the largest projects currently held by a junior mining Company. Its U.S. assets include La Jara Mesa, in Grants, New Mexico, and La Sal, in the Lisbon Valley district of Utah as well as a prominent ISR project called Churchrock, also located in New Mexico.

Laramide Resources Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Marc Henderson, who is President, CEO and Director of Laramide Resources, Ltd. Marc, could you give our readers/investors an overview of your Company and what differentiates it from others?

Marc Henderson:

We're a uranium mining development company, with economically attractive deposits located in Tier One, geopolitically friendly jurisdictions, the U.S. and Australia. The company’s mission is to develop these deposits, which are essential to generating carbon free, clean electricity in nuclear power plants. Nuclear is an important share of the electricity generation market in the world, and we think it’s about to enter an interesting new growth phase.

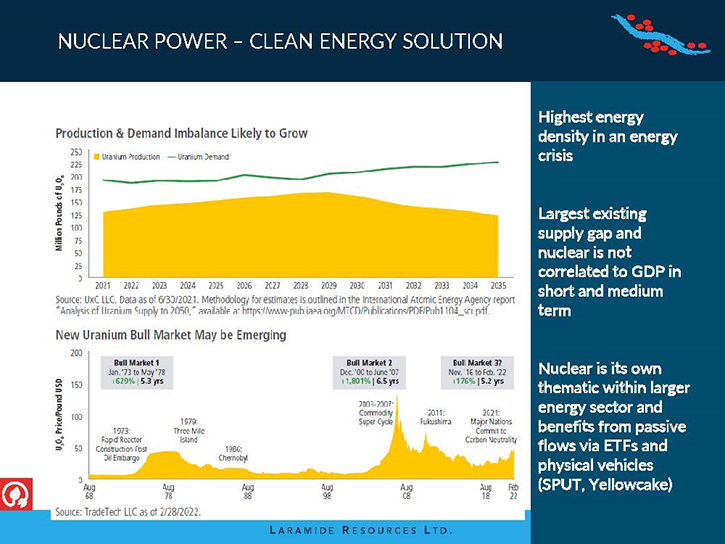

A big driver of this potentially new Nuclear Renaissance is that it is becoming clear that all forms of energy seem to be acutely in short supply at the moment, and this is starting to have major consequences in terms of affordability. Furthermore, as pressure emerges to transition away from fossil fuels and carbon intensive energy production generally, nuclear has gotten itself back in the conversation as a potentially big part of a clean energy solution. This is a view that has started to gain many prominent adherents, both in energy policy making circles, but also including thought leaders like Bill Gates and Elon Musk.

Notwithstanding this positive macro backdrop, however, development companies, like ourselves, are very heavily tied to the price signals from the marketplace. We've been in a period of low uranium prices for quite some time - almost a decade - but this seems to be changing now and I think that's going to create a landscape, where companies like ours can get on with and develop their asset base.

Our Company probably is most differentiated from other peer group companies by the fact that we have not one, but two very large, very attractive, lowest quartile cost uranium projects, one in the United States and one in Australia.

Our assets are Westmoreland in Australia and Churchrock in the United States. They're also differentiated from the fact that one of those assets, the latter one, is an ISR asset, with ISR being an acronym for In Situ Recovery, a methodology with a more benign and modest geographic footprint which seems to be gaining adherence for its relative attractiveness environmentally and from a social license perspective. The Australian asset will be a more conventional open pit type operation.

Dr. Allen Alper:

Could you tell our readers/investors a little bit more about those projects?

Marc Henderson:

Westmoreland in Australia is the one that we have had the longest and that we consider our “company maker”. It really is what got us into the uranium business, and we feel fortunate to have acquired it. It came about, in a multistep process, where we effectively acquired the land and the real estate around it and then went to the party, who had most recently developed the deposit, which was Rio Tinto, and were able to acquire their entire database. None of this data – nor any of the previous data for that matter – was in the public domain because it had been discovered and advanced entirely by industry majors. So, we effectively put the land and the data back together.

We believe that we obviously have a very favorable situation here, just awaiting the price, and the right political environment, in which to bring the asset online. It's a very substantial deposit. Probably between our work and the previous owners, it's had $100 million (if not more) spent on it. It has 50 million plus pounds. It has a number of very attractive attributes, which puts it on the lowest part of the cost curve, mainly because of the grade, but also, the size and geometry of the deposit, including its proximity to surface, etc. The ore body is only 60 meters deep at the deepest, has very high recoveries, and also benefits from low reagent consumption in the plant. And so, it's a very attractive asset.

Westmoreland could produce at the rate of roughly around 5 million pounds a year which is a scale that the utilities find attractive when they are seeking a long-term contractual relationship. It also benefits from reasonably open-ended exploration potential, both on Westmoreland itself (which is in Queensland) but also on another property that we have acquired contiguous to it, also from Rio Tinto. That property is called Murphy and is located in the Northern Territory, which is the neighboring state. Given the scale of this land holding, our exploration is really conceived at a district scale.

The primary American asset is called Churchrock. It is an asset that was drilled out, at the very tail end of the American uranium boom in the 1970s. For those who aren't familiar with that, America went from having zero nuclear power plants to 100 nuclear power plants, in a space of about 10 years. That decade was characterized by considerable angst about energy as well. We had gas line-ups and two energy crises in that era and the price of oil at one point went up ten times, going from $3 to $30 between 1971 and 1974.

This energy shock precipitated a frantic search for alternative forms of energy and was the inception of the search for energy security. As a result, America went on a crash course and built a lot of nuclear power plants in a hurry. That demand created a tremendous search for uranium everywhere in the world. There was an awful lot of effort undertaken, to find sources of uranium to fuel all of these future power plants. A lot of the big energy companies, of the day, including many of the biggest oil companies, were involved in the nuclear business.

These included companies like SOHIO, Kerr-McGee, Chevron and General Electric, who were a reactor vendor. The Churchrock asset was actually drilled out by a subsidiary of General Electric, and it was discovered in 1979-1980 at the tail end of that boom. By that time, the uranium price had skyrocketed, going from roughly $4 or $5 a pound to around $40 a pound. At that point, the boom had faded because the crash energy-crisis program was so successful that America went from having a deficit of electricity production to having a surplus.

Churchrock is large asset, with a Mineral Resource Estimate of 50 million plus pounds. The throughput capacity isn't the same as something like Westmoreland though, because it is a little more limited due to the nature of the ISR production methodology there. This asset will come online at roughly 1 million pounds a year, and then step up in phases with a couple of expansions to reach 3 million pounds a year.

It was licensed by the NRC (Nuclear Regulatory Commission) in 2012. We were the owners of the royalty on this project at that time, and then we parlayed that into buying out the owner in 2016. We've been waiting for the market to get to get the right set of circumstances providing a window to develop the asset. We think that window is rapidly approaching now.

Dr. Allen Alper:

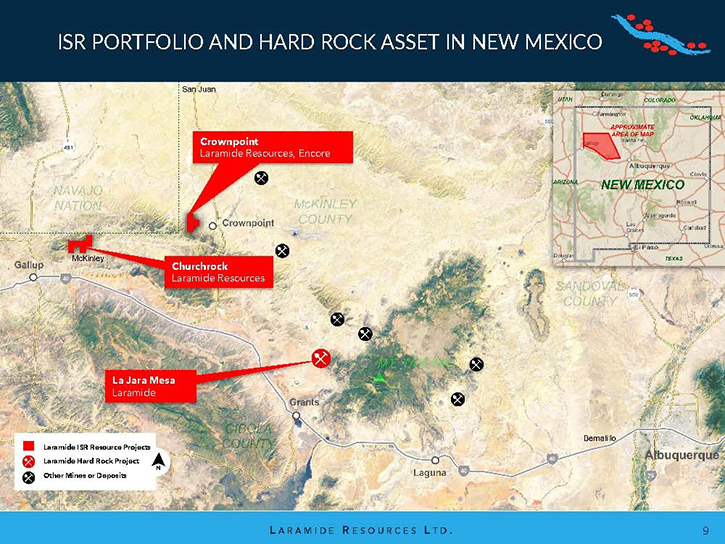

Churchrock is in northwestern New Mexico, is that correct?

Marc Henderson:

Yes, and for perspective, New Mexico has been historically the largest source of uranium production for American uranium supply. It was producing, for decades, between 13 and 19 million pounds a year. In New Mexico previously, uranium was produced largely from underground mines.

ISR methodology only came into being, roughly in the 80s, when Cameco initiated the first ISR production in America. They have operations now in Nebraska and also in Wyoming. Wyoming has probably been the biggest ISR state, but New Mexico, with the right geology, has a lot of potential for ISR as well.

On the hard rock side, there is a lot of legacy resource in New Mexico. However, uranium mining in New Mexico was historically on the higher part of the cost curve, because of the nature of the geology. To some degree in the past, that production was the benefit of government subsidy programs, although that's not the case today.

For those that are following this space, there's been a quite a push, for what's left of the uranium business, to try to get government support for domestic security supply reasons. America needs roughly 50 million pounds a year to fuel its domestic nuclear reactors, and last year produced less than a million pounds. They are quite vulnerable on the security of supply front.

Dr. Allen Alper:

Well, that sounds like a real need that the United States has and it sounds like you have enough water to do ISR work.

Marc Henderson:

Yeah, we basically have all the things we need, including water rights and everything else. We need one state permit, which we're now going to be applying for, and it's effectively for the disposal permanent restoration permit. We have an 18-month permanent period ahead of us, on the assumption that we would get that permit. We have a relatively short construction period, given the nature of what we're doing. Initially, we will just be doing a well field, not building our own a plant, which is scheduled for phase two.

The nature of ISR lends itself to production being brought on rapidly. In terms of alleviating any security of supply concerns, there are a number of near-term uranium projects, in the United States. I would say that we are one of probably half a dozen Companies that have the projects and sufficient resources in place such that, if the political support and pricing environment were to align, you could pretty rapidly get, say 10 million pounds of production in America up and running relatively quickly.

Dr. Allen Alper:

That's excellent. You also have another project in Utah, could you tell us a little bit about that?

Marc Henderson:

Of course. We have a couple of other smaller, hardrock projects that we don't talk too much about. These were projects that were owned by Homestake Mining. For those of you and your readers that remember that Company, it was a great American Gold Company which was acquired by Barrick some years ago, with Barrick probably now being the acknowledged industry leader in gold.

Homestake Mining's origins go back to the last century, starting with their big gold mine in South Dakota, but they were also a big producer of uranium through the 50s, 60s and 70s and they had a few remaining legacy assets. When Barrick bought them, they were not particularly interested in staying in the uranium space, so we were fortunate to be able to buy those. One is in Utah, called La Sal, which is effectively production ready. We have a permit to do a bulk sample that can be commissioned relatively quickly, and thereafter we could transform it into an operating permit. But it's a very small asset; that is, it would produce potentially half a million pounds a year for maybe five or six years, and it would need to go to a custom mill.

There's only one hard rock mill that still operates in the United States, now owned by Energy Fuels, so anybody that has a viable hard rock deposit, is probably in a dialog with Energy Fuels about if and when they can get their material into that plant.

The other asset we have is called La Jara Mesa. This is a bigger asset, and the permitting is currently being completed on it. It's a very attractive asset although not particularly large at the moment; maybe 10 million pounds. We would search for a processing facility to process the ore, or it could potentially be part of a bigger hard rock mining plan, in New Mexico, maybe in connection with some other assets, if they start to think about bringing the hard rock potential of New Mexico back. But in order to catalyze that sort of development plan would probably require a more vigorous domestic security of supply prioritization.

Dr. Allen Alper:

Well, it sounds like you are in a great position, having the Churchrock Project and also the large district project in Australia.

Marc Henderson:

Yes, I agree. We think we have attractive assets that are on the lowest part of a cost curve. Uranium is a little different than some of the other commodities because it is, to a considerable degree, a contractual business. The buyers (i.e., utilities) need what you have, and they should be willing to enter long term contracts, in order to ensure supply. They also want a diversified portfolio of supply, which creates the opportunity for new entrants like Laramide.

In the recent past, however, I think the industry got themselves in a trend where they sort of forgot about security of supply and portfolio concentration risks because Kazakhstan emerged in the 2008-09 period as such an attractive and large-scale source of very low-cost uranium. Prior to that, they were a very modest producer. Then, they very quickly ramped up from 10 million pounds to ultimately peak output of almost 60 million pounds a year.

As a result, the industry became - I don’t want to say addicted - but it was an easy and defensible business decision to buy from the lowest cost supplier. There’s a bit of a rethink going on now globally, around supply chains, security of supply generally and geopolitical considerations.

Another thing to bear in mind going forward, is that the production out of Kazakhstan is coming from a legacy asset base that effectively was drilled out decades earlier (by the Russians) and only recently has found a market.

It basically started to come online at scale in alignment with the Chinese build out. In a repeat of what the Americans did in the 70s, the Chinese in the early 2000’s came out and said, for a whole variety of reasons - including air quality and a voracious demand for energy, that they needed to add, a nuclear baseload component to supplement their grid. They went from producing zero gigawatts and announced that by 2020 they were going to build 60 gigawatts of nuclear. And most impressively, they more or less did what they said they were going to do. Again, they need a supply base to support all of these plants once they are built. So, the rise of Kazakhstan really happened in tandem with the rise of the Chinese domestic nuclear power industry.

This is why we are obviously bullish for the sector because every time you build a brand-new nuclear plant, you have a 60-year asset that you have to find fuel for. China is also continuing, rapidly, to expand their percentage of electricity that's nuclear generated. Their latest proposals plan for 200 gigawatts of nuclear generation by 2035. So that’s a lot of growth ahead. That macro backdrop is going to create a tremendous underpinning for folks like ourselves with projects that can deliver into a market that's going to need it.

Dr. Allen Alper:

That sounds excellent! Marc, could you tell our readers/investors, a little bit about your share and capital structure?

Marc Henderson:

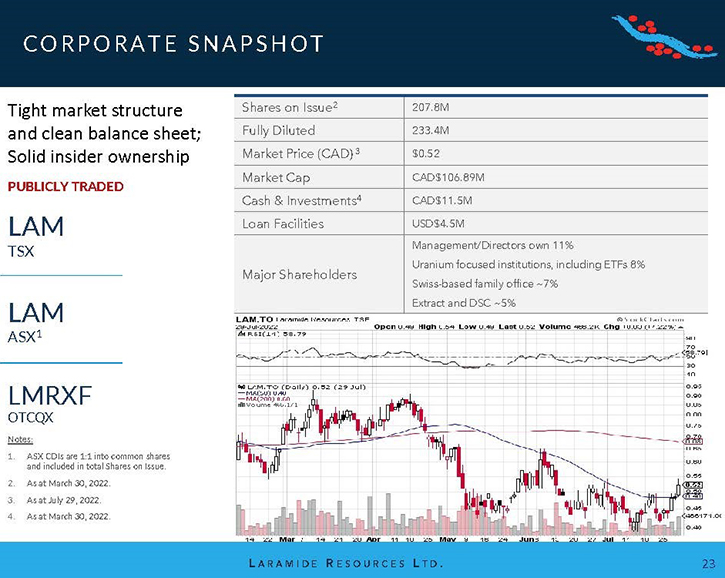

The capital structure is roughly around 200 million shares, we’re listed on Toronto, the ASX and on the OTC, in the United States. Insiders probably own a little more than 10% of the Company and then we have several institutions that own it, including all the prominent uranium focused ETFs. We also have a very large retail following because the Company has been around for a while and was around in the last uranium cycle.

The last uranium cycle that we had was quite a powerful upcycle and kind of tied in with that whole Chinese build-out referenced earlier. In that cycle, the uranium price went from $7 to $135 and there was an awful lot of enthusiasm around uranium; we are one of the legacy names in the space from that cycle, so we do have a reasonable amount of visibility in the marketplace, because of that.

Dr. Allen Alper:

Sounds excellent. It's good to see that Management has skin in the game and is aligned with investors.

Marc Henderson:

Yes, we do eat our own cooking! I'm not a 10% shareholder, but probably just a little bit less than that. I'm a big believer in nuclear power and a big believer in the uranium and nuclear energy space. I do think our moment is approaching. Even following it as closely as I do, I am surprised at the magnitude of the energy crisis that we're in right now and how quickly it landed on us. The world sort of collectively sleepwalked into it, although it's been coming for a while.

One positive from this though, is that I think it has forced the public at large to very quickly become educated about energy. I don't think they were as educated as they needed to be before, in terms of where does the power and energy come from. We're in an interesting moment, and the policymakers have a lot of work to do and a lot of choices on their hands. I do think that nuclear is going to be a bigger share of power generation, going forward, just because of all the natural attributes and advantages that it has.

Dr. Allen Alper:

Well, that sounds like an excellent opportunity for your investors, shareholders, and stakeholders. Marc, could you summarize and highlight the primary reasons our readers/investors should consider investing in Laramide Resources?

Marc Henderson:

We are in an energy awakening era. I think we're at the beginning of what will be a pretty good cycle, in nuclear and uranium generally and these cycles tend to last a long time.

As a result of the downtrend that we had that was driven by the events in Japan with Fukushima, we had ten years effectively of being in the wilderness with a very deep and protracted bear market. I'd be shocked if we don't have four or five pretty good years as we get back to a market that relies on newly mined supply.

We lived on inventories a lot. We lived on cheap Kazakhstan material a lot, but I think those sources are going to be challenged going forward. We're going to have a very good market, for anybody that can supply the demand that's going to be out there. The price has moved up, in the last year. It's been a little volatile, it moved from $25 to $65 per pound and pulled back to $45. The big driver of the whole space is contracts and I think you are getting really close to a contracting cycle in nuclear.

Once that contracting cycle starts, the market starts to see validation on price in terms of the actual market, not only in the spot market. It’s those contractual prices – with the utilities writing contracts over five- and ten-year periods, that underpin the entire industry. I think that's what is really going to kick off the next leg of the bull market and I think we're particularly well positioned for that kind of market.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://laramide.com/

Marc Henderson

President & CEO

416-599-7363

info@laramide.com

|

|