Jeffrey Wilson, CEO and President, Precipitate Gold Corp. (TSXV: PRG, OTCQB: PREIF) Discusses Advancing District Scale Gold and Copper Camps in Newfoundland, Canada and the Dominican Republic

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/12/2022

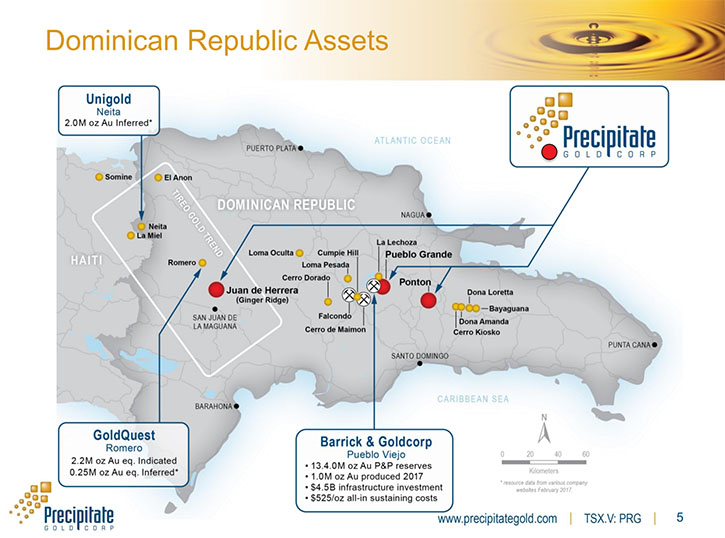

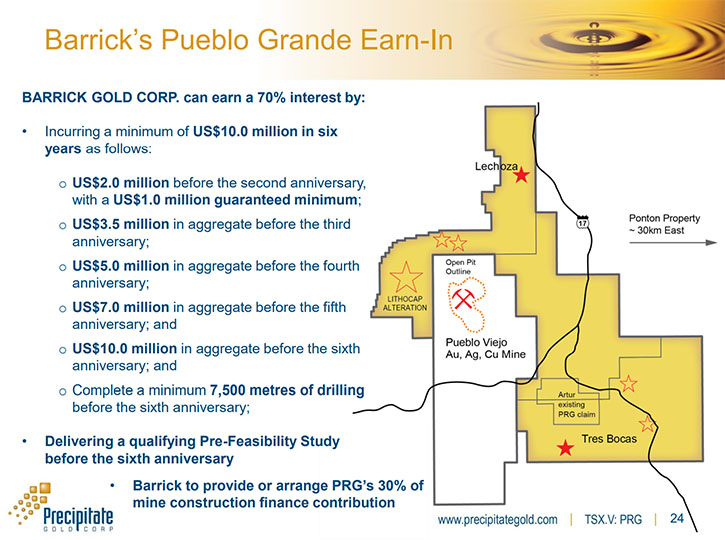

We spoke with Jeffrey Wilson, who is CEO and President of Precipitate Gold Corp. (TSXV: PRG, OTCQB: PREIF), a mineral exploration company, actively exploring its Motherlode Project, in Newfoundland and its 100% owned Ponton and Juan de Herrera projects, in the Dominican Republic. The Company’s Pueblo Grande Project is subject to an Earn-In Agreement, with Barrick Gold Corporation, whereby Barrick can earn a 70% interest, by incurring US$10M, within six years and producing a qualifying Pre-feasibility Study. This year will see a lot of exploration drilling work, on all of the Precipitate Gold's projects, looking at the potential to make new discoveries.

Precipitate Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Jeffrey Wilson, who is CEO and President of Precipitate Gold Corp. Jeff, I wonder if you could give our readers/investors an overview of your Company and what differentiates it from others? Then update us on what's happening in the Dominican Republic, in your gold properties, and your new acquisitions in Newfoundland.

Jeff Wilson:

In quick summary Precipitate Gold is a junior exploration Company, really focused on the discovery and early-stage end of the spectrum. We're looking at opportunities, property assets that have the potential to host significant size mineral deposits that ultimately, one day, can be attractive to mid-tier and major companies. We've been in the DR now, since 2012, we have three quite strategic assets there. One of which is adjacent to an existing resource, of a little over three and a half million ounces gold equivalent, which is held by a Company called Gold Quest Mining.

We are situated, immediately adjacent to that project, over about a 40-kilometer strike length of a number of targets on our ground. We have drill permits in hand and are ready to continue to explore multiple targets there, at such time as we deem it appropriate. Part of that has to do with some permitting issues, for our neighbors, that we hope are being worked out now and that will be the green light for us to become active there again.

But we also have a project elsewhere in country, which is situated adjacent to and essentially surrounding, one of the largest gold mining operations on the planet and that's Barrick's Pueblo Viejo. We have a significant land package, surrounding that mining operation. And in 2020, we entered into an earn in agreement with Barrick, whereby Barrick has the right to earn a 70% interest, in our Pueblo Ground project, by spending $10 million US and delivering a pre-feasibility study, within a six-year period. So that, I think, is a real differentiating factor for us. I think it validates our objective to find projects that can attract mid-tier major companies, as we've done so with that asset.

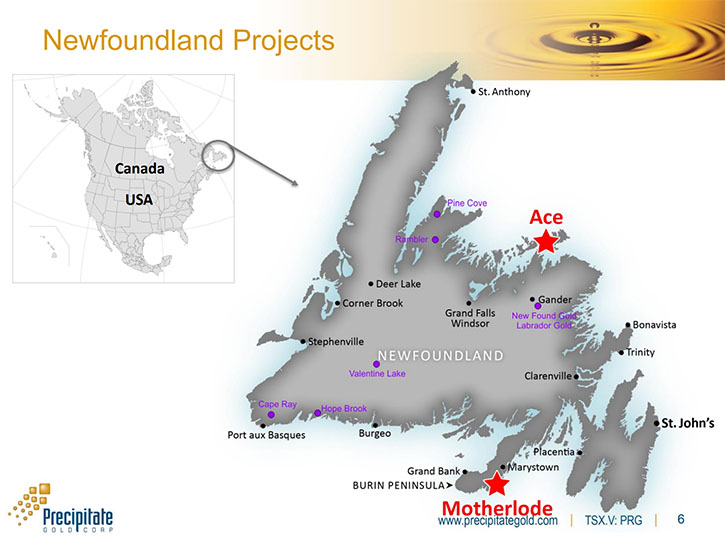

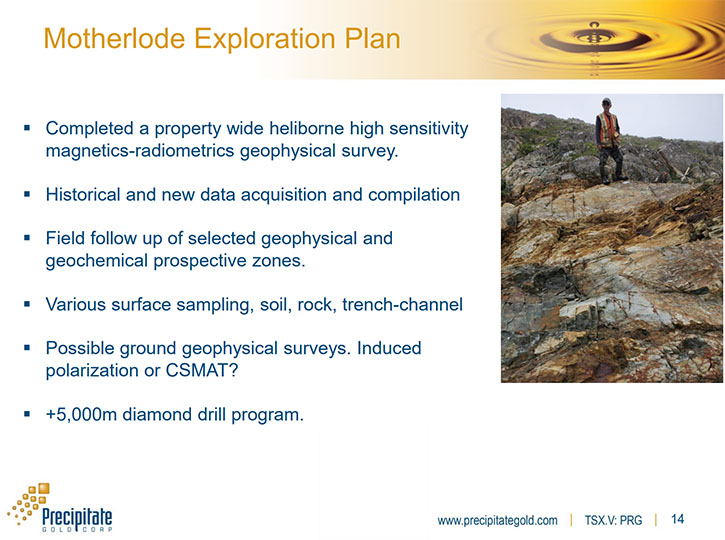

While we've been waiting for some of the permitting issues to be resolved in the DR, we sought to find some assets, in another jurisdiction, where we could diversify a little bit. We acquired, in middle to late 2021, two assets in the province of Newfoundland, Canada. One is a project called Motherlode, which has seen some prior work, some prior drilling in the early 2000s and we think has the potential to be part of a much larger opportunity there on an underexplored regional play. We consolidated a large land package, to give ourselves a lot of hunting ground.

Over the last couple of months, we've advanced that project, with airborne geophysics and some groundwork, and we hope to get much more active on that this year, including hopefully a first phase of drilling. We also acquired a project called the Ace Project, which is in north central Newfoundland. It’s proximal to two fairly well-known plays there; a Company called Ethos Gold, which has been reporting good project samples, from there, up to 7,000 grams per ton gold. And a Company called Exploits Discovery, who have also been reporting some quite high-grade 50, 60 gram per ton material as well.

We're situated in the same geological terrain, along strike, virtually adjacent to those projects. So again, we think we're in a prospective area in the right rocks and the right geology, with projects that have either been underexplored or underappreciated, in the past, and have the potential to provide meaningful discoveries, if our exploration work goes well.

Dr. Allen Alper:

That sounds excellent. I wonder if you could tell us a little bit more about your plans for 2022.

Jeff Wilson:

We expect this to be quite an active year for us. There are few moving parts and we're hoping a couple of things will fall into place here. Our expectation now is that the two key projects, in the DR, have the potential to be real catalysts. What's pending there is the granting of a development or an environmental impact study for our neighbors, Gold Quest. There have been a lot of rumblings that that may be getting closer, after several years of waiting. That I think would be a real driver and a signal to the market and to foreign investors that the DR is in favor of mining and wants to see mining advance. That would give us the green light to get much more active, on our project next to them.

Barrick is also talking about a significant expansion of their Pueblo Viejo. I think a positive announcement on that front would be supportive or encouraging for the jurisdiction. And that would be a real catalyst for us to get back and start to spend, in an area where we believe the return on investment makes sense.

Simultaneous to that are our two projects in Newfoundland that we're hoping to bring to a drill stage or at least a drill decision this spring or summer. All going well, we could be drilling on both of those projects this year, perhaps as early as April or May. If things go the way we expect them to go in the DR, we could have drills turning on multiple projects, in two different jurisdictions. I think it could be a real active year for us, in terms of news flow and potential catalysts.

Dr. Allen Alper:

It sounds like 2022 will be a very exciting time for your shareholders and stakeholders.

Jeff Wilson:

Yeah, we're hoping so. We've put together a reasonable sized private placement late last year that topped up the Treasury, with both flow through dollars that we could expend in Newfoundland and hard dollars that we can utilize for other purposes, including the DR. Our projects in the Dominican Republic are all owned 100%, so we don't have any underlying obligations or payment schedules and can utilize those funds in a discretionary manner. So we're well financed, we raised $2.6 million late last year and that will give us more than enough financial capacity to do the kind of work programs that we envision, in the months ahead, including potential drilling in Canada. If some of those catalysts in the DR come together for us here in the coming months and perhaps there's a little bit of an increase in valuation, there may be an opportunity for us to tap into some interest there and get much more aggressive with the budget in the DR for the balance of 2022.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about your background, your Team, your Board?

Jeff Wilson:

My background, I’m a capital markets and finance guy. I came out of the investor relations and money raising side of the business. I've been in the business for over 25 years now. I've been exclusively focused on the junior exploration side of the business. I've been lucky enough to work with good smart technical people, who have identified projects that have been of interest in mid-tier major companies. I've been fortunate enough to be involved in a few takeovers and buyouts, where we've made shareholders a significant return on investment.

Our Board of Directors is made up of largely geological expertise and early-stage exploration and discovery people. Adrian Fleming is the Chairman. Adrian cut his teeth with Placer, but also made a name for himself with the White Gold discovery in the Yukon, which was bought out by Kinross some years ago.

Alistair Waddell is on the Board. Alistair was also at Kinross, at one point in time. He's now running a Company called Inflection Resources. Good, Smart, Technical Mind! Alistair spent a fair bit of time, exploring in the DR, previously in his career, so a good level of knowledge there.

Lon Shaver is the last member of our Board and Lon is a VP at Silvercorp, a very prominent silver mining company. Previous to that, he was an investment banker at Raymond James, for a number of years and Lon and I worked together previously, so we've had a lot of history together. Lon has a very astute capacity for transactions, deal flow negotiations and obviously, as a former banker, is very well connected on the finance side of the business as well. So it brings us a really good balance, when you mingle all of the strengths of the Team together.

Michael Moore is my Vice President of Exploration. Mike’s a geo who has been responsible for all the work that's been done, on all projects, since the company's inception in 2012 and really brings a great balance of technical expertise and an understanding of capital markets and stretching a dime, in order to move projects forward in a fiscally responsible manner. That's been very useful for us, as times get challenging in these markets.

So that's the Team. We have some people in country in the DR, and we have some key personnel in Newfoundland, as well, that have been doing some of the groundwork and prospecting for us. So we're well-situated and well-suited and think we have the potential here to move these projects forward.

Dr. Allen Alper:

Well, it looks like a very strong Team, well experience and diversified, so that's excellent. Jeff, could you tell us a little bit about your share and capital structure?

Jeff Wilson:

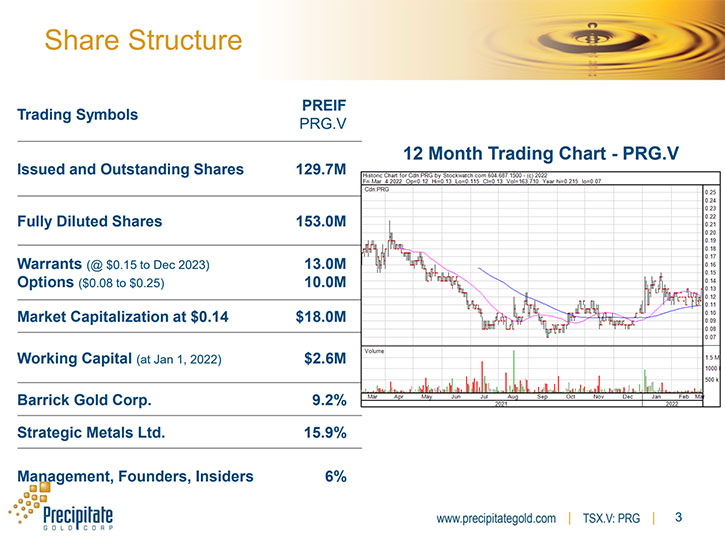

The Company has about 129 million shares issued and outstanding, about 153 million on a fully diluted basis. The only warrants that are outstanding, on the Company, are related to that most recent financing that we did, about two months ago, late December. So not a significant amount of warrant overhang or market capsule, a little under $20 million Canadian right now and we have about $2.6 million in the Treasury. I will mention that of that 129 million shares issued and outstanding, it's noteworthy to mention that Barrick owns about 12 million shares of that issued and outstanding number. Barrick has just under 10% and took a position in the Company, at the time we did our earning agreement with them, back in early 2020.

A fairly well-known junior exploration group here in Vancouver is a Company called Strategic Metals. Doug Eaton and the boys also have a significant position, they have just under 20 million shares of the Company, which they acquired through a private placement and a subsequent exercise of warrants. Although we have a reasonable number of shares, out of 129 million, to float itself is actually relatively limited, when you take into account some of those large shareholders, Management insiders and a couple of key high-net-worth individuals that hold several million shares each. We think we have a well-placed capital structure and an ability to continue to add value and move things forward.

Dr. Allen Alper:

Well, that excellent. It sounds like you have some rather strong backing, with well-funded people and very knowledgeable mining people. And Management has skin in the game, so that's excellent!

Jeff Wilson:

Yeah, that's important. We are constantly focused on aligning ourselves, with shareholders and really looking to do what's in the best interest of shareholders, at every decision point we get to. That's paramount for us for sure!

Dr. Allen Alper:

Jeff, could you tell our readers/investors the primary reasons they should consider investing in Precipitate Gold Corp.?

Jeff Wilson:

I think there are several, and I think that clearly we've been in a pocket of time here over the last several weeks and months where the gold and the precious metals markets have been a little underappreciated and perhaps a little bit depressed. I think there's a great number of quite compelling opportunities, at these valuations. I like to think that at current trading prices Precipitate is one of them. We've shown a track record for driving the share price on the back of positive news and building toward catalysts.

The primary catalyst for us historically, has been drilling and we are hoping to work toward drilling on multiple fronts, here in the coming months. So we think this could be a significant entry point for investors. Looking at the potential to make discoveries, in regions where we've tried not to go into the areas where everybody's running to pick up ground and you end up getting ground that's maybe not as perspective. Perhaps not the right geology, maybe it doesn't have the right affinities, as people expect you to have.

I think for us, we've gone a little bit off the beaten path. The DR is not a particularly well-known active jurisdiction for mineral exploration. However, one of the largest gold mines in the world exists there. I think there's good reason to believe, from a technical standpoint, that there's a lot of potential for ongoing and future discoveries. That's why we're there in spite of what the flavor of the month might be.

Similarly, in Newfoundland, I think again, we've tried hard not to race in to be in that area where everybody's trying to be next to New Found Gold and position themselves to be the next story for Eric Sprott to jump into because of location. We've picked up ground that we think, regardless of what happens to the current euphoria for Newfoundland as a jurisdiction is going to hold up, regardless of what happens with New Found Gold in other parts of the province. They have their own technical merits, they're in the right kinds of rocks and we believe, applying the right kind of systematic exploration, we can bring these to a drill decision in the coming months.

If the drill gods look down on us kindly, maybe we can make a significant new discovery here, in areas that have been overlooked by previous operators. Thinking a little bit outside the box, trying to be in places that have the right technical merit, but maybe not covered by others, who've already been in there. Trying to find something new, having enough ground to make a significant discovery and applying good science, that's been our strategy all along. We're excited to be able to do that, on multiple fronts, here this year.

Dr. Allen Alper:

Sounds excellent! Those sound like very compelling reasons for readers/investors to consider investing in Precipitate Gold Corp. Jeff, is there anything else you'd like to add?

Jeff Wilson:

No, I think my view on this, at this point, is just that we seem to be, not for reasons that I think any of us were hoping for, geopolitically. But I think that we look to be moving into what could be a fairly exciting time here in the gold and precious metal space. I think, when you combine that, with the opportunities that already exist in energy metals and battery metals, I think that the sector is set up here, for a pretty exciting run and cycle. I think we're positioned well, with good projects, good Teams of people and financed enough to be able to do the work necessary to make discoveries. We think we're just heading into what could be a very, very exciting time for natural resource investors, here in the months ahead.

Dr. Allen Alper:

I think you're right. It looks like it's been a little bit of a drought and it looks like the timing is now great. With all these inflationary measures that have been taking place and the kind of creation of new money, that gold and precious metals are going to come to the forefront.

Jeff Wilson:

I believe so too, it certainly looks that way. An interesting wrinkle in that was, we saw on the back of some of the geopolitical concerns that we not only saw gold rise here in recent days, but we saw cryptocurrency heading in the opposite direction. I think that's an interesting dynamic that really supports what's been historically a safe haven investment in gold and still seems to be present even here today in the face of modern alternatives such as crypto.

Dr. Allen Alper:

Yeah, I think you’re definitely right.

https://www.precipitategold.com/

For further information, please contact:

Tel: 604-558-0335

Toll Free: 855-558-0335

investor@precipitategold.com

|

|