James Hesketh, President and CEO, Viva Gold Corp. (TSX-Venture: VAU; OTCQB: VAUCF) Discusses Advancing Its Large-Scale, Low-Cost Tonopah Gold Project in Nevada, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/4/2022

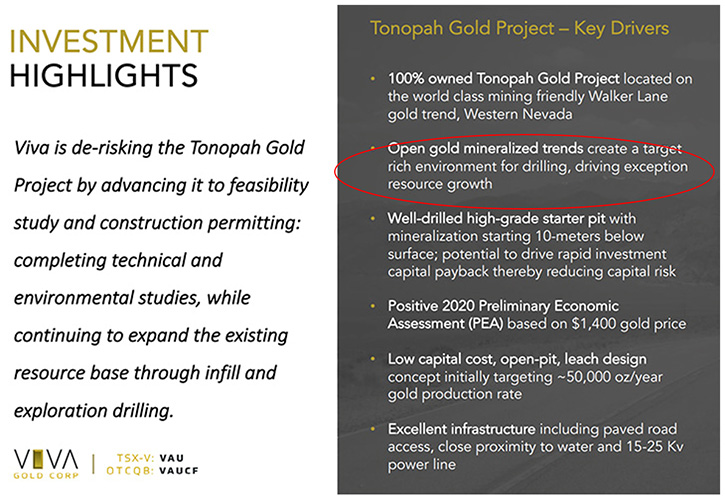

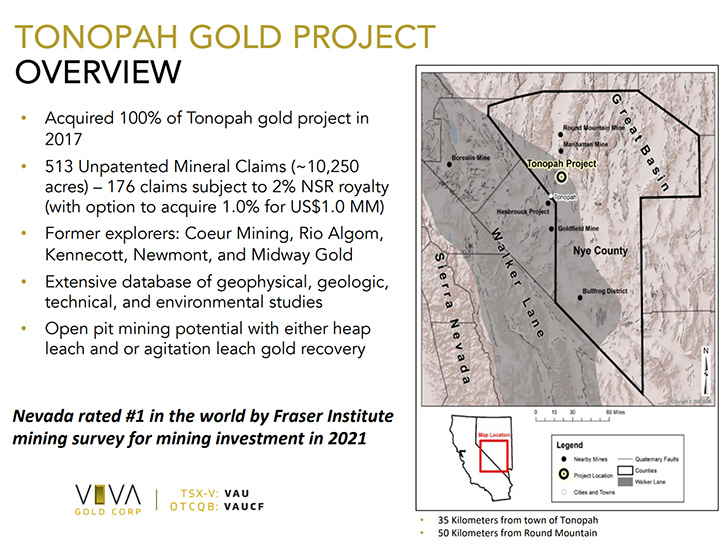

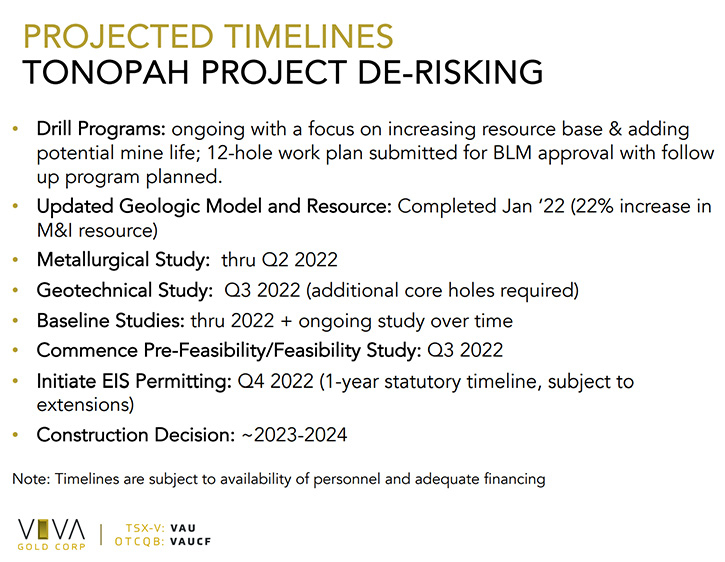

We spoke with James Hesketh, President and CEO of Viva Gold Corp. (TSX-Venture: VAU; OTCQB: VAUCF). Viva Gold Corp is advancing its 100% owned, large-scale, low-cost Tonopah Gold Project, located on the world class, mining-friendly Walker Lane Trend, in Nevada, 30 kilometers south-east of the World class Round Mountain Mine. The project has excellent infrastructure and a well-drilled, high-grade starter pit, with mineralization starting 10-meters below surface. The positive 2020 PEA shows; low capital cost, open-pit, leach design concept, initially targeting an initial ~50,000 oz/year gold production rate. In 2022, Viva Gold updated its geologic model and increased M&I resource by 22%. Near-term plans include Pre-Feasibility/Feasibility Study (Q3/2022), initiating EIS Permitting (Q4/2022), with the view of making a construction decision around 2023-2024.

Viva Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with James Hesketh, who is President and CEO of Viva Gold Corp. James, could you give our readers/investors an overview of your Company and what differentiates it from others?

James Hesketh:

The key asset, in our Company, is the Tonopah Gold Project, located about a 20 minutes’ drive outside of the town of Tonopah, in Nevada. The project is located in a world class, mining friendly jurisdiction. The unique aspect of the Tonopah Gold Deposit is the presence of a high-grade starter pit. Some of our highest-grade intercepts are actually closest to the surface and in our PEA from 2020, we were able to develop a starter pit at around an $800 gold price. That would support the first two years of mining, at an average gold grade of about 1.6 grams with a low strip ratio. That is the unique aspect of the project. Other than that, we see tremendous exploration upside and we have a really well-advanced core of measured and indicated resource. We have a proven track record of being able to grow the resource with every annual drilling program. So that's really the key to the Company and the project.

Dr. Allen Alper:

That's excellent. You did a PEA and I think perhaps a pre-feasibility, could you tell our readers/investors about that?

James Hesketh:

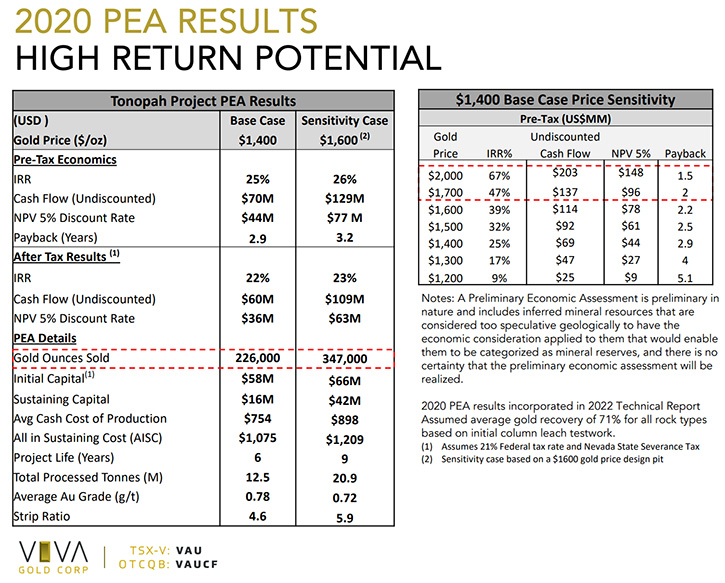

We haven't completed a pre-feasibility at this point in time, but we have completed a PEA and that assessment was performed at a $1,400 gold price. That $1,400 project returned an IRR of about 25%, with a NPV at a 5% discount rate of $44 million and cash flow of about $70 million, that's net after recovery of sunk capital. The payback at $1,400 was 2.9 years. On sensitivity analysis of the capital payback on the same case at $1,700 was two years, at $2,000 gold it was 1.5 years. That is the function of the high-grade starter pit driving those short paybacks. IRR at $2,000 was 67%, with an undiscounted cash flow at $203 million, after recovery of capital. Capital cost for this project were estimated at roughly around $60 million and cash costs of production about $750, with $1,075 all in sustaining cost. That was based on a prior resource estimate. Since then, we've added quite a bit of additional resource to the project, so we can anticipate larger cash flows and larger production scale, as we revisit economics in the future.

Dr. Allen Alper:

That sounds very good. Could you tell our readers/investors, your plans for 2022?

James Hesketh:

We are currently submitting a new drilling plan for this year's drilling. We anticipate drilling out the along strike extensions, both East and West, which are wide open at this point. We anticipate that the program, if it is successful and if estimated, based on the same density of resource, per linear meter of extension that we see in the existing deposit, could add up to several hundred thousand additional ounces added to the resource base. We operate the project under a Plan of Operations and so we write work plans against that Plan of Operations. This new submittal is work plan number 39. Because the regulators are quite familiar with this project, we typically get quite rapid turnaround on our work plan submittals.

We have a drill rig and crew lined up for late Q2. On top of that, we're continuing to perform additional metallurgical test work that is based on samples, collected from drilling we completed in 2021. We collected about 1.8 tons of metallurgical samples for process optimization work, as a component of moving the project towards (pre) feasibility study. Additional work includes environmental test work, including ore and waste characterization studies, required for the permitting process. We have recently conducted a number of biologic studies and one archeological sweep, updating prior work done on the project. That is the current work plan for this year. We anticipate, pending completion of additional financing, moving into the pre-feasibility/feasibility process, later this year.

Dr. Allen Alper:

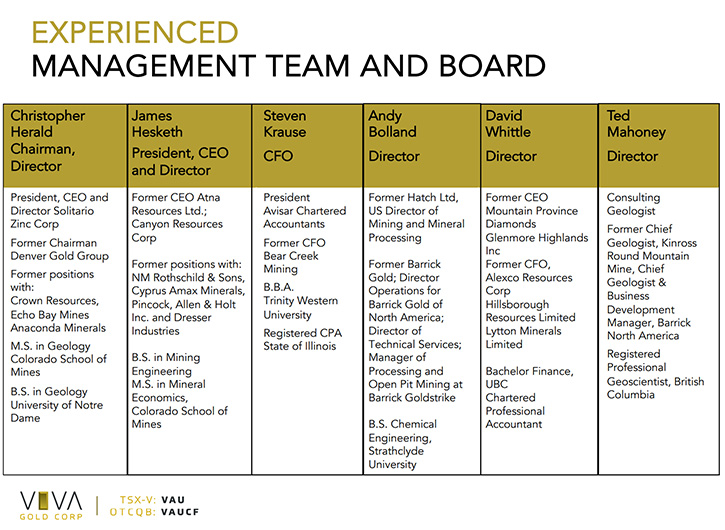

That sounds excellent. James, could you tell our readers/investors about your background and also your Team and your Board?

James Hesketh:

I am a Mining Engineer and have a Master's degree in Mineral Economics, both from the Colorado School of Mines. We have an excellent Team. Our Chairman, Chris Herald, a very strong geologist. We have Andy Bolland, whose last position, with Barrick Gold, was Director of Operations for Barrick North America. In that role, he had all of the North American mining operations under him. He's a Chemical Engineer by training, an excellent Metallurgist, and a highly experienced Operator in Nevada, so he brings a lot to the table. David Whittle, another Director, has a number of CFO roles in his background, including one Company, where he was CEO, and is a really strong Financial Director. Ted Mahoney, another Senior Geologist, was former Chief Geologist at the Kinross Round Mountain Mine. Round Mountain is important to us. It's about a half hour's drive from our site, so he has a very strong background in local geology. I met him when he was Director of Business Development for Barrick North America. As a result, he's been to most of the sites in North America and brings a very broad perspective. The remainder of our Team, includes a geologist, corporate secretary, I.R., etc. All of those individuals have worked for me for a number of years in multiple companies, so it's a very strong and cohesive Team at this point.

Dr. Allen Alper:

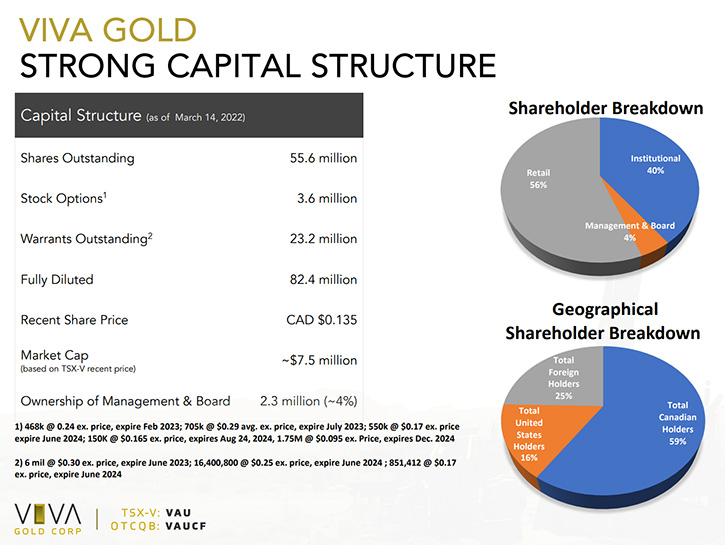

James, you have a great Team. You have a great background as does your Team and Board, so that's excellent. James, could you tell us a little bit about your share and capital structure?

James Hesketh:

The Company has quite tight share register, 55.6 million shares outstanding. Of that, about 40% is institutionally held. We've been able to attract some larger players. In terms of geographic distribution, around 45% the shareholding is US and international, the remainder is Canadian. Fairly simple Company. We floated this Company on the Toronto Venture Exchange in late 2017, so it's a fairly new Company in that regard.

Dr. Allen Alper:

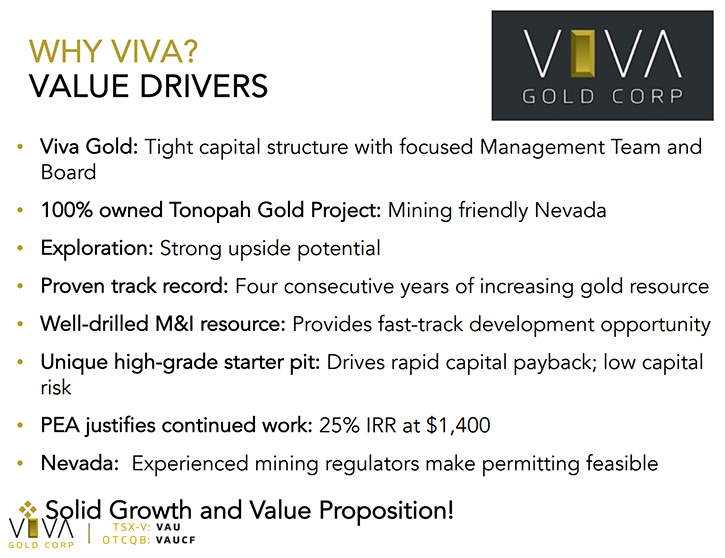

That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Viva Gold Corp?

James Hesketh:

Right now, 400,000 ounces of gold resource in the measured and indicated category and 200,000 ounces is in the inferred category, all contained within a $1,650 resource shell. We anticipate being able to grow that total, with additional drilling. Our goal is to grow the resource towards a million ounces contained in all categories. We've completed metallurgical studies, over a year's worth of water sampling, ore and waste characterization tests, seep and spring studies, biologic studies and archeological studies. In addition, we've worked closely with the town of Tonopah in our ESG efforts. This project is well prepared to move towards prefeasibility/feasibility study and permitting.

Importantly, the Tonopah gold project has excellent existing infrastructure. We have paved road access directly to our site, close proximity to a 15 KV power line, attached to the Nevada energy grid, crossing the eastern boundary of our property. This power line can be upgraded to 25 kilovolt capacity. We also have close proximity to a public water utility pipeline, which also crosses the same eastern boundary. This kind of infrastructure translates to low-cost project capital to move forward on, and in the right jurisdiction. We have a lot of exploration upside, and we can see the potential for strongly growing the gold resource. And just down the road from us, Centerra recently acquired the Goldfield District Project, for $206 million. AngloGold recently acquired the Corvus Projects in Beatty, further to the south of us, for $450 million. Augusta Gold came into Bullfrog Gold in 2020, on a 100% basis that would have cost about $52 million at the time. Coeur Mining acquired the Sterling Mine, from Northern Empire, in 2018. So, we've had a lot of acquisitions, in the neighborhood. We're a half hour from the producing Kinross Round Mountain Mine. It's the type of neighborhood where majors pay attention. So, you if you put it all together, I believe we have a strong growth and value package to offer to investors.

Dr. Allen Alper:

Those sound like extremely strong reasons for readers/investors to consider investing in your Company. James, is there anything else you would like to add?

James Hesketh:

Just take a look at our website and our presentations. I think we can convince you that Viva is a good investment proposal. We have a lot of justification. We have a tight capital structure; we own 100% of our project and we see strong exploration upside potential. We've have a proven track record of four years of consecutively increasing our gold resource. The project already has a well-drilled, measured and indicated resource. And we have a unique high-grade starter pit. And finally, it's Nevada! It's the best place in the world to have a mining project! So, this is a very solid growth and value proposition.

Dr. Allen Alper:

Those are very compelling reasons to consider investing in silver and gold. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://vivagoldcorp.com/

James Hesketh, President & CEO

(720) 291-1775

jhesketh@vivagoldcorp.com

|

|