Mark Wallace, Managing Director, Gold 50 Ltd (ASX: G50) Discuses Its Well-Financed Exploration Activities in One of the World’s Best Jurisdictions Nevada and Arizona

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/29/2021

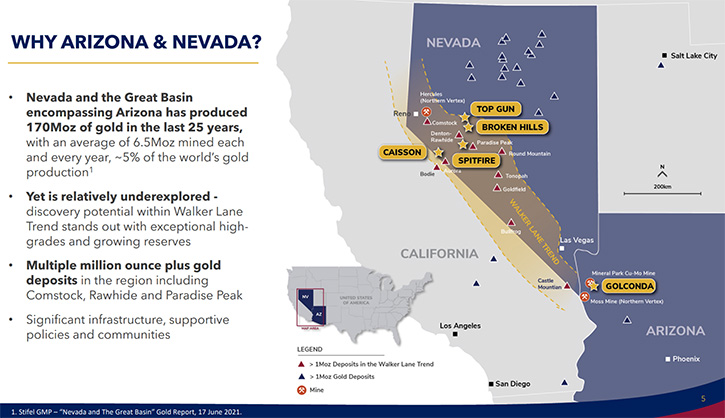

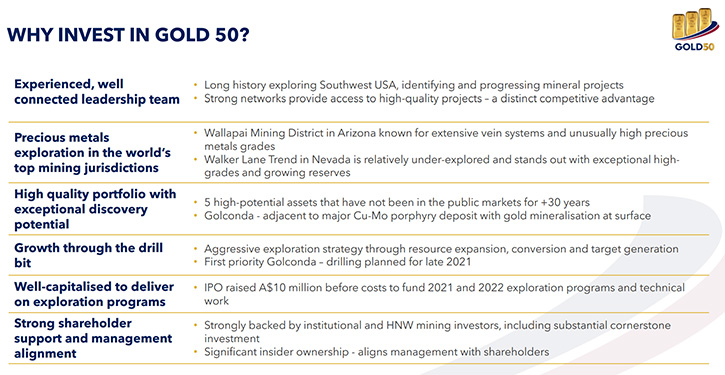

We spoke with Mark Wallace, Managing Director of Gold 50 Limited (ASX: G50) - a mineral exploration company that has recently completed an IPO on the ASX, raised $10 million, and now has a good budget for two years. Gold 50 is focused on their flagship Golconda Project, in the Wallapai Mining District of Arizona, where the Company has consolidated an historical mining district, adjacent to a major copper-molybdenum porphyry deposit and known for its extensive mineralized veins, containing unusually high precious metals grades. In Nevada, Gold 50 has four high-quality, early-stage gold exploration projects, in the Walker Lane Trend of Nevada, a prolific yet relatively underexplored region that stands out for its exceptional high-gold-grades and growing reserves. Near-term plans include exploration drilling in Nevada, at the Spitfire and the Top Gun deposits in October-November of 2021, and at the Golconda project in early 2022.

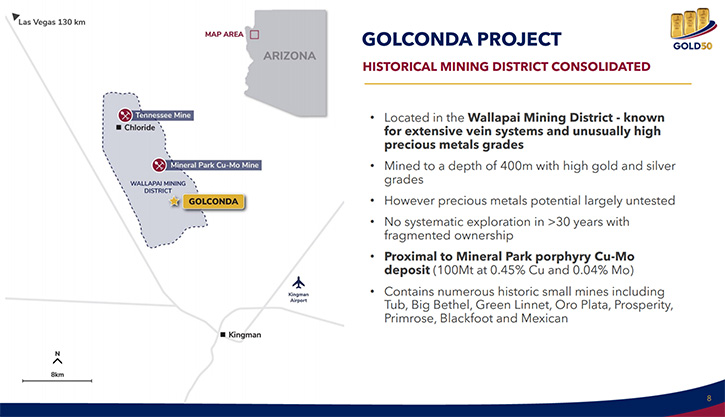

The Golconda Project, Arizona

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Mark Wallace, Managing Director of Gold 50. Mark, I wonder if you could give our readers/investors an overview of your Company and the exciting properties that you’re working and discovering gold and silver, etc. in Arizona and in Nevada.

Mark Wallace:Gold 50 is exploring for precious metals, specifically in Tier One jurisdictions of Nevada and Arizona. The projects and the assets came about through a relationship of one of our Directors, Bernard Rower. He is the CEO Managing Director of Ioneer, they're developing a lithium boron project in Nevada. He's a 20-year veteran of operating in that part of the world, has a lot of experience and a good network, and the projects came in via his relationships. Exploration is the core DNA of Gold 50, so we’re excited about developing these early-stage projects.

Our flagship project is Golconda, in Arizona. It's a historical producing base metal mine, zinc and lead. It finished around 1917, when the surface infrastructure had burnt to the ground in a fire. No one's really worked, via the ground, since then, in a systematic way. Various owners have owned the ground over the last 100 years. Predominately, in the last 30 or 40 years, they've campaigned, explored it because it was held in small, patented claims among each other. In the last few years, Gold 50 has had the opportunity to bulk up the postage stamps into a bigger footprint and then take a high-level modern view of understanding the geology.

The four projects we have in Nevada are in the Walker Lane Trend, we think it's prolific and underexplored. Where most people in Nevada have concentrated on the Carlin style trend, which is big tonnage, lower grade ore bodies that definitely the Nevada gold mines of Barrick and Newmont are easier to develop for themselves. But for juniors, it's a far more difficult prospect and we prefer the higher-grade epithermal and opportunities in the Walker Lane.

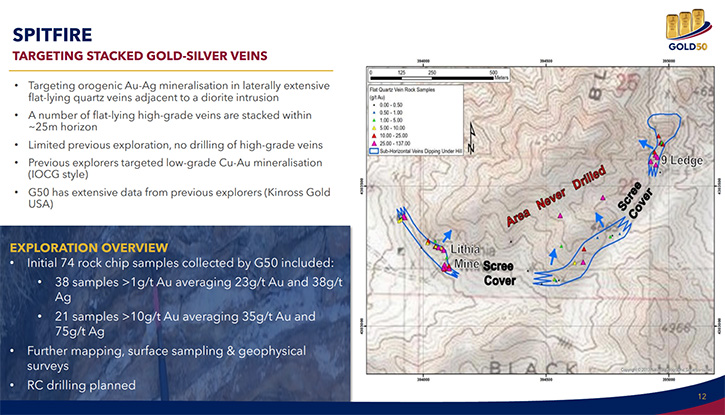

We have four projects there, not far from Hawthorne, very close to Reno in the Walker Lane. Spitfire is probably our most advanced prospect there in Nevada. We've recently picked up a database, on which Kinross had spent significant time and money working over the prospects. Targeting a different style of mineralization than we are, more probably a porphyry opportunity. We've found these significantly higher-grade veins, in and around and intrusive that we're targeting. It’s exciting times and we can't wait to really get into it.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit more about your plans for the remainder of 2021 and going into 2022?

Mark Wallace:

We've recently completed an IPO on the ASX. We raised $10 million, which gives us a good budget for two years. Then, depending on success on the projects, we will develop from there. I've looked at the capital as depending on the development of each individual project. I think half of that budget will be going into Arizona at Golconda. About a quarter of that budget would be at Spitfire. The rest of it will be split between other projects in Nevada: Top Gun, Broken Hills, and Caisson.

At the moment, we look to be drilling, hopefully, subject to rig availability and crews late in October, early November, at Spitfire and Top Gun. That's probably where the more immediate news flow will come from. That's because the recent Kinross database acquisition has given us the confidence to spend the money to go drilling there. Because the projects haven't been worked in a systematic modern method, we've gone back to our first principles and basics, everything from magnetic surveys, whether it's drone or ground supported.

We've done that at projects in Golconda, in Arizona, the recent database included all of that from Kinross at Spitfire. The money will be spent on mapping all the projects, completing any geophysics that need to be completed and then any surface work, soils, and streams and so on. Most of the non-intrusive work, we can do to help us with our targeting and understanding of the geology. Then that drives the drilling. It would be first Spitfire and then Top Gun this year. I'd like to think we're drilling at Golconda, in Arizona, early in 2022.

There have been significant rains and storms, through the Cerbat Mountains and through Arizona this summer. We're back into fixing roads and things like that right now. We have a great Team, both in Nevada and Arizona. We're allocating the capital wisely, as we go through our exploration programs.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about your background, the Board and the Team you have in Arizona and in Nevada?

Mark Wallace:

Absolutely. The people at Gold 50 really are the brains, trust and the lifeblood of Gold 50. I'll start with Bernard Rowe, our Non-Executive Director, Founder of Ioneer. He has 20-years of experience operating in Nevada and around the world. They’re developing a lithium boron project called Rhyolite Ridge. There's Robert Reynolds, our Chairman. He's been involved in everything from exploration through to development. A lot of gold projects around the world; Delta Gold, Avoca, Alacer. I think probably some of your readers might know names like Extorre Gold Mines, Exeter Resources and things like that.

I am Managing Director, I come from a finance background. I grew up in a mining town in Western Australia, Kalgoorlie. By osmosis, I probably know enough to be dangerous when it comes to geology, but my background is economics and finance. I worked in capital markets for Royal Bank of Canada, for 10 years in between London and Sydney and then moving to boutique advisory GMP Securities. Finally I spent the better part of 2 years at Blue Ocean Equities here in Sydney, always focused on global mining and global energy projects.

With Management and Board being Sydney-based, but the projects being in the US, there are really two important gentlemen that work for us over there. Wade Johnson, who's our Nevada Manager, is an exploration geologist, with over 10 years’ experience. He's worked at Agnico and Cordex and Silver Predator. He's concentrating on our Nevada projects.

For Arizona, there's a gentleman there, named Danny Sims. He's a PhD Economics and Structural Geology, with significant experience through western USA, Alaska, Mexico, South America and Indonesia. He worked at Cominco and Newmont. He's a structural geo by training and that's a specific skill set; we require for Golconda. It's very structurally complex here. He's a huge asset for Gold 50, directing the workflows and programs in Arizona for us. That's the key Management, Directors and Leadership Team right there.

Dr. Allen Alper:

Well, you have a very impressive Board, accomplished and successful and a very impressive Team in the field, leaders in the field. So that's great. You're very well set up. Could you tell us a little bit about your share and capital structure?

Mark Wallace:

We've been involved in junior companies for a long time. We've spent a lot of time making sure we have the right investors and the right structure for Gold 50. There are roughly 95 million shares on issue, of which about 50 million shares are escrowed. That's a function of the pre-IPO investors and then insider ownership. So, well over half of the Company has very strong insider ownership and early investor ownership.

The other, roughly 40 million shares were the public offering. That's not escrow, but that's very tightly held, through investors that I wouldn't say we selected and invited them to the register, but they're very well aligned, with the philosophy of the Board and how it operates at early-stage exploration assets in this part of the world. Limited options on issue. There's a performance rights for myself. This is at a time and share price that heavily aligns management with the rest of the shareholders.

That's about it. It is nice and simple. At our last share price of around 27 cents, it’s a 25, 26 million market cap, with about $9.5 million in the bank and a very good idea on how we're going to spend that money, through our projects, over the next two years.

Dr. Allen Alper:

Well, that's excellent. Sounds like you're very well positioned to move forward with your exploration. You have a great Team, a great location, and great projects to explore. It's nice to see that the Board and Management are aligned with investors and have a great deal of ownership in the Company.

Mark Wallace:

Exactly. Thank you.

Dr. Allen Alper:

Mark, could you tell our readers/investors the primary reasons they should consider investing in Gold 50?

Mark Wallace:

I think it’s three-fold. We have really strong people and a network that has a history of success. I think that's a really important part of the Gold 50 story. Also, in this day and age, jurisdiction and ownership is becoming a significant issue for investors, whether in emerging markets or even parts of Canada, where things are changing pretty quickly, when it comes to coal assets and so on. I think Arizona and Nevada haven't seen as much exploration expenditure, as they should have, over the years. I think that's going to change and I feel like we're at the forefront of that. Third, our projects are really exciting. We don't think they've had any modern exploration completed on them at all. We're bringing that to bear, with a well-financed capital structure and the good people to do it. So, there's every reason to be excited to be a part of the Gold 50 story.

Dr. Allen Alper:

Well, Mark, those sound like very compelling reasons to consider investing in Gold 50. Is there anything else you'd like to add?

Mark Wallace:Gold 50 is at a really interesting point in its life, very early. Yet we have a clear path and plans for executing our exploration budgets. I invite anyone to take a look at us and I'd love to see them become part of our story.

https://www.gold50.com/

Mark Wallace

Managing Director

Gold 50 Limited

queries@gold50.com

+ 61 2 8355 1819

|

|