Nolan Peterson, CEO, World Copper Ltd. (TSX.V: WCU, OTCQB: WCUFF) Discusses Exploration and Development of Two Primary Copper Porphyry Projects in Chile, and One Copper-Oxide Porphyry Project in Arizona.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/3/2021

We spoke with Nolan Peterson, CEO of World Copper Ltd. (TSX.V: WCU, OTCQB: WCUFF), a Canadian resource company, focused on the exploration and development of its two primary copper porphyry projects in Chile, and one copper-oxide porphyry project in Arizona. The Escalones porphyry-skarn project, southeast of Santiago, Chile, has indicated and inferred resources and tremendous upside exploration potential. The Cristal property, in northern Chile, is in a prospective porphyry copper belt, with high potential for additional large porphyry discoveries. The 100% owned, advanced Zonia copper-oxide porphyry project, in central Arizona, is located on private land and is being fast-tracked to production.

World Copper Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News interviewing Nolan Peterson, who is CEO of World Copper, Ltd. First of all, Nolan, I want to congratulate you for having your Company approved for the OTCQB Venture Markets, that’s excellent. Excellent! Nolan, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Nolan Peterson:

We are a Canadian based resource company, based out of Vancouver, B.C. We have two main assets in Chile right now, the Cristal Project and the Escalones Project. We are in the process of a transaction, with Cardero Resources, another Vancouver based resource company, with a project in Arizona, called the Zonia Project. What we are offering to the market is a Company that offers exploration blue sky potential, with our assets in Chile, as well as a compelling path for development, within the near term. And by that, I mean within the next three to four years, with the Zonia Project, for which we have a deal with Cardero.

In contrast to other junior mining companies that are more focused on exploration and building up an asset for an eventual sale or take out, we are looking to develop these assets, such as Zonia, and bring them into production in the near term. Yesterday, on August 23rd, we put out some exciting brand-new news for the Escalones Project in Chile, which positions it, as a project that has a much clearer path for forward development, as in a copper oxide project, in contrast to a copper sulphide project, which it was previously. That gives us another case for a project that can be brought to production, within a more accelerated timeframe. That one will take a few more years than Zonia, but it's definitely come a little bit closer, with yesterday's news.

Dr. Allen Alper:

That sounds excellent! Could you tell our readers/investors more about the three key projects?

Nolan Peterson:

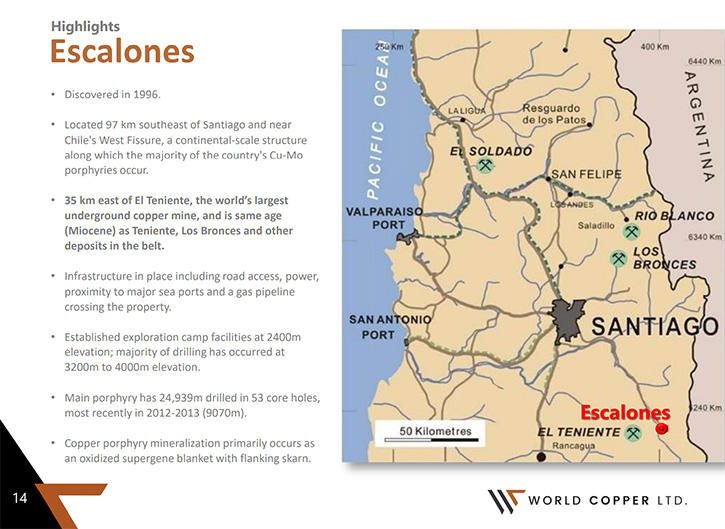

The Escalones Project is our flagship Chilean asset, in the Santiago Region of Chile. It's in an area with good infrastructure. It has a copper oxide resource, as defined recently, in an updated resource statement, of about 426 million tons of copper oxide ore at a grade of .37%, with a recovery of 71%. That would make it one of the largest, if not the largest, copper oxide projects in development, in Chile at the moment.

We have, on the Escalones property, four other copper Porphyry targets. One is immediately to the south of the existing resources. We call that the Mancha Amarilla Resource, and that has the potential to expand the existing resource substantially, as we expect the mineralogy to be the same as the main resource. A successful drill program, later this year, in the Chilean summer, could potentially double the resource in size. This is, of course, a very aggressive forward looking statement, which we will need to get drills out into the field to prove out.

We also have, at the main resource, some skarn mineralization, which flanks the main resource, and the Mancha Amarilla that has the potential to add additional oxide tons, at an expected higher-grade than the main resource. To the northeast of the main resource of Escalones, we have three other targets, which are on the claims block that share the same mineral characteristics as the main resource. And once we get some drills up there, we expect to prove that those are substantial resources in their own right.

We have the Cristal Project, which is in northern Chile, near the Peruvian border. This is a smaller land package, with the potential to be a high-grade copper deposit. We want to get some drills up there in the next couple of years to prove this out. There are some major players in the region that have made some discoveries recently and we believe that Cristal is primed to be the next big discovery in the region.

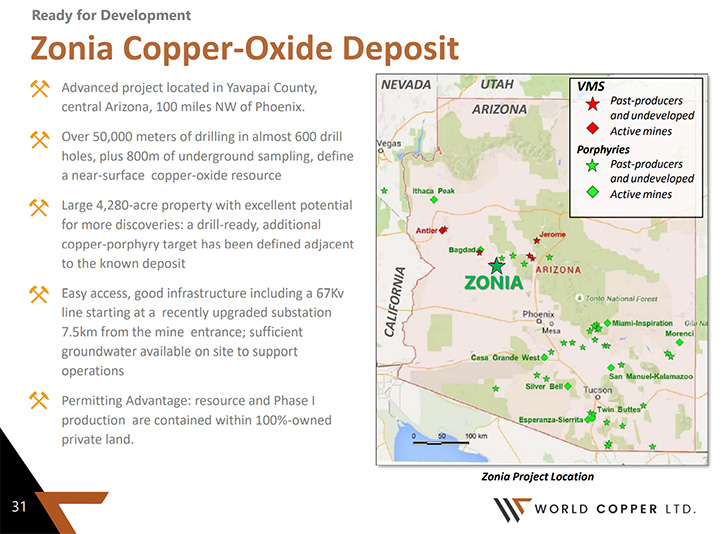

We have the Zonia Project, which we are acquiring through a merger, with Cardero Resources. This is in Arizona, a great mining jurisdiction, just like Chile. We want to focus World Copper on these fantastic jurisdictions, with stable governments and supportive of mining. Zonia is about 120 miles to the northwest of Phoenix, Arizona. It's in an area with good infrastructure as well.

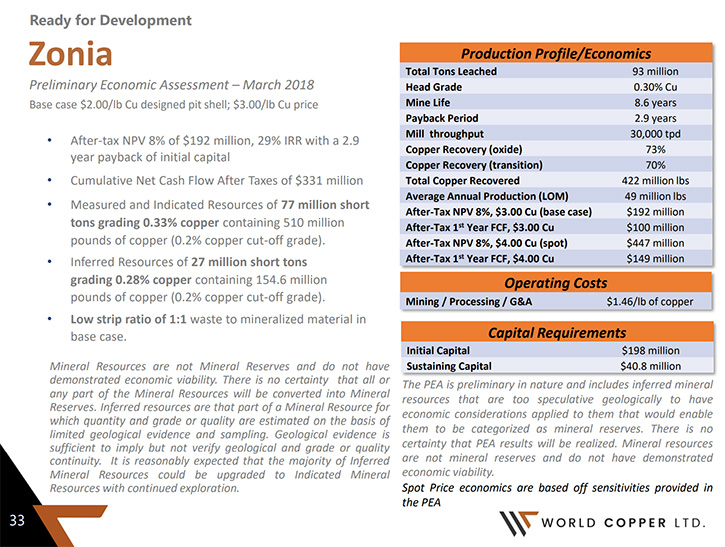

It had a preliminary economic assessment, carried out on it in 2018. At the time, the economics suggested that it could be built for about $200 million, with an NPV of $192 million, and that was at $3.00 copper. Closer to today's prices of copper, around $4.00, the NPV is about $450 million and, after tax, first year free cash is around $150 million. That's why we are aggressively pursuing the project.

The fact that the resource sits on private land in Arizona means that we anticipate being able to permit this mine within three to four years. With where we see copper going and the fact that Zonia is at the right scale for us, it's important that we move quickly to develop this asset. Once we complete a feasibility study and prove that it’s something that we can tackle, we’ll aim to start development to hit the high copper price window very hard in the coming years.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors, one of the great features of your Chilean project is the ability to heap leach it. Could you talk about that?

Nolan Peterson:

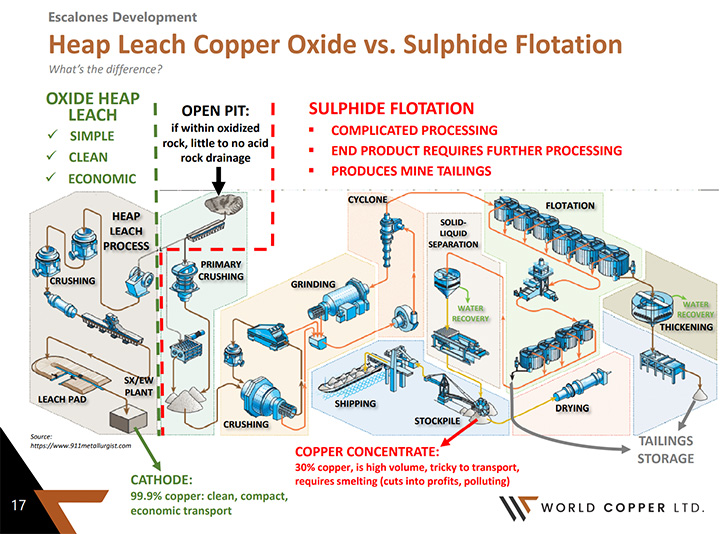

In the copper industry, there are two main sources of copper production, some from copper sulfide and some from copper oxides. The majority of the world's copper production comes from copper sulfide, through sulfide flotation. These deposits are generally much larger than oxide deposits, but they are much more expensive to develop. The ore is deeper into the ground. The mining costs are higher. The processing costs are higher because they require more infrastructure, and more infrastructure means higher initial CapEx.

They also use more water through the flotation process, which also requires a tailings storage facility, which in itself is more expensive. The permitting is much more rigorous, because of the water consumption and environmental impacts of sulfide operations. And then once you're done processing the sulfides, you have a concentrate that has to be sent somewhere else, for further smelting, to produce copper metal.

Copper oxides, in contrast, are closer to the surface. They are amendable to heap leaching, which is a much more simplistic process, simply crushed or placed into a heap leach pad, spray it with sulfuric acid, which generates a pregnant leach solution, which is ultimately recycled. But from that, you use a solvent to extract the copper and then you use electrowinning to produce sheets of copper.

One hundred percent pure copper requires less infrastructure and less water consumption, on the order of at least three to four times less water, for copper oxide projects in Chile, per pound of copper produced. They don't require tailings storage facilities, and the permitting process is much faster. We believe that Escalones, as an oxide project, has a lower initial CapEx, lower operating costs, higher margins for operations, and with its size and scale, it would be a very impressive project to take forward. It sounds excellent!

Dr. Allen Alper:

That sounds like a great competitive advantage, with much lower cost CapEx and much lower operating cost.

Nolan Peterson:

Yes, definitely!

Dr. Allen Alper:

Nolan, could you tell our readers/investors, a little bit about how your projects fit in, with the electrification of the world?

Nolan Peterson:

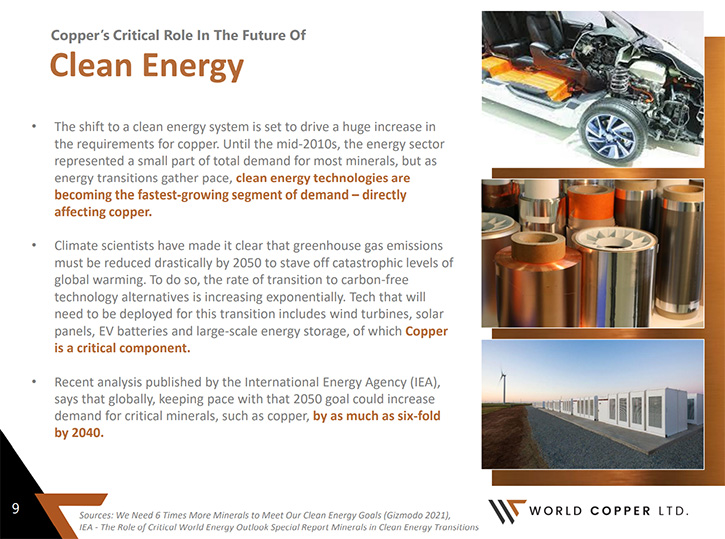

Copper has an image, it's a pretty mundane metal. It's definitely not what I would call a sexy metal, like lithium, and manganese and cobalt that we're starting to hear about that are going into batteries and electronics. But unsurprisingly, because of copper properties, it is going to be a part of the green revolution that's coming upon us. And its usage is actually going to increase as the demand for it increases from this application.

Many people are surprised by the metals that are used in an electric vehicle. They will say lithium, for the batteries, and some of the other metals I listed. But copper is actually used three times as much, in an electric vehicle, as it is in the normal internal combustion vehicle. Up to 200 pounds of copper is in an electric vehicle. That's going to create a lot of demand, going forward, as we know how popular electric vehicles are. You also have to think about the new power facilities, the wind turbines that use copper, even the normal power generators use copper. And then you have the infrastructure to deliver the power to cities and charging stations. Then, of course, you have the charging stations themselves. And that's just one aspect of it. When you have the continued westernization of economies like China and India, as they start to get Western style housing and infrastructure, that will produce a sustained demand for copper going forward.

Dr. Allen Alper:

That sounds excellent, like a great opportunity for World Copper. Could you tell our readers/investors a little bit about your background, your Team and your Board?

Nolan Peterson:

My background is engineering. I'm a process metallurgist, by background. I spent the first five years of my career, working in the engineering consulting industry, for a company called SNC Lavalin. I've worked with clients like Barrick, Rio Tinto and Newmont, so some very large players in the mining industry. I spent the early parts of my career working for these clients, on their projects that were in development. These models, resource estimates, processing plans, as well as working in the fields, really gave me great exposure to how major players shepherd their projects along and unlock value along the way.

I then went to join an intermediate Canadian gold producer, called New Gold, and I worked in Kamloops on the New Afton copper gold project. We took that project through commissioning and construction and then into operations. Then I spent a few years working for a New Gold corporate project development group, on the Blackwater and Rainy River projects and doing feasibility studies. Then ultimately, Rainy River was chosen for construction and then taken into operations, and I was involved in that.

I have a very strong financial background as well, in addition to my technical engineering background, over the years I picked up an MBA and became a CFA Charterholder. I've spent the last five years, in corporate finance, working in accounting, financial management and cost control and just general corporate oversight and governance. I bring a strong development background to World Copper, which is something that our Chairman, Henk van Alphen, wanted. Henk has a long history of putting companies together and wanted to add my type of experience to the Company in order to take World Copper on a development path, with Zonia and now Escalones.

Hank van Alphen has had success in growing companies. His first major success was Corriente Resources, which he sold in the early 2000s, for a substantial increase in valuation. I believe the deal went from about $10 million to be sold for over $800 million to a Chinese interest. He also founded a Company called International Tower Hill Mines, of which he was Chairman for a number of years and grew that Company to over a billion dollars. He sees this as his next great success story. He's also involved in Wealth Minerals, which is a lithium company that operates in Chile. They are a major shareholder of World Copper and we're glad to have them on board.

We also have an Executive Director named Marcelo Awad, who is a good friend of Hank’s. He was a former CEO of Antofagasta; a Chilean copper company and he was responsible for helping that company grow from $4 billion to a $20 billion valuation. He's very supportive of our activities. We have very impressive geologists, such as John Drobe and Patrick Burns, as well on our Team. John Drobe, our Chief Geologist, and Patrick Burns is our President. They have a lot of experience in South America and developing assets like similar assets like Escalones historically, so very happy to have them on board.

We recently brought on a new General Manager of our Chilean operations. His name is Krzysztof Napierala. He has over a decade of experience, working for a company called KGHM, which is a major global Polish based copper producer. He was working on their international operations and then most recently their General Manager in Chile and their General Manager, for their Franke mine. We’re bringing a lot of experience, on into the team of people, who build companies and have also built assets in the past, such as myself and Krzysztof. We hope that that inspires confidence in the market and your readers/investors.

Dr. Allen Alper:

Well, that's a very accomplished group, you and the Board and the Team, that’s very impressive. Nolan, could you tell our readers/investors a little bit about your share and capital structure?

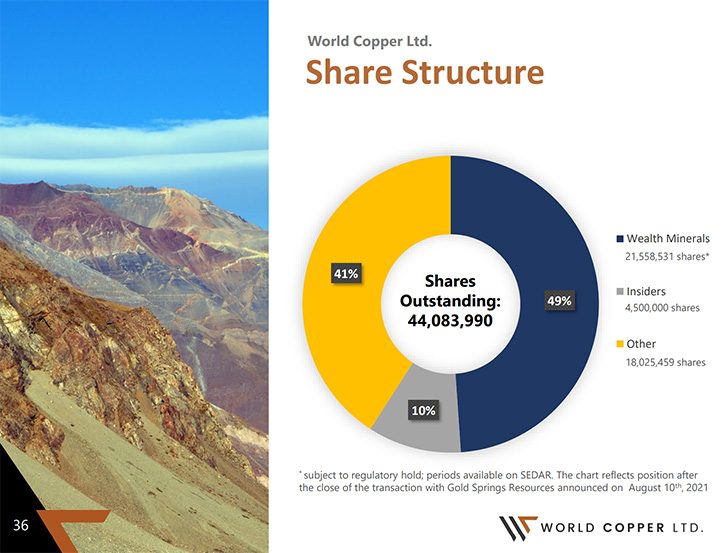

Nolan Peterson:World Copper currently has about 44 million shares outstanding. We recently did a three to one rollback, so that that's after the rollback. That's in preparation for our merger, with Cardero Resources, which will be a 60-40 merger transaction. We will issue them 40% of our shares. That will about 29 million. In total post-merger, we will have 73 million shares outstanding.

Our major shareholder, right now, for World Copper, is Wealth Minerals. They own 20% of the Company, and the other 30% is held by a company called Gold Springs Resources. But in early August, the transaction was announced where Wealth Minerals would be acquiring all of Gold Springs’ shares for a deal valued at 33 cents a share, so they will become a 49% owner, pre-merger, with Cardero Resources. The remaining 50%, 10% is held by insiders and close associates of the Company that we know are not going to be selling anytime soon. The remaining 40 million, of that 44 million shares, is free trading in the market.

Dr. Allen Alper:

That sounds great! That sounds like you have very strong support, with Wealth Minerals, and you have term investors. Sounds like you're financially secure, as you explore and develop your three main projects. Nolan, could you tell our readers/investors the primary reasons they should consider investing and World Copper, Ltd.?

Nolan Peterson:

The biggest thing that I would consider, when I'm looking at a junior mining company, is what am I investing in? Is it the hope that there is a resource on a property that a junior mining company will find, and a drill result will come back, with high grade samples that you can build a resource around and then probably sell it to a major player? Or do I want to invest in a company that actually has resources in place? That would be Escalones and Zonia and the potential for expansion.

Even if we never found additional copper at Escalones, with this current size of the resource, it is more than enough to progress. When you're presented with a menu of companies to invest in, look for the ones that have an asset that already exists. Look at the valuations of the companies involved and the potential upside. I think it's pretty clear that World Copper is undervalued for the assets that we have in our possession and the expertise that we have in developing assets. What we bring to the table is really a very complete story in the mining industry, and for a junior.

Dr. Allen Alper:

Well, those sound like very compelling reasons for our readers/investors to consider investing in World Copper. Nolan, is there anything else you'd like to add?

Nolan Peterson:

One other thing is, as you mentioned, that we're trading on the OTCQB, that is very important! We’re just really starting to get our message out to the US audience. I would guess that most of your readers/investors are based in the US and I think it's a very good story. Zonia is a Made in America project that will bring a lot to the local region in Arizona, and it has a lot of support there. I think that is very important. And it's very early stage for our story and for the World Copper story in general. So, it's a great time to get in and invest.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://worldcopperltd.com/

Nolan Peterson

Chief Executive Officer

Henk van Alphen or Michael Pound

Phone: 604-638-3665

E-mail: info@worldcopperltd.com

|

|