Endurance Gold Corporation (EDG -- TSX.V): Project Generator, Acquisition, Exploration and Development of Potential World-Class Deposits in North America; Robert T. Boyd, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/8/2021

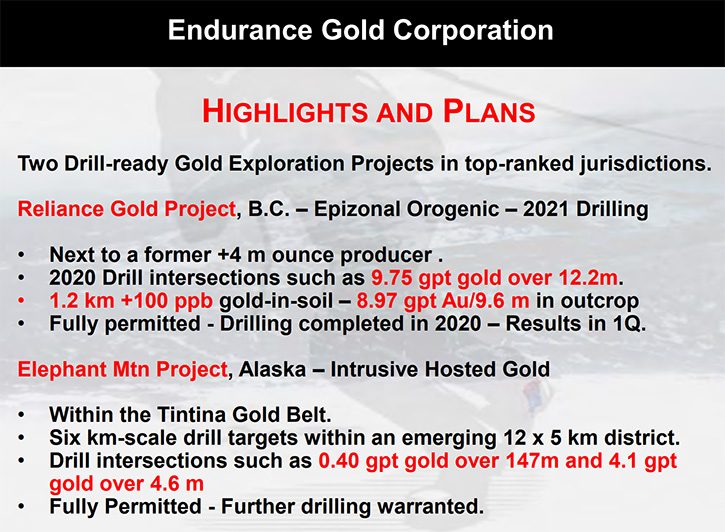

Endurance Gold Corporation (EDG -- TSX.V) is a project generator, focused on the acquisition, exploration and development of highly prospective North American mineral properties, with the potential to develop world-class deposits. Endurance Gold owns two drill-ready, gold exploration projects in top-ranked jurisdictions: the fully permitted, high-grade Reliance Gold Project, located in the historic Bralorne gold camp in British Columbia, and the fully permitted Elephant Mtn Project, located in Central Alaska, within the prolific Tintina Gold Belt. We learned from Robert T. Boyd, President and CEO of Endurance Gold that the Directors of the Company own more than 50%, aligning their interests with the shareholders. On the Reliance Property in British Columbia, the Company has already intersected values such 9.7 gpt gold over 12.2 metres from surface and is currently awaiting results on eleven (11) additional drill holes with plans for 2021 to include a drilling program that will begin in April and could continue throughout the year due to year-round, all-weather road access. In Alaska, the Company is considering its strategic options, including identifying a partner to explore and develop six large drill-ready targets at their Elephant Mtn Project.

RELIANCE Gold Property, Gold Bridge, B.C.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rob Boyd, who is President and CEO of Endurance Gold. Robert, could you give our readers/ investors an overview of your Company? Also, what differentiates your Company from others?

Robert T Boyd: Sure, Allen, I am happy to. Endurance Gold is a TSX Venture-listed Company. We are in the business of mineral exploration, as a project generator. What is unique about our Company is, despite being over 10 years old, we are still more than 50% owned by three Directors of the Company, including myself with about 6%, so we are very aligned with our shareholders' interests. But of particular interest to us, as shareholders and potential investors, is a very recent drill discovery we have made on our Reliance Gold Project. Reliance is only a four-hour summer drive north of Vancouver, within the historic Bralorne gold camp, which has produced over 4 million ounces of gold between 1934 and 1974. The Reliance Gold project discovery is located only about 10 kilometers away from the Bralorne-Pioneer Gold Mine. All the geological earmarks suggest that Reliance is also an orogenic gold system, similar to Bralorne, but at a shallower erosional exposure.

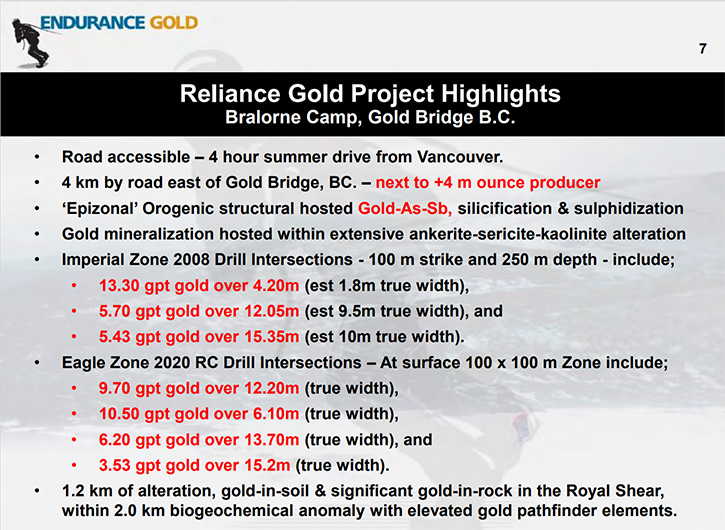

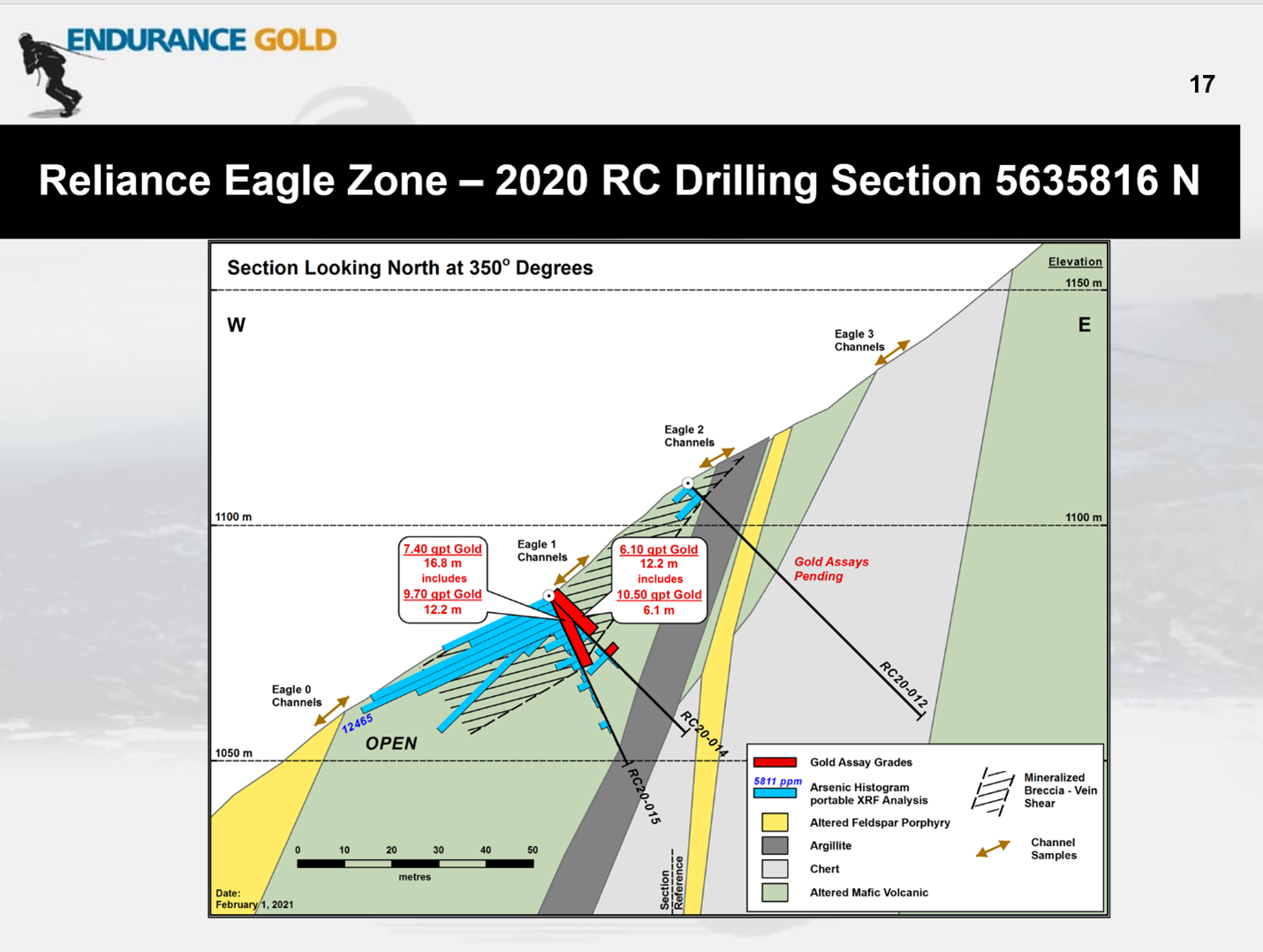

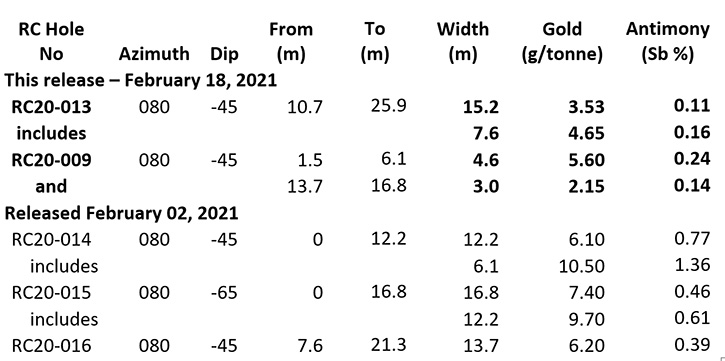

After a successful 2020 summer and fall exploration program, we culminated the year with the completion of 16 RC drill holes in December. We announced the results from five of these 16 holes in February, with results expected in March for the remaining 11 holes. Of those five holes reported, all intersected gold at shallow depth that so far averages 5.07 g/t gold over an average estimated true width of 14.6 meters. We drill tested under road cuts, at the Eagle Zone that had excellent gold results in surface channel sampling. We have a zone sticking out on surface, the significance of which had never previously been recognized. This first phase of drilling has conservative tests to determine and understand the structural setting. At the Eagle Zone, we have identified a shallow-dipping subsidiary tensional shear feature that is hosted, within much steeper dipping faults and a shear complex, called the Royal Shear, which we have now traced out, based on geochem, geology, channel sampling and drilling for about two kilometers of strike potential, with gold in bedrock and drill holes over about 1.2 kilometers of strike.

Historic drilling, by one junior that owned the property back in the mid to late '80s, did intersect excellent gold mineralization at the Imperial Zone, along the Royal Shear. The new Eagle Zone, we have discovered in drilling, is about 400 away. The gold mineralization was identified this year, through systematic channel sampling of historic road cuts. The best mineralized outcrops show evidence of oxidized sulphides, without obvious quartz veining and we believe this is the reason prior owners did not recognize and sample the many mineralized outcrops. That mineralization in outcrops, and now drill holes, is very encouraging and suggests a well-developed orogenic gold system. So, it is a great looking project.

The nearby Bralorne Mine has produced over 4 million ounces of gold. We look like we are on a parallel structural system, with very strong alteration and great drill intercepts. Reliance does have potential to evolve into a multi-million-ounce discovery. Our goal now is to do systematic exploration to prove this concept. We are in the process of completing a $2 million financing to fund our next exploration program of drilling and some IP geophysics. Drilling is anticipated to start in April and continue through the year.

Dr. Allen Alper: That sounds like great!

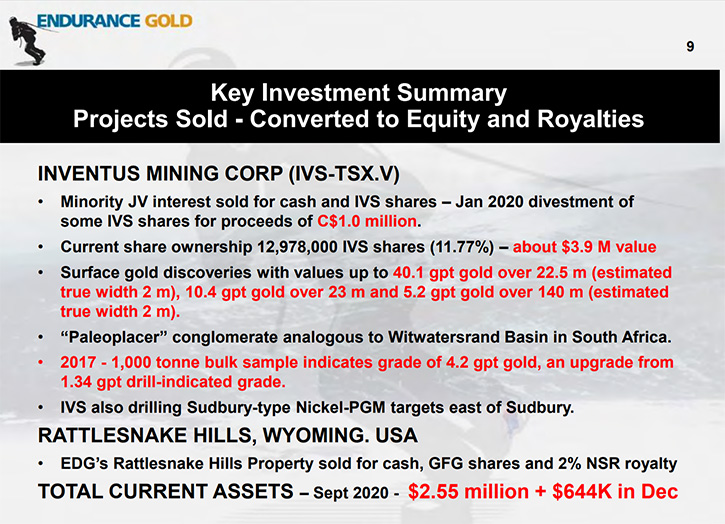

Robert T Boyd: Yes, what is also unique about our Company, as a project generator, is that we also own an excellent gold project in Alaska, with outstanding exploration potential. We also have a large footprint, intrusive hosted, rare earth niobium project in the southeastern Yukon.

Dr. Allen Alper: Those all sound like exciting projects! It sounds like 2021 will be a truly exciting time for Endurance Gold, as you drill and recover more data and information.

Robert T Boyd: Yeah, we are pretty excited about the Reliance Project, in particular. It is a project we can work year-round. There are all weather roads that cross the property, which is only a four-kilometer drive, east of the town of Gold Bridge. So, visitors can commute from the Gold Bridge Motel, and be back for a beer, at the end of the day, at the local pub. So, it is a great location. We feel it provides us a unique opportunity to advance the project with year-round exploration.

Dr. Allen Alper: Well, that sounds exciting. Could you tell our readers/investors a little bit more about your Alaska projects?

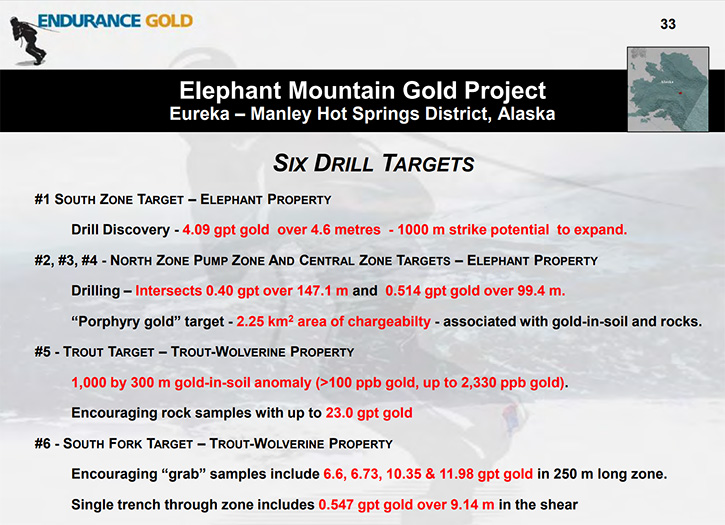

Robert T Boyd: In Central Alaska we own 100% of a large district scale exploration play, which we call our Elephant Mountain Project. That project encompasses an area of 12 kilometers by 5 kilometers in size, with a land position in two packages over 10,000 acres in size. We have identified about six kilometer-scale targets that warrant drilling. On one target we have strong gold in soil anomalies, extending at least 1,400 metres long by 200 meters wide. A single hole on a mineralized structure, within that soil anomaly, identified a structure that returned 4.09 gpt gold over 4.6 m and is wide open for expansion. Another excellent soil anomaly target was drilled and returned an intersection of 147 meters grading 0.4 g/t gold, with a higher-grade interval of 48.2 meters of 0.63 g/t gold, associated with a mineralized, altered granodiorite intrusive. This intrusive-hosted drill hole is directly associated with a 1,200 x 600 metre, chargeability anomaly, which warrants a program of grid-based drilling, showing potential for significant growth as a gold target.

The Elephant Mountain Project is accessible by the Elliot Highway, northwest of Fairbanks, Alaska. The project falls within the regionally extensive Tintina Gold Belt, known for multi-million-ounce mines and discoveries such as Kinross' Fort Knox Gold Mine and the Golden Summit property, owned by Freegold Ventures, and International Tower Hills' Livengood Project, all in the Fairbanks area like Elephant. Kinross' gold mine has been producing now for over 20 years and produced over 7 million ounces of gold.

RC Drilling 2020

All of these projects and mines fall within a class of deposits, referred to as reduced intrusive-hosted gold targets. Perhaps the closest geological analogy to Elephant Mountain is Victoria Gold’s Eagle Mine located in the Yukon, which was recently brought into commercial production.

Elephant Mountain has a large low-grade intersection, associated with a very large chargeability anomaly in the intrusive, which remains to be tested with grid drilling, by at least 200 m deep drill holes. So, it is a big drilling kind of project. We, as a Company, need to get ourselves to a critical mass to fund this project or identify a senior funding partner to take that project forward. But it is not just one target that we are chasing at Elephant. There are six targets like that. All those targets have potential and only the two targets have had minor drill testing. We are onto something pretty good there, and we're happy that it's relatively accessible on state mining claims, which bode well for future permitting issues.

Like a lot of these gold systems in Alaska and the Yukon, there is almost always an associated historic placer gold camp. This is because Central Alaska has not been glaciated, you often find that these gold systems create very strong stream sediment anomalies for gold which usually means placer mining operations. Elephant is located in the old Rampart-Eureka placer mining district, of Alaska, which is northwest of Fairbanks. The area is relatively accessible. As a result of that, we can drive pickup trucks right to the edge of the property and ATVs onto the property. The project is very well located in Central Alaska on state mining claims. It is a project that needs a lot of exploration investment, to advance these targets and turn them into major discoveries.

Dr. Allen Alper: It sounds very promising. Could you tell our readers/investors a little bit about your background, your Team and Board?

Robert T Boyd: I am an exploration geologist. I have been for almost 40 years now, and I am currently the President CEO and a Director of Endurance Gold. In the past, I have been involved in the exploration business for a number of commodities. For instance, I have been the President and CEO of Ashton Mining of Canada, which made a diamond discovery, now a diamond mine in Quebec. Ashton was sold and became part of Stornoway Diamonds. More recently I was a Lead Independent Director for Peregrine Diamond. Peregrine made an excellent diamond discovery up in the Arctic islands near Iqaluit. Peregrine was sold in 2018 to De Beers, based on that discovery.

I have also been involved as a CEO of a potash company that was acquired by BHP and the project incorporated into their Jansen Project. I spent a big part of my early exploration career with Homestake Mining Company, before it was merged with Corona, exploring for gold in Canada. One of the exciting projects I advocated, was the Back River Goose Lake Project, now owned and controlled by Sabina, who has grown the project to over 6 or 7 million ounces in size. So, I understand the business and have had a lot of experience in mineral exploration and the business of mineral exploration.

Dr. Allen Alper: Wow. I am impressed!

Robert T Boyd: I forgot to mention that I also serve as an independent Director for Condor Resource, a project generator type company, exploring for gold and base metals in Peru, with an excellent portfolio of projects.

Dr. Allen Alper: Oh, you have a great background and a great track record. That's excellent! It looks like you are well qualified to be a prospect generator.

Robert T Boyd: Yeah. The goal of our team is to take the Reliance project forward and advance it, as much as we can, through discovery and towards feasibility, and hopefully, turn this into a multi-million-ounce gold discovery that will rival the former Bralorne Mine. Reliance is an ideal project for us in these COVID times, since it is a project we can access by road and does not involve commercial air flights. It came along at an ideal time for us. We advanced the project very quickly and made these discoveries on unrecognized gold zones in outcrops. So, it's fantastic!

Dr. Allen Alper: Well, that sounds great! Could you tell us a little bit more about some of your other Team Members and Board?

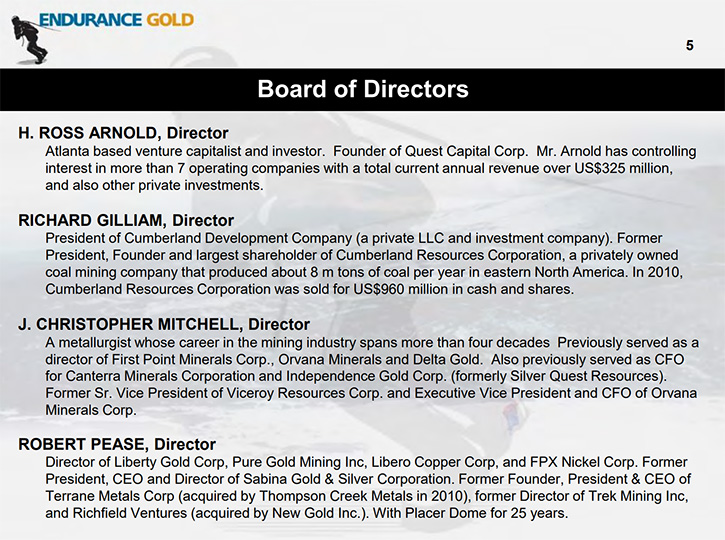

Robert T Boyd: As I may have mentioned at the beginning, what's unique about us is we're about 55% owned by three Directors. As one of the Directors, I own about 6% and then two other Directors, based in the Eastern US, are Richard Gilliam and Ross Arnold, one in Charlottesville, Virginia and one in Atlanta, with each owning about 24%. Both Richard and Ross have experience in the mining sector. Richard was involved in building a coal mining company, with his brother, which he has now sold. They have been very supportive and helped to venture capitalize the Company, when it first went public many years ago. They have been very supportive, as Directors and investors in the Company, throughout the years.

We also have two other Canadian Directors; Rob Pease, who has a great track record in our business, an ex-Placer executive that also built and sold Terrane Metals, which owned the Mount Milligan Mine in BC, which was sold in a takeover bid. And then Chris Mitchell, who also has a long career as a Board Member and other key technical roles in junior mining companies. We are also privileged to have the long-term and excellent guidance of Teresa Cheng, a junior mining industry veteran, as CFO for the Company.

Dr. Allen Alper: Oh, it sounds like you have a very experienced and knowledgeable Board. Can you tell our readers/investors a little bit about your share and capital structure?

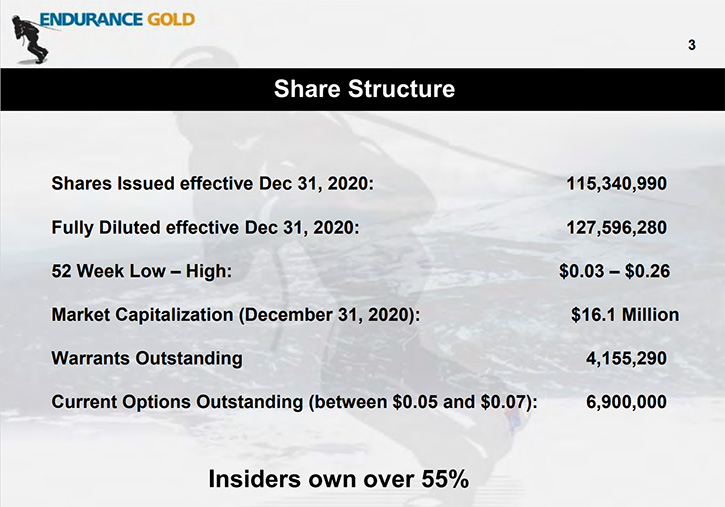

Robert T Boyd: Sure, I would be happy to. As of year-end 2020, we had 115 million shares issued and outstanding. About 8 million options issued, and 4.2 million warrants at $0.25 that were tied to a financing we completed in November of 2020. Those are two-year long warrants. With all that, we are fully diluted at around 127.6 million shares. We are now in the midst of completing a $2 million unit financing, at $0.31 per unit, which includes a ½ warrant. So, there is the expected issuance of about another 6.7 million shares. Working capital is about $3.4 million, which includes cash and ownership of securities in other junior mining companies that we have acquired as a result of our project generation activities.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Endurance Gold?

Robert T Boyd: Investing in Endurance Gold gives your investors exposure to an exciting new and growing gold discovery, developing next to and adjoining, the biggest historic gold producer in the province of British Columbia. We will be drilling and exploring this year, with the goal of evolving Reliance into a major discovery that will demonstrate size potential, similar to our former producing neighbor.

Dr. Allen Alper: That sounds excellent, Robert, is there anything else you would like to add?

Robert T Boyd: We continue to look at opportunities to recognize value for all our exploration assets, but we are currently very focused on turning Reliance into a major discovery, through self-funding. We still have other projects, like the Elephant Project, Alaska already discussed. But also, a rare earth niobium project in the Yukon that provide shareholders exposure to more than just Reliance to generate shareholder wealth.

Dr. Allen Alper: Well, those all sound like compelling reasons for our readers/investors to consider investing in Endurance Gold. It is nice to see that the Directors and Management are committed and have skin in the game, just like the other shareholders, to make the Company grow and expand and increase in value.

Robert T Boyd: Absolutely! We are very much aligned with our shareholders, in terms of wanting to make this a success.

Dr. Allen Alper: We will publish your press releases as they come out, so our readers/investors can follow your progress.

http://www.endurancegold.com/

Robert T. Boyd

Endurance Gold Corporation

Toll Free: (877) 624 2237

info@endurancegold.com

|

|