Montem Resources Ltd (ASX: MR1): A Steelmaking Coal Development Company, Run by an Outstandingly Successful Team, Operating in Southern Alberta, Canada; Peter Doyle, MD & CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/7/2020

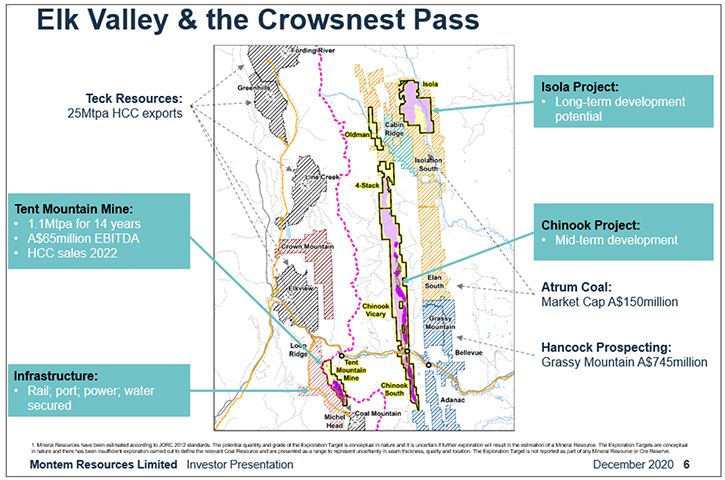

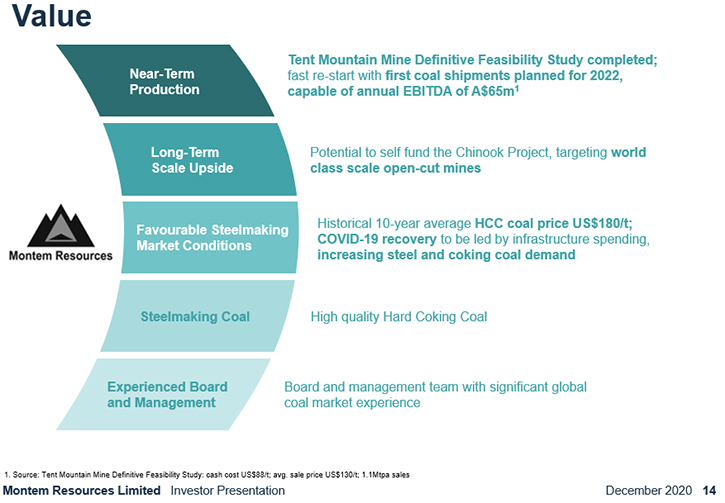

Montem Resources Limited (ASX: MR1) is a steelmaking, coal development company, operating in the Crowsnest Pass district, in southern Alberta, Canada. The Company is planning an integrated mining complex in the Crowsnest Pass, focusing on low-cost development of open-cut mines that leverage access to major infrastructure. The Company's Managing Director and CEO, Peter Doyle’s current focus is on restarting the Tent Mountain Mine, which completed a DFS in 2020. We learned Montem Resources is in the business of restarting old mines, including one with existing permits, which gives them a fast track into production. The Company just raised $8 million and the Tent Mountain Mine is on track to restart in 2022.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Doyle, who's Managing Director and CEO of Montem Resources. Peter, I wonder if you could give our readers/investors overview of your Company and what differentiates your Company from others.

Peter Doyle: Sure, Allen. Firstly, thanks very much for conducting the interview and having me on, I'm certainly excited to pick up the attention of your publication. Montem Resources is a hard coking coal exploration and development Company operating in Canada. We're publicly listed on the Australian stock exchange. We listed on the exchange on the 15th of September, raising $8 million, which will help us develop our assets through to construction. The differentiator for us and our competitive advantage is that we are restarting old mines to produce hard coking coal, which is becoming a scarcer resource on the global stage. It's essential for the modern production of hot iron metal in the blast furnace, which is then refined into steel. Almost every product that we use is either made of steel or has been made from something that is made of steel. About 70% of that steel will be produced from a blast furnace and steelmaking coal is an essential raw material in that process. The advantage Montem has is that we're restarting old mines and the first one retains existing permits. That gives us a fast track into production. We are on track to restart that mine, called the Tent Mountain Mine, in 2022.

We then have a large pipeline of mine projects that will use the reinvested profits from the Tent Mountain Mine for development. The first big project in that pipeline will be the Chinook Project, next door to Tent Mountain. It's in the heartland of coking coal production and development in Canada. This mine is in its early phases of being delineated, but from the drilling that we've done so far and the concept studies, we believe that that deposit will be able to support multiple, large scale hard coking coal mines. Beyond that, we have a large pipeline of Greenfield assets and overall up to a 1.5 billion tonnes of exploration targets across all our assets. So we're a small company with big ambitions. We have a huge asset base and we have one advanced project and one project just beginning to show its potential.

Dr. Allen Alper: Well, that's excellent! Could you tell our readers/investors a little bit about your plans for the remainder of 2020 going into 2021?

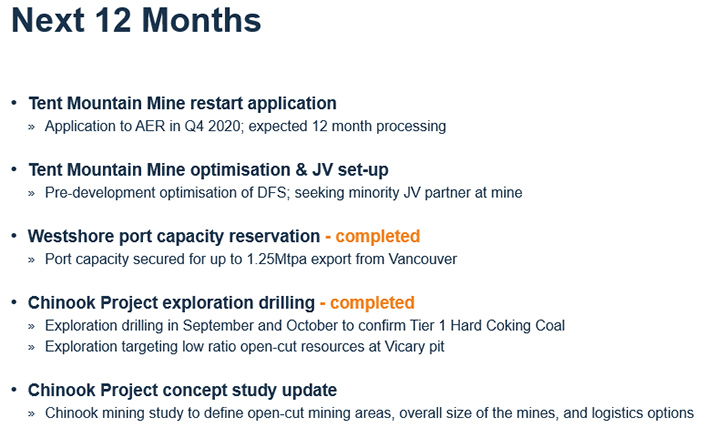

Peter Doyle: Our immediate focus is restarting the Tent Mountain Mine. We are in the final phase of completing the relevant applications to the Alberta Regulator to restart that mine. We've already received effectively the green light from the federal regulators, who said something to the effect of: "Okay, you're restarting an existing mine. It's relatively modest in size, being about 1.1 million tonnes. You are below our thresholds. So, we'll leave it to the Alberta Regulator to get that completed," which is a really big benefit to us because it potentially expedites the restart process.

We are negotiating with potential joint venture partners to join us in the equity stake in that mine. That way it will reduce the need for our existing shareholders to help us with the construction cost of the mine. We're getting ready to start that construction in the summer of 2021, and complete it in the winter of '21, '22 and restart the mine in the second quarter of 2022 and put coal on boats in the middle of the year.

We are also focused, in the latter half of this year, on completing a concept study for the Chinook Project, being the second of our assets to be developed. Our initial Chinook scoping study looks very, very interesting. We've just had some great drilling success at Chinook, where we found coal seams, on average, at 22 meters thick, which is pretty stunning for hard coking coal. The drilling that we did, showed a very attractive dip slope mining domain that we thought existed, but we've proved it up now.

We will need to do additional exploration next year to bring that Chinook up to a pre-feasibility level study. It is beside the old Vickery underground mine, which in its life exported 100% of its product to be turned into coke and used in the Japanese steel mills. So we know the product is good. The Japanese steel makers have told us that it's good. And we are eagerly awaiting the results from the coal quality testing from that drilling, which should be in our possession early in the New Year. So that's our focus, get Tent Mountain going as fast as possible and prove out Chinook.

Dr. Allen Alper: That sounds excellent. That was an exciting time for Montem, that's really great from now until when you get them to production, it'll be a very exciting time and a great time for you shareholders and your stakeholders.

Peter Doyle: Yeah, we certainly hope so.

Dr. Allen Alper: What markets are you planning to go for in the future, once your mine is on stream?

Peter Doyle: Our markets will be the same as the nearby major producer, Teck Resources and most of Western Canadian hard coking coal finds markets in Asia. It's the dominant market, North Asia, so Japan, Korea, Taiwan, and China. A smaller amount of Canadian coal goes to India, and a little bit actually goes to the U.S. steel makers, and to the European steel makers, but the real focus will be north Asia. And probably quantity wise, approximately in that order, we expect Japan will take around about half the product, and Korea and China will make up predominantly the rest. There's potential to sell cargoes to Brazil and sell cargoes to the European steel mills, but the North Asia market is the key focus area. That's also the focus area of our efforts in finding a joint venture partner for the mine. The idea is to sell down a small minority stake in the mine with an associated offtake and marketing deal and to use that as an equity lever in the debt markets to fund the entire project.

Dr. Allen Alper: That sounds very good. So my understanding is you'll have access to ports and you have good infrastructure. Could you comment on that?

Peter Doyle: Yeah, absolutely. So the main rail line operated by CP Rail runs straight through the middle of our projects. The Tent Mountain Mine sits six kilometers south of that rail line, and we have an existing road to an existing rail siding site. We have an option agreement that has secured that rail site. We're in negotiations with CP. We have also already secured the port allocation at the Westshore Terminal. Westshore is the largest coal terminal on the West Coast of the Americas. It's a premium terminal, handling all the biggest ships that travel back and forth, cross the Pacific to North Asia, including Japan, Korea and China. We secured access to Westshore last year, by making modest reservation fee payments to Westshore to secure that tonnage, which is up to 1.25 million tons per annum.

Dr. Allen Alper: Oh, that's excellent. Could you tell our readers/investors a little bit about your background and your Board?

Peter Doyle: By way of background, I'm an Australian, as you can tell from my accent. I studied Geology at university and fell into the coal industry really quite gladly. I went to university in Newcastle, home to the biggest coal exporting port in the world. I spent a bit of time in exploration and then moved into production roles at a mine. Glencore came and bought that mine in the late '90s. I stayed with Glencore through a number of different roles, moved into technical marketing and then traveled the world with my trade. I left Australia to work in China and to study the Chinese coal industry. I went over to Europe and worked in London for a while and worked across the Atlantic in the U.S. and European energy market as a management consultant. And then I came back to Australia and I joined up with Mark Lochtenberg, whom I had met at my time in Glencore and worked with Mark at Cockatoo Coal.

Cockatoo Coal was at the time a very successful metallurgical coal producer and developer in Queensland, and Mark was their Chairman. At Montem, Mark and I have a very good rapport and a lot of experience together. He's an incredible leader and knows the coal industry as well as anybody around the world, mostly through his role previously with Marc Rich trading. And then as the co-head of Glencore coal unit, all through the '90s and early 2,000s. I'm also very pleased and proud to have a wonderful team working with me here in Canada. I've been based here for five years. We have an incredible skillset in our management team all the way from the requisite engineering and geological work through to our permitting, Indigenous and government relations specialists.

Peter Doyle: We have a great technical team. It's led by a man named Bob Bell, who was previously the Chief Commercial Officer at Teck Coal. Bob has over 30 years’ experience in coal. I have over 25 years. The rest of our Board, have all been involved in coal mining in one way or another. We cover it all very, very well, including the governance around accounting and legal matters. Overall, Montem was designed by our Founder and Non-Executive Director, Rob Tindall. He bought these assets and he wanted to start a mining company. So the rest of us have an unabashed ambition to start mining coal in the Crowsnest Pass and end up with annual production of 10 million tonnes. That's our stated aim, and that's what we believe our asset base can support. It will take some time and investment, but we have the team, we have the assets, and thankfully the market, believe it or not, is with us, and also the government is with us. So yeah, we think that the Montem is set up with all the attributes required to be successful.

Dr. Allen Alper: Your Board and Teams have excellent backgrounds and excellent experience. It looks like you are all very capable of moving forward.

Peter Doyle: We're certainly trying.

Dr. Allen Alper: Well it seems like you have the background to do it, so I'm sure you'll be successful. Could you tell our readers/investors a little bit about your capital structure?

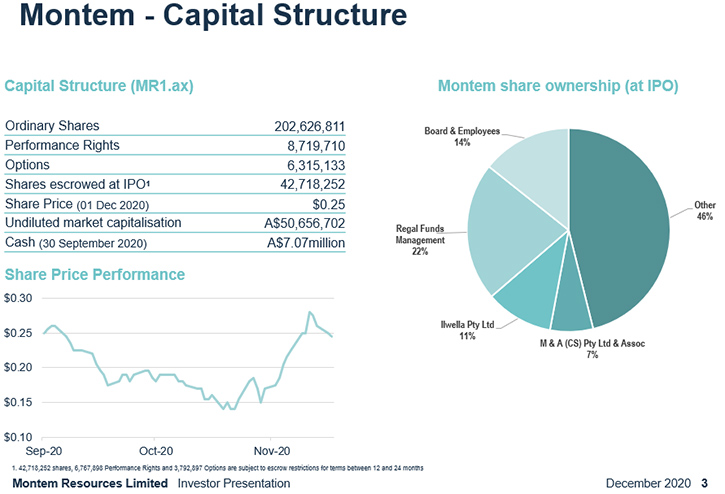

Peter Doyle: We're a publicly listed company. We have just over 200 million shares on issue and had $7 million in the bank at the end of September. As of the 30th of September, as a publicly listed company, we have something in the order of 350 to 400 shareholders, including all Montem employees. I like to emphasize that because I think it's very important. There're not many of our employees, but we all own shares, and most have bought those shares. Our key supporters are the Board, and the founders, as well as Mark Lochtenberg, who's put quite a bit of investment in.

Our largest shareholder is Regal Funds Management, a major fund manager in Sydney. Another key shareholder is the Flannery family through their private company Ilwella. Brian Flannery is extremely well known in the Australian coal industry, having built up Felix Resources, with his partner Travers Duncan. Brian was the Managing Director and they sold that to a Yancoal, probably 10 years ago now, for significant return on investment. Brian is a very successful investor and developer of coal companies. We also have a number of large private investors and smaller funds, and our general shareholding is around half the shares.

Dr. Allen Alper: Well, it's good to see that the Board and Management has skin in the game and believes in the project.

Peter Doyle: We've all invested in it along the way, at various different stages.

Dr. Allen Alper: Oh, that's great. Could you tell our readers/investors the primary reasons they should consider investing in Montem?

Peter Doyle: Fundamentally for value. Compared to our peers right next door, it's incredible, the value that we represent. Immediately to our West, we have the largest operating coking coal mines in Canada. Teck Resources has 25 million tonnes coming out of their mines annually, and they're only a few kilometers away. Immediately to our East, we have Hancock Prospecting, which is Australia's largest private mining company. They paid A$745 million for their asset the Grassy Mountain Project last year, and our capitalization right now is around A$50 million. To the North of Grassy Mountain, are Atrum Coal's assets. I was part of the team that identified those assets and purchased those assets when I worked for Atrum. Impressive coal deposits, very similar to our Chinook asset!

Atrum's current market capitalization on the ASX is somewhere around A$150 million. I came here to Canada to help push that company along. They're doing well, but we're one third their value, there's an arbitrage there that's easy to assess and leverage for new investors.

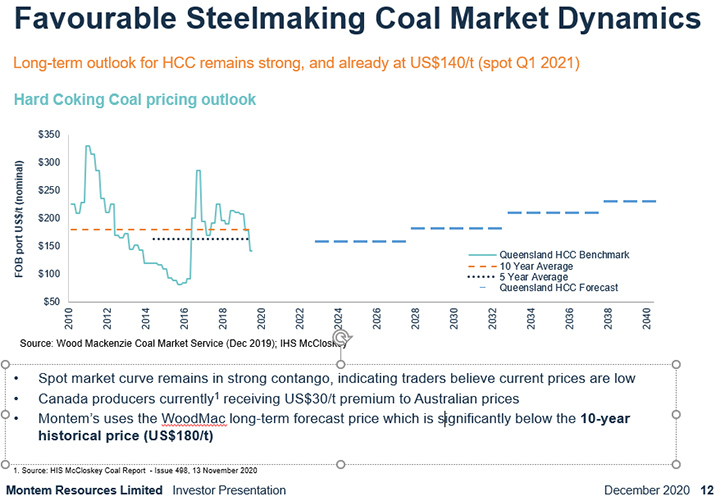

Finally, coking coal might be a difficult thing for people to digest, but it's not going anywhere. There is a lack of development of coking coal assets around the world. It's well-documented by the major forecasters there is a supply shortage looming, and prices are set to go back to, and exceed their 10-year averages.

Right now, coking coal from Canada is selling around about US$150 FOB Vancouver. The long-term average is US$180 on the Pacific market, over the last 10 years. We firmly believe that the prices will spike in the near future and remain at and above that 10-year average over the next decade, and likely even better prices at times as supply remains tight. There's a concentrated supply side, there're fewer and fewer investments going into building new coking coal supply and there's growing demand for steel making coal across the world. So the supply gap is looming and we will be selling into that.

Dr. Allen Alper: All those seem like excellent reasons for our readers/investors to consider investing in Montem.

Peter Doyle: I'd encourage people to understand that the coal in the Crowsnest Pass, in the Elk Valley, has nothing to do with thermal power. It is a 100% metallurgical coal, used to make steel.

Dr. Allen Alper: That's very good to clarify. Is there anything else you want to add?

Peter Doyle: I think we've covered everything that we need to, Allen. We would encourage your readers/investors to have a look at us. We think we present great value, and a really good opportunity to get in at the base level and enjoy the profits, as we develop into a coal mining company.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://montem-resources.com/

Peter Doyle

Managing Director and CEO

+1 778 888 7604

pdoyle@montem-resources.com

|

|