AVZ Minerals Ltd (ASX: AVZ): Developing the vast Manono Lithium and Tin Project in the south of the Democratic Republic of Congo (DRC); Interview with Nigel Ferguson, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/20/2020

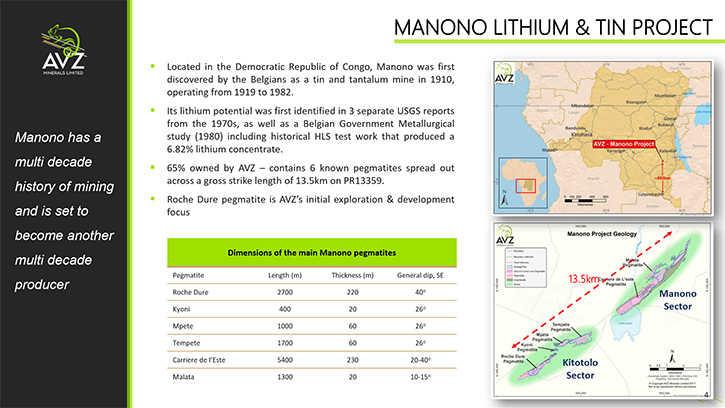

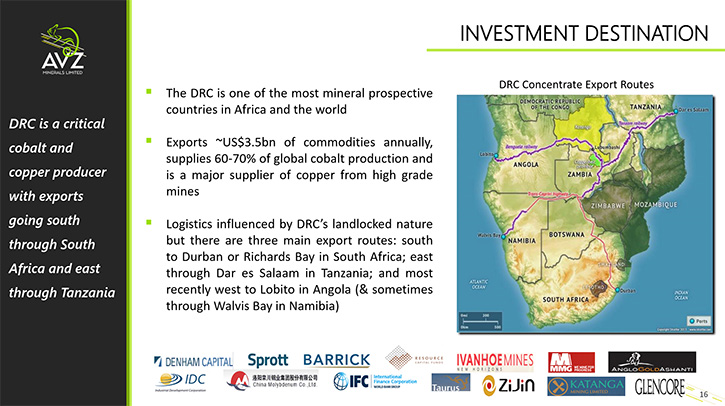

AVZ Minerals Ltd (ASX: AVZ) is a mineral exploration company focused on developing the Manono Lithium and Tin Project located in the south of the Democratic Republic of Congo (DRC) in central Africa. AVZ has a 60% interest in the Manono Project. We learned from Nigel Ferguson, who is Managing Director of AVZ Minerals, that Manono is a world class, tier-one asset, with over 400 million tonnes of 1.65% lithium as well as 300,000 tonnes of tin under the present JORC resource, which he believes makes it the third largest tin resource in the world. Near-term plans include completing the definitive feasibility study and environmental studies, securing additional equity from a joint venture partner, construction of the camp and, ultimately, going into production in 2021.

Manono Lithium and Tin Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nigel Ferguson, who is Managing Director of AVZ Minerals Ltd. Nigel, could you give our readers/investors an overview of your Company, and what differentiates AVZ Minerals from others?

Nigel Ferguson: Certainly. AVZ is an ASX listed Company, with a single asset in the Democratic Republic of Congo, the Manono Lithium and Tin Project. It is a world class, tier-one asset with over 400 million tonnes of 1.65% lithium and 700 ppm tin. I think it represents about the third largest tin resource in the world, 300,000 tonnes of tin under the present JORC resources. Within those JORC resources, the 400 million tonnes, we have 270 million tonnes of Measured Indicated category resources, which will be converted to reserves in the very near future.

The style of mineralization is such that the pegmatite we are chasing is a single pegmatite, of over 200 meters width and about 1600 meters long. It is one of the cleanest pegmatites, so not a typical pegmatite in that it's not zoned as most are.

This pegmatite is uniformly mineralized, homogenous from one side to the other: with 0.9% iron, 0.1% fluorine, 0.3% phosphorus, and mica is below 2% and within the concentrate product it is around about 1%; it's just a very clean product and we have an extremely long mine life. We've only modeled the project to a 20 year mine life, a price of 750 and obviously that's softened a lot from where we were when we did that scoping study; the 5 million tonne scoping study gave us an NPV10 pre-tax, pre-royalty of $2.6 billion US, our share is about $2 billion and with an internal rate of return of about 64%, it has very strong economics. We still believe we will have very strong economics when we complete the definitive feasibility study in Q1 2020.

Dr. Allen Alper: Oh that sounds excellent. Could you tell our readers/investors your primary goals for next year?

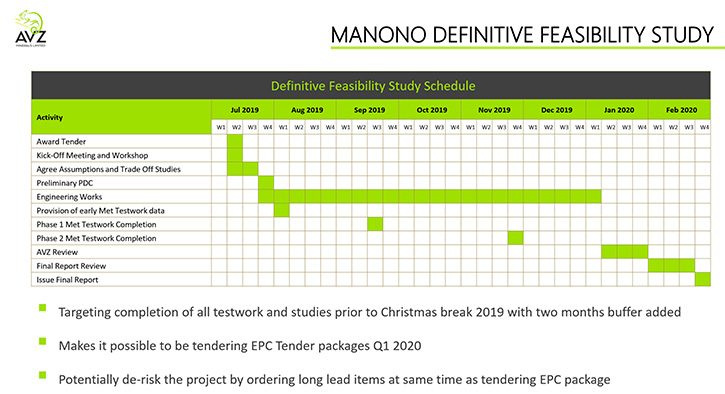

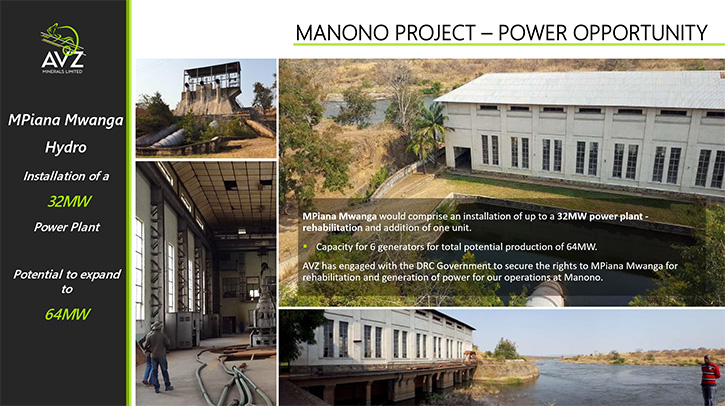

Nigel Ferguson: We will be completing the definitive feasibility study, with which we are about 85% through at the moment. We expect a large rush of completion work increasing; completion of subsections of that report over the next month, so we will be looking to announce those figures for the data in quarter one of 2020, probably end of February, early March. We also hope to secure rights to the MPiana Mwanga Hydro Facility. It is an historical hydro facility that's approximately 82 kilometers to the southeast of us. It was originally in production, producing power for the mine site back in the fifties and sixties and we hope to refurbish that and bring that back into a commissioned state so that we can run our operation at Manono on hydro-electricity, that includes all of the processing plants, the electric shovels we are looking at and hopefully electric trucks as well. So we're trying to be as green to the environment as possible.

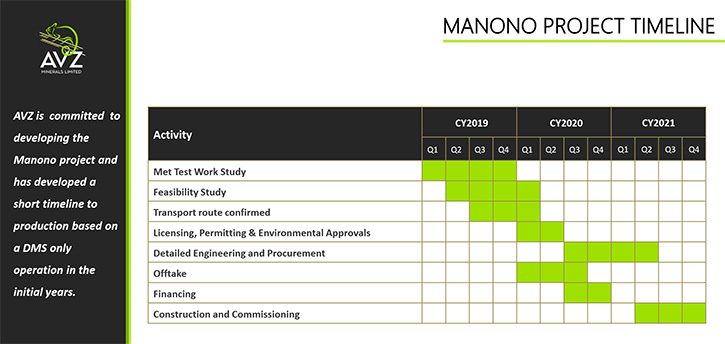

We will be looking to secure additional equity from our joint venture partners. We have secured 5% under an option agreement with Dathomir and would look to secure additional equity from the government, who are hold 25% of the project so that we can bring our current 60% up to around about 75 or 80% or better of the project by the time we go into production. Environmental studies are underway at the moment. The engineering side of things will happen next year, as we will be awarded specifications to start pre-commissioning and earthworks onsite. Construction of the camp is already commenced and is expanding. We believe, end of 2020r, we will have constructed the necessary infrastructure and have staffed and equipment the project to put us into production in 2021.

Dr. Allen Alper: Oh that sounds excellent. Could you tell our readers/investors a bit about your background and the Board and the Executive Team?

Nigel Ferguson: We have a very strong Board at AVZ. We’ve built that up over a period of time. Personally, I'm a geologist with 33 years’ experience. I have worked in the Congo since 2004. Since commencing there, I have developed a very good relationship with local governments, heads of states, ministries, et cetera, et cetera, but also with the hands-on-people that we need to make this operation a success; from geologists, administrators, security and logistics et cetera. To complement that team, we have brought on board Graeme Johnston, our Technical Director. Previously, he's taken several projects through to a definitive feasibility study, as I have myself, but then handed over to the engineers to allow them to finish. We've recently secured the services of Peter Huljich, a lawyer who has worked in the Congo, East Africa previously, with hydroelectric projects. He was very successful in that area and we were very thankful to have his skill set on board.

We also have Mr. Rhett Brans, a civil engineer on the Board as well. He has worked in Africa, more recently in West Africa and also in Mozambique on large projects. He has a significant amount of experience in the African arena. Recently we appointed Dr. John Clarke to the Board as non-executive Chairman. Dr. Clarke has over 45 years’ experience in the industry, working his way through from research initially in South Africa, to being the main Board Director, Executive Director, with Ashanti Goldfields Limited and operating in Ghana and further afield in Africa. But he's also operated in the DRC previously as well. So we are very happy to have this level of experience brought to the table. So we feel we're set to really crank this up and put it into production as soon as possible.

Dr. Allen Alper: Oh, you and your team have an excellent background and a great track record. Seems like you're well-equipped to take your project to manufacturing. It sounds like it is a huge long-life project and excellent.

Could you tell our readers/investors a little bit about your share and capital structure?

Nigel Ferguson: Certainly we're not your typical North American, Canadian-style structure. We have 2.2 billion shares on issue. Currently our price is around 4.2, 4.3 cents, which gives us a market cap of about a hundred million Australian. Cash at the bank is around $6 million. We have just recently announced a strategic investor, a group called Yibin Tianyi, who are constructing a hydroxide conversion plant in Yibin, China, at the moment. They are looking to produce 25,000 tonnes per annum of hydroxide and expand that up to a hundred thousand. Obviously we think that's a strategic investment for them. A partnership would allow us to provide our products to them, at the end of the day, for conversion. They are 15% owned by CATL, the largest battery manufacturer in China. We look forward to working with them. They should have their finance applications cleared for investment by the end of January 2020.

The remaining shares in the Company, after that placement, we will have Yibin with 11%, 11 1/2% of the Company. We will have Huayou Cobalt, another Chinese group, who are operational in the DRC, with approximately 7.5% of the Company. Lithium Plus with 3%, a small fund in Australia that is investing in lithium projects, and they have 3%. Management and Directors are sitting on roughly 8.5% of the Company and the rest is retail. About 70, 75% of the Company is retail at this present time. We have a lithium exchange fund, based in New Zealand, invested that has been buying up stock and they're sitting on around about 3.5%.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors how it is operating in the DRC?

Nigel Ferguson: I've operated there since 2004, and I've operated successfully without any issues whatsoever.

It is Africa, so you need to be aware of your surroundings and very conscious of the local communities that need to be involved and looked after. AVZ is going to do that through the AVZ foundation, which we will fund through profits from the Company to reinvest in the community. It's very much something we've always done, but that will probably be on a larger scale than we've done before. 96% of our employees are locals. The Congolese have very well-trained geologists and engineers and metallurgists, they are of the highest standard. They're very knowledgeable in their areas and, as you can imagine, with a long history of copper and cobalt production in the Congo Belt, there are a lot of engineers and technical people available to us.

One person I didn't mention was Mr. Serge Ngandu, who has joined us as a Director of Corporate Affairs-Dathcom Mining. He's a process engineer by profession, with over 30 years’ experience in the DRC at all levels. He is a very well respected gentleman. That relationship with the locals is very important. We do everything by the book, we pay the locals above salary wage. We are supportive of medical and extra benefits. We find it frustrating at times, with the bureaucracy, the red tape that we have to go through, but we can get things done. Its all a process of education.

Dr. Allen Alper: Oh, that sounds excellent. It's great that you have a team that has experience working in Africa and working in DRC and you know what you're doing.

Nigel Ferguson: It makes the job a lot easier.

Dr. Allen Alper: That's right. That's excellent. Could you tell our readers/investors the primary reasons they should consider investing in AVZ Minerals?

Nigel Ferguson:AVZ is at a turning point. The lithium market is depressed at the moment, prices are off 35-40% from where they were a year and a half ago. AVZ is a single commodity company with a single licence. It is heavily leveraged to the EV thematics, electric vehicles, etc. Demand, we believe, will start to increase from maybe 18 months out to two years out and onwards, with huge demand coming from Europe and the US on the back of the Chinese as well. We believe that we are very well positioned on a timing basis and on an operational basis as well. If there is extra demand, we have such a huge resource in the Roche Dure resource, we believe that we have the ability to increase production and produce more if required.

We will be producing a SC6.0 spodumene concentrate of 6%. We will be progressing that through to a hydroxide plant or a carbonate plant at some stage in the future. We haven't made up our minds on that, but it is ultimately a goal to produce a hydroxide, or a carbonate product. We're pretty much focused on the one product. We do have some by-product credits with tin and some other minerals, but as the lithium price increases and demand comes through, we believe that we will be very well set to ride that wave forward.

Dr. Allen Alper: Well that sounds excellent. Very strong reasons for readers/investors to consider investing in AVZ Minerals. Nigel, is there anything else you would like to add?

Nigel Ferguson: There's lots of news coming and then we'll be into construction. So watch this space. Thank you for interviewing us for Metals News.

Dr. Allen Alper: That sounds excellent. You’re welcome. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://avzminerals.com.au/

Mr. Leonard Math

Company Secretary

AVZ Minerals Limited

Phone: +61 8 6117 9397

Email: admin@avzminerals.com.au

|

|