Element 25 Limited (ASX: E25): Owns 100% of Australia’s Largest Onshore Manganese Resource; Interview with Justin Brown, Executive Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/22/2019

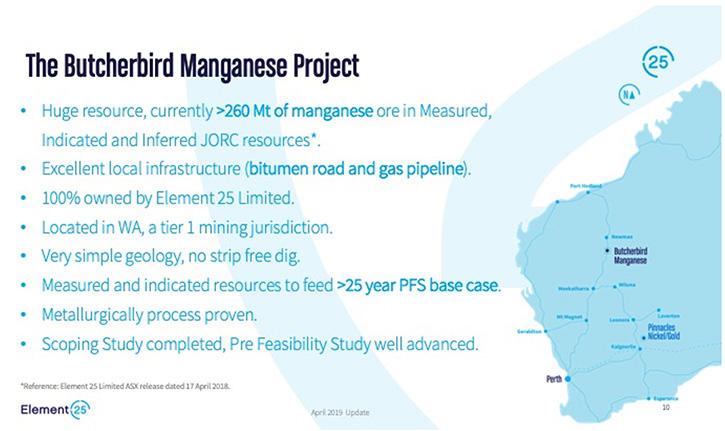

Element 25 Limited (ASX: E25) owns 100% of the Butcherbird Project that hosts Australia’s largest onshore manganese resource. The project is located in a low-risk mining jurisdiction in Western Australia, near excellent infrastructure. It contains over 260 Mt of manganese ore, with exceedingly simple geology. We learned from Justin Brown, Executive Director of Element 25, that the Company’s core strategy is to develop a globally significant, high-purity manganese production hub in a tier-1 jurisdiction, at a time when demand for manganese is growing strongly. The pre-feasibility study, due in July, is in progress, along with permitting and metallurgical testing. The definitive feasibility study is scheduled to be delivered by second quarter of 2020. We learned from Mr. Brown that the Company has already produced its first samples of high purity manganese products for dispatch to off-takers, which will underpin off-take negotiations.

Element 25 Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Justin Brown, who is Executive Director of Element 25 Limited. Justin, I wonder if you could give our readers/investors an overview of your Company and let them know what's been happening since our last interview in 2018, and also what your plans are for 2019.

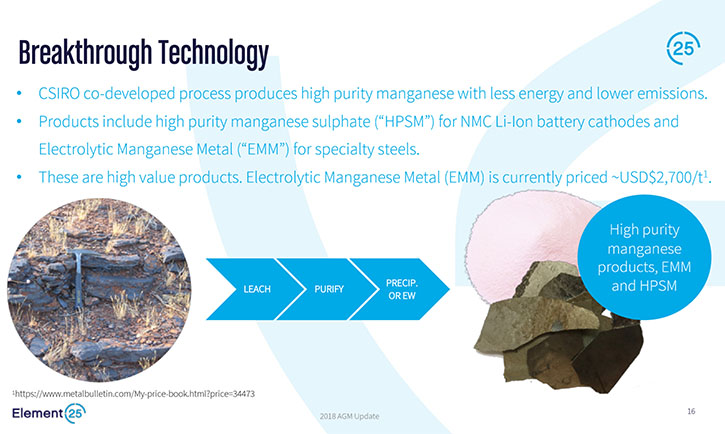

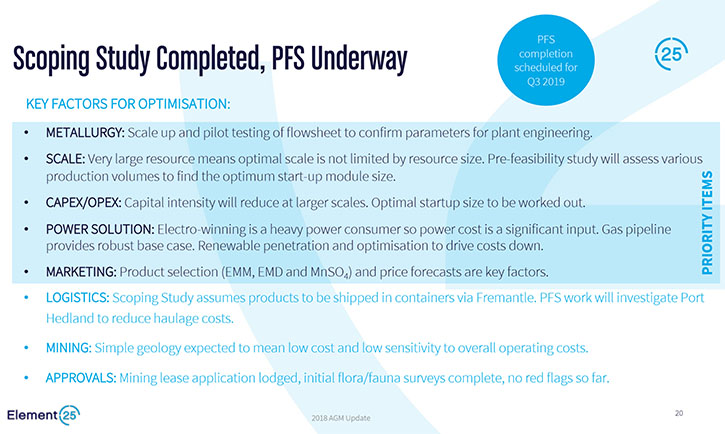

Justin Brown: Sure, Allen. It'd be a pleasure to. Element 25, for those that aren't familiar with the Company, is an Australian Stock Exchange listed company, listed under (ASX: E25). We are developing the world class Butcherbird Manganese project, located in Western Australia. We have a genuine opportunity to develop a globally significant, high-purity manganese production hub in a tier-1 jurisdiction, at a time when demand for manganese is growing strongly. It's growing strongly because of traditional applications such as stainless steel, but also because of the new energy revolution, which is driving demand for batteries that use high purity manganese in the cathode. The Company is doing a pre-feasibility study and we're well progressed. We did a scoping study at the beginning of 2018 and that was very promising, and so we've been working since then to complete the various threads of the pre-feasibility study, which includes things like permitting, resource infill drilling and upgrade, detailed metallurgical testing, pastoral lease access agreements, Native Title Agreements et cetera.

They're all progressing fantastically well. We recently published a big upgrade to our resource base at Butcherbird, increasing the metal content by about 34 percent, and that'll form the basis of the maiden reserve for the pre-feasibility study. We've also advanced negotiations, with the native title parties in the area, so permitting is well advanced in terms of mining lease grants. The metallurgy has gone through a couple of stages of successful work. Since we last spoke, we produced our first samples of high purity manganese products for dispatch to off-takers, which will underpin off-take negotiations.

One of the things about our project is that the power solution is very critical, so we've been pushing hard to find the best solution to supply what is a fairly substantial power requirement, to drive the electro-winning of manganese metal, and that's looking like it's going to be extremely competitive cost-wise, utilizing both the gas pipeline that cuts through the project and also the wind and solar resources that are present at the project location. It looks like it'll be a hybrid solution, 50/50 renewables and gas, driving the overall cost of power down.

So, all PFS threads are advancing wonderfully well. We expect to have the PFS ready for delivery in around July. Obviously that'll show the market the incredible investment opportunity before them, whereby we plan to be producing the cleanest, lowest cost, greenest high purity manganese globally. And because of the resource size we'll be doing it for a long time, so the mine life will be measured in decades, not years, and so we're really excited about the prospects.

Dr. Allen Alper: That sounds exciting! This is going to be a fantastic year for Element 25.

Justin Brown: Absolutely Allen.

Dr. Allen Alper: Could you tell our readers/investors a bit more about your project and what differentiates it from others?

Justin Brown: Absolutely! There are a few interesting aspects to that question. One is that it's important to know that most of the high purity manganese is currently produced out of China. Traditionally China produced these products using cheap local manganese ores that they mined within China. They've effectively depleted their local ore stocks now, so what Chinese producers need to do is go to other countries, typically Africa, to acquire manganese ore to feed their process plant which is expensive. The process infrastructure is quite old, and inefficient from an energy point of view, they're also quite polluting, and they're quite high cost.

So what we've done is actually work with the local Commonwealth Scientific and Industrial Research Organization to develop a flow sheet which allows us to treat our ores much more efficiently and more cleanly, at room temperature and atmospheric pressure, with no addition of energy and very simple reagents, so we have a very clean, low cost processing pathway. Coupled with that, we have a very large ore body, which provides cheap manganese tons to our plant, so we basically out-compete existing producers, both in terms of access to cheap, low cost ore, but also we have a cheap, low cost process, which means that we're well ahead commercially. And then we basically produce these high purity products that are decarbonized, cleaner, greener and more cost-competitive than the competitors, and that should put us at the lowest point, cost-wise globally, which means that our business will be very resilient.

Dr. Allen Alper: Well that sounds excellent! Could you tell us what your plans are going forward, your objectives and timing?

Justin Brown: Certainly. So there are a number of threads that we're working towards and they're all going to dovetail together to allow for the delivery of the pre-feasibility study and the maiden reserve around July 2019. That's all on track and looking really good. We'll then move into the definitive feasibility study phase, in parallel with the latter stages of the pre-feasibility study. We'll be working very closely with potential off-take partners, potential independent power providers, and potential project financiers, to ideally bring together a project financing package underpinned by bankable off-take, and then of course we will undertake the detailed engineering design that needs to go into the plant.

By second quarter of 2020, we hope to deliver a definitive feasibility study, with project financing and off-take very well advanced. Then we’ll move into the project build, and then production and growth. So it's a pretty exciting pathway that's ahead of us and we're all very bullish about the potential.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors about your background and the team?

Justin Brown: My background is as a geologist originally, I've been in the corporate space for about 13 years now. I have an experienced mining engineer as our study manager, we have geologists working with us to do the process water exploration and resource definition work. We have a very well-credentialed engineering firm, Lycopodium, based here in Perth, who are leading the metallurgical work. We have a highly credentialed project development company, Advisian, specialists in energy, so they're looking after the energy for us. We have an environmental company here doing the heavy lifting on the environmental and permitting. So we have a very experienced and capable team working on bringing this project together. I think we have exciting times ahead.

Dr. Allen Alper: That does sound exciting! A very, very strong team, with excellent backgrounds! That's great! Could you tell our readers/investors a bit about your share and capital structure?

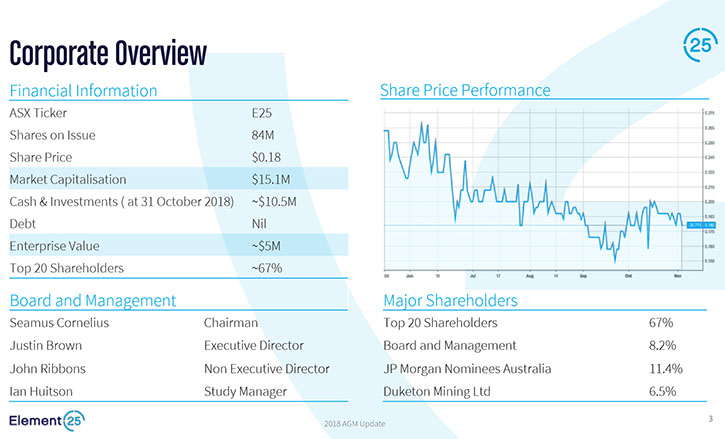

Justin Brown: One of the somewhat unique aspects of Element 25 is that we have a very tight capital structure, having been listed for about 13 years now, we only have 84 million shares on issue, which is quite unusual for an Australian listed company. We have a strong balance sheet, so we have cash and listed share investments to the tune of about nine million Australian dollars, so we're well funded at this point, to fund the current activities. And if you look at our share price, like a lot of companies in the junior space at the moment, it is struggling in terms of price, so we're listed at around 19 cents, which capitalizes us at about 16 million dollars. In our view, we're undervalued for the opportunity presented here. We think this could be a genuine world class company, at an enterprise value of about 10 million bucks. The stock is very cheap in our view and represents a fantastic investment opportunity.

Dr. Allen Alper: That sounds great. That sounds like an excellent opportunity. I wonder if you could elaborate on the primary reasons our readers/investors should consider investing in Element 25?

Justin Brown: I'd like to think we are at the cheapest price point we'll be, for some time, because we've done a lot of de-risking work, even including permitting, capital operating cost estimations. The de-risking has progressed extremely well and you're not paying a lot for the stock. We have a project which is in a tier-1 jurisdiction. It has a very low risk mining scenario with the low strip for more cost effective mining. The metallurgy is proven now, so there's low risk there. The market in high purity manganese is growing strongly, both for traditional steel uses, and batteries and new energy vehicles, so we have a period of high growth and demand, a struggling supply in China, a very low cost operation. All this positions us uniquely to have a very long-life, lucrative business around producing high purity manganese for global requirements.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add Justin?

Justin Brown: Just to thank you, Allen, for interviewing Element 25 for Metals News. I have a lot of faith in this Company. I have my own money in it. I'm a substantial shareholder, alongside other shareholders, so you know I believe in what we’re doing. I'd encourage others to consider joining us on the journey.

Dr. Allen Alper: Well that sounds excellent! Sounds like it's a project and a Company that's worth being investigated and looked at carefully by our readers/investors for future growth and opportunity for wealth accumulation.

Justin Brown: I'd agree with those comments.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.element25.com.au/

Element 25 Limited

+61 8 6315 1400

admin@e25.com.au

Level 2, 45 Richardson Street,

West Perth, WA, 6005

PO Box 910

West Perth WA 6872

Australia

|

|