LiCo Energy Metals (TSX-V: LIC, OTCQB: WCTXF): Well-Positioned to Supply Cobalt and Lithium for Li-Ion Batteries, Interview with Tim Fernback, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 1/11/2018

LiCo Energy Metals (TSX-V: LIC, OTCQB: WCTXF) is a grassroots Canadian company

that conducts exploration for lithium and cobalt metals used in the production of

lithium-ion batteries. LiCo Energy Metals has four ongoing projects in mining-

friendly jurisdictions within Canada, United States, and Chile. We learned from Tim

Fernback, President and CEO of LiCo Energy Metals, that their properties are

strategically located in some of the best areas where the presence of lithium and

cobalt has been found historically. LiCo happens to be one of the four companies, in

the Atacama Desert in Chile that holds close to 50% of the world's lithium

reserves.

LiCo Energy Metals - Glencore Bucke and Teledyne drilling

program

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Tim Fernback, President and CEO of LiCo Energy Metals. Could you give

our readers/investors an overview of your company, your focus and current

activities?

Mr. Tim Fernback: LiCo Energy Metals is a true energy metal company.

We are a Canadian exploration company that is focused on both lithium and cobalt,

two of the main metals inside a lithium ion battery. Our company is currently traded

on the Toronto Venture Exchange under the symbol LIC. We're also traded under the

OTCQB board, WCTXF and also the Frankfurt Exchange under the symbol 43W1. We're a

company that has projects internationally, with Canada, the US and also Chile. I'd

be happy to talk more about each individual project with you, as questions arise.

Dr. Allen Alper: Why don't you tell our readers/investors about your

properties, what's happening at each of them and why they're important?

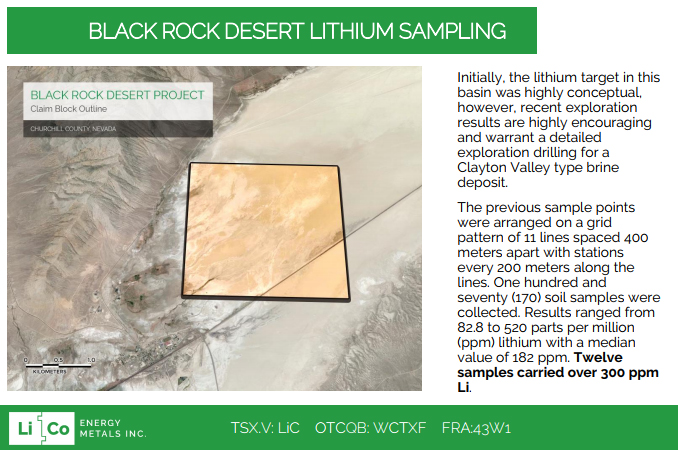

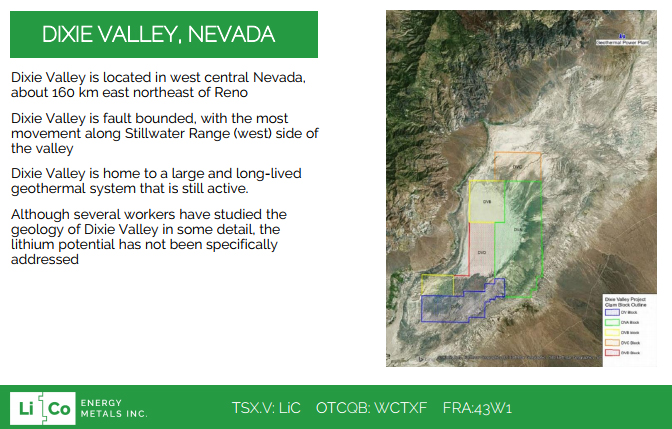

Mr. Tim Fernback: For our lithium properties we own property in

Nevada. We have two large claim packages in Nevada that we own outright. One is

called the Black Rock Desert Project and the other is called the Dixie Valley

Project. They both have similar geologic formations and geophysical data to a

Clayton Valley style project, which is the only producing lithium brine in North

America. We think having our properties strategically located in Nevada, where other

lithium brines exist, and in sufficient quantity is really important for having a

great beginning of a great resource here in North America.

We also have a lithium property in the Atacama Desert in Chile. The Atacama Desert

holds close to 50% of the world's known lithium reserves. 37% of the world's

production is out of the Salar de Atacama and that's accomplished primarily by two

companies, SQM and Albemarle, both very large lithium producers. There are four

companies located in the Atacama Desert and we are one of them. We are exploring in

the region and we believe that we have a property that one day could be a resource.

Obviously it's in one of the most highly concentrated lithium brines in the world,

so we believe we are very well located there. On our property in the Atacama Desert,

we're currently working with the indigenous population to make sure that we have a

successful project in the long term. We expect the company will be drilling the

property in the upcoming year. That's our corporate goal.

We also have cobalt properties in Ontario, Canada. “The Mining Journal” just

announced some of their most favorable jurisdictions worldwide for operating and

exploring and Ontario was one of the premier jurisdictions internationally. It was

second overall to explore for minerals and having a favorable jurisdiction for that.

We're in an area that has historic cobalt and silver production. We are drilling

properties that have had some historic drilling. We're firming up the drill results

from the 80s, the last time cobalt drilling was taking place on the properties.

We've now completed a 32 drill hole program. We've drilled over 4100 meters of

diamond drill core, on both our Glencore Bucke property and our Teledyne property.

We have 12 contiguous claims there, so we feel that once we get the results back

from the assay lab, if it continues the way the first 10 drill cores have been

assayed, I believe we'll have very good results and be able to chart our destiny

towards a larger resource underground on those particular claims.

One of the properties is a property we recently acquired from Glencore. As you know,

Glencore is the world's largest cobalt producer. We are hoping that, with some of

our drill results, we'll be able to determine an in situ value of about $100 million

underground in terms of mineralization. If we do that, it opens up the door for

Glencore to be a partner with us going forward. They have a back in option and they

also have an offtake agreement on the particular properties as well. We're really

happy about that property, the drill results so far have gone very well, as planned.

Dr. Allen Alper: Well that's excellent. You're in a great position to move

forward in cobalt.

Mr. Tim Fernback: Yeah, definitely.

Dr. Allen Alper: Could you explain to our readers/investors why lithium and

cobalt, and lithium ion batteries are so important?

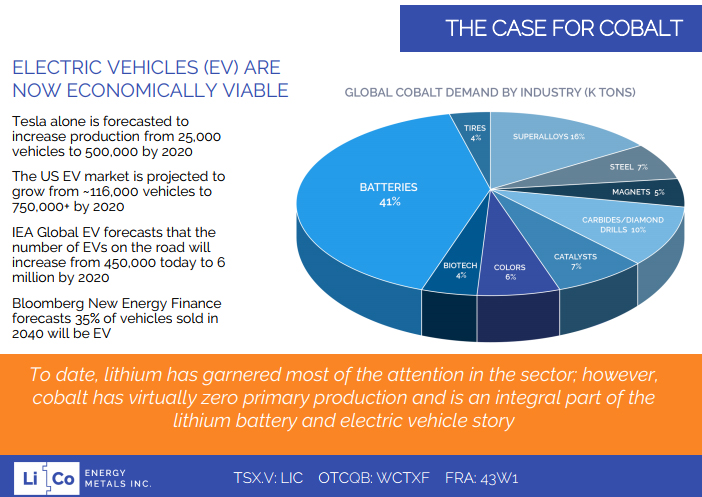

Mr. Tim Fernback: Certainly. Lithium ion batteries are the de facto

standard for a rechargeable battery, whether it's for an electric vehicle, a laptop

computer or a mobile phone. Obviously lithium is a major component in the lithium

ion battery. Cobalt is another major metal inside that battery. To give you an

example, a Tesla Model S has 113 pounds of lithium in its battery and 52 pounds of

cobalt. That's just one Tesla vehicle battery. As the market for electric vehicles

and other renewable and rechargeable energy sources and demand for these types of

batteries exists and grows we believe that there's going to be a huge upside for

both the commodity price of lithium and cobalt. That's why I believe you're seeing

prices react the way they're going, specifically in cobalt and lithium, strong

performance as commodities.

Dr. Allen Alper: That's excellent. Could you elaborate a bit more on the

projected supply and demand for lithium and cobalt and your projections of how that

market is going to grow?

Mr. Tim Fernback: Cobalt has seen some really strong growth recently

in terms of the commodity price. The vast majority of analysts are predicting a

strong and growing cobalt commodity price over the next several years. Right now

we're hitting highs for the commodity price and the prediction is that the price

will keep going up as the demand for that metal continues to prove out. So you can

virtually look at all of the mining research that goes on in terms of global cobalt

production and there is definitely strength in terms of the commodity price. The

interesting thing about cobalt is that it's typically a secondary metal to other

metal production so most of the cobalt that's mined today comes as a secondary metal

to say copper production or nickel production.

So when the value of the primary metal, say copper for example, declines, you have a

corresponding decline in production of cobalt because the metal is mined at the same

time as the copper.

Our properties in particular have cobalt as a primary metal, so it's a

little different from most out there. We believe that our properties will be mined

and explored based on the value of the commodity for cobalt, and not necessarily

based on the commodity price outlook for a secondary metal like copper. So we're

really excited about our properties.

Likewise, the market for lithium seems to be very stable in terms of lithium

carbonate and lithium hydroxide. The latest market data shows that the market price

has continued to increase .3% a month over the last little while. If you look at the

BMI lithium price index, for example in 2015 it was somewhere in the order of 120.

Today it's closer to that 300 mark, so there's been quite a significant shift upward

in terms of price for lithium carbonate and also lithium hydroxide.

Dr. Allen Alper: That sounds excellent. Could you tell our reviewers about

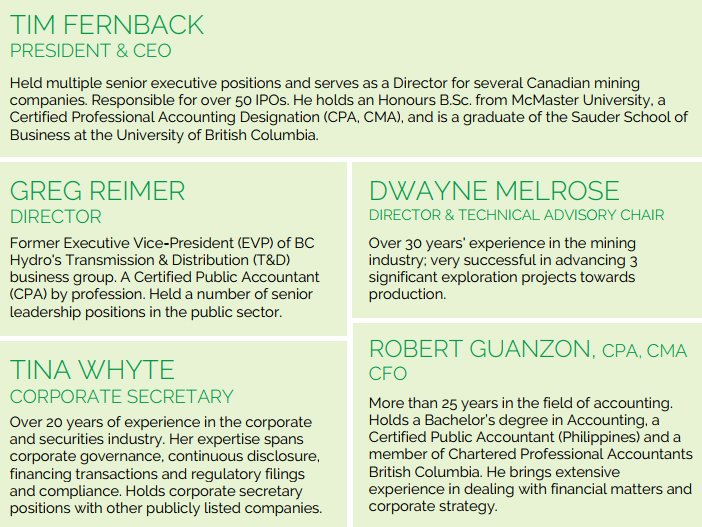

your background, your team and your board?

Mr. Tim Fernback: I am the President and CEO of the company. I'm an

accountant by trade. I have worked several years in the investment banking and

venture capital industries. I've been the director and officer of several different

publicly traded mining companies. I came into the company about a year ago. I've

looked to shepherd the company through its financial needs and our different

drilling programs. We have several other great people within our team. A top notch

drilling tech and QPs obviously, but in terms of the board, we have a fellow by the

name of Dwayne Melrose, who's our director and Technical Advisory Chair. Dwayne has

over 30 years’ experience in the mining industry, very successful! He's advanced

three significant exploration projects towards production. He's the former President

and CEO of True Gold Mining. He's been involved with a lot of successful operations.

The last project he worked on he was responsible for raising over $200 million in

debt and equity financing for the project. So we have a really good senior operator

in Dwayne and a very experienced person.

Greg Reimer is another very valuable board member. Greg is the former

Executive Vice President of BC Hydro. BC Hydro is a large electric utility in

Canada. Greg himself is an accountant by profession. He's held several major

positions within not only BC Hydro, this large utility that's committed to electric

power and renewable sources of energy, but also he was the former Deputy Minister of

the Provincial Mines Body here in British Columbia and has accomplished a lot of

work with indigenous populations and also negotiating land treaties with them. So

Greg brings a real world experience to us. He brings a look at the end game for us,

which is the creation of the electric battery. We are happy that Greg is on our

board. He provides an incredible advantage to us that most other energy metals

companies don't have.

That's really our group. We have technical advisors specifically with our

Chilean properties. Francisco Pimentel is a local Chilean, well known in the

Antofagasta area, who has worked on a number of different lithium production and

exploration projects. Similarly, Marcelo Bravo Veas is another advisor to us on the

lithium side. Getting good advice from local partners is a really important part of

our business.

Dr. Allen Alper: That sounds excellent. It sounds like you have a very well

balance and very competent team. You all have excellent backgrounds.

Mr. Tim Fernback: Thank you.

Dr. Allen Alper: Could you tell our readers/investors a bit about your

capital structure.

Mr. Tim Fernback: The Company has recently completed a financing

partly to carry out some exploration work on our Teledyne and Glencore Bucke

properties for 2018 and partly for general working capital purposes. That was

roughly about a one million dollar financing that was just completed. On top of

that, we've converted another $1.2 million in warrants for the company, so we have a

really strong cash position in the company right now. The issued and outstanding

shares for the company are around 140 million shares. We believe we're undervalued

and looking to continue to add value to our shareholders portfolios.

Dr. Allen Alper: Well that sounds great. What are the primary reasons our

high-net-worth readers/investors should consider investing in your company?

Mr. Tim Fernback: The first reason is that we have a great team

assembled, so from a technical advisory area, in terms of lithium and cobalt, I

believe that by investing in LiCo, you get an ability to play both energy metals

that are strategic in the lithium ion battery. Our properties are in very strategic

locations, some of the best locations to mine or explore and also where the presence

of the underlying metal has been historically determined to exist. Lithium, we're in

the best place in North America for a lithium brine deposit and we're in the best

place in the world in Chile. We're one of four companies that are in the Atacama

Desert.

For cobalt we have a primarily cobalt exploration play. High grade, narrow

vein deposits in Ontario where there have been historic cobalt resources. We

believe we're in the right commodities in the right locations.

Dr. Allen Alper: Well that sounds excellent. Is there anything else you'd

like to add, Tim?

Mr. Tim Fernback: Next year we plan to do some more drilling on our

cobalt property to continue our current drilling program. Readers/investors should

be able to follow the company and our drill results from our current exploration

programs. Look forward to those in early January. Continue to follow our story as we

add more properties and more value for our shareholders.

Dr. Allen Alper: Well that sounds fantastic.

https://licoenergymetals.com/

LiCo Energy Metals Inc.

1220-789 West Pender Street

Vancouver, BC, Canada, V6C 1H2

1-236-521-0207

info@licoenergymetals.com

|

|