Ronald Coombes, President and CEO, Providence Gold Mines Inc. (TSXV: PHD, US-OTCQB: PRRVF, FRANKFURT: 7RH1-F) Discusses Gold Exploration in the Eastern Belt of the “Mother Lode” District, Sonora, California

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/17/2022

We spoke with Ronald Allan Coombes, who is President and CEO of Providence Gold Mines Inc. (TSXV: PHD, US-OTCQB: PRRVF, FRANKFURT: 7RH1-F), a Canadian mining exploration company that has acquired the famous Providence Group of Gold Mines, located near a resource-friendly community of Sonora, California, on the eastern belt of the “Mother Lode” District. Most recently, Providence Gold discovered stockpiles of what was thought to be waste rock. Recent testing of sample material returned significant amounts of gold. The Company has designed a near surface, up to 4000 meters drilling program, beneath and between the historical high-grade stopes. According to Mr. Coombes, the project has good potential for possibly four million ounces of high-grade.

Providence Gold Mines Inc., Sonora California

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Ronald Allan Coombes, who is President and CEO of Providence Gold Mines. Ron, I wonder if you could give our readers\investors an overview of your Company, what differentiates your Company from others and tell us all of the great things that happened this year and your plans for next year?

Ronald Allan Coombes:

Sure. We acquired the property in 2017. The property is a very famous gold property, right near the town site of Sonora, California, which is an unusual spot in California, because it's very resource friendly. Meaning that the community actually is very pleased with our presence in exploring their backyard, which is what we look for as a Company, first and foremost, looking for properties of merit, where you can develop them.

Dr. Allen Alper:

Well, that sounds good. Could you tell us something more about the history and also what you found? Could you elaborate a little further on the property being patented?

Ronald Allan Coombes:

We originally acquired the patented property because of its rich, high-grade history. Patented gives you significant advantage over government land. Although there are permitting requirements, patented property gives you grandfathered rights, as a past producer, which significantly reduces the amount of government red tape, ensuring your production rights.

To date we've examined a number of the deposits that are on the property. The property has numerous deposits, along a strike of 2.2 kilometers or 1.4 miles. We've looked at those deposits now, each one of them, and are very pleased with the results to date. The first one that was the primary deposit on the property, produced about 225,000 thousand ounces. The very first stope, over a 14-month period, reported 30,000 ounces for 15 ounces per ton, so these are definitely high-grade deposits on the property.

The width, historically of the stopes, was 3 to 4 meters thickness, where the best gold values are. These sorts of deposits are known to go to depths of 3,000 feet and greater, and they get better at depth. The property has been sitting idle since 1918. The reason being is that first there was a legal dispute, while they were in the middle of making a profitable mining operation. The lessee and the lessor didn't renew the lease. Then they had a major wildfire, which ravished that entire area of California, it burnt everything to the ground.

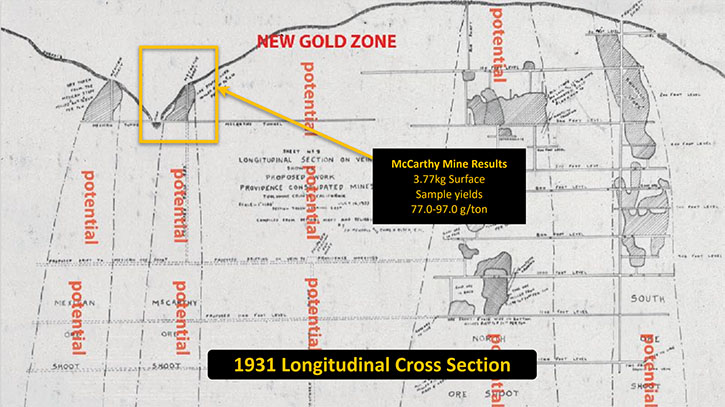

Then the Spanish Flu hit the world, and that pandemic was even more severe than COVID-19 has been. It’s a calamity of things that have happened. The mine sat idle, with no further development or aspirations since 1931. In 1931 a group went in with the objective of putting a new drift in, over the Mexican and Consuela Mines and they failed to reach that target. Since 2017, we’ve gone in and completed underground grade verification. We did surface sampling, surface geochem, a 3D LIDAR survey of the 600-level underground, which significantly helped us in our target modeling. I really recommend everybody have a look at the guided tour, in our presentation that's on our website. You just have to click on the link, and it will open up for you.

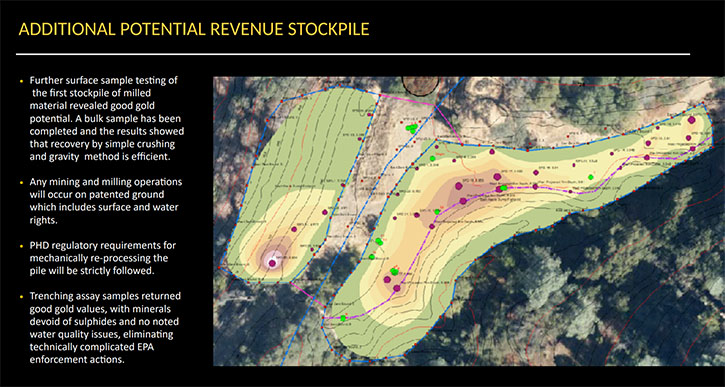

In the last two years, we discovered that we have a stockpile of material on the property that looks like it could be profitable. It's not 43-101 compliant, having said that, it's there. We got some pretty decent numbers. We've trenched that stockpile and then drilled it to depth. The fire situation last year has really hampered our ability to do what we'd like to do. We've done all of our modeling. We just finished an exploration program in September, which yielded 75 to 95 grams and verified that they were mining high-grade, at the McCarthy deposit, which is one of our primary targets in our planned drill program.

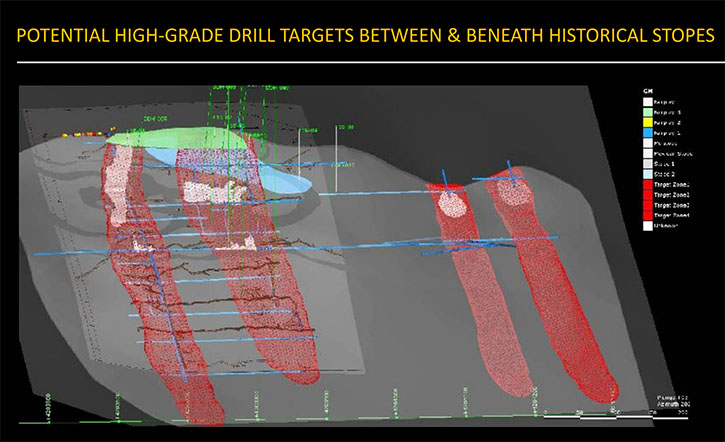

We're planning to drill it now for the very first time in the property's history. Once our financing is completed, we're planning a 4,000-meter drill program, which will examine and investigate the near surface potential, which is enormous. And we’ll drill some deeper holes, to be able to establish an inferred resource. We're pretty excited to have a property that is sitting idle, that has historically produced such high-grade. We’ve modeled that now and think there’s good potential for possibly four million ounces of high-grade.

Dr. Allen Alper:

That’s sounds very good. Could you tell our readers/investors a little bit about your background and your Team?

Ronald Allan Coombes:

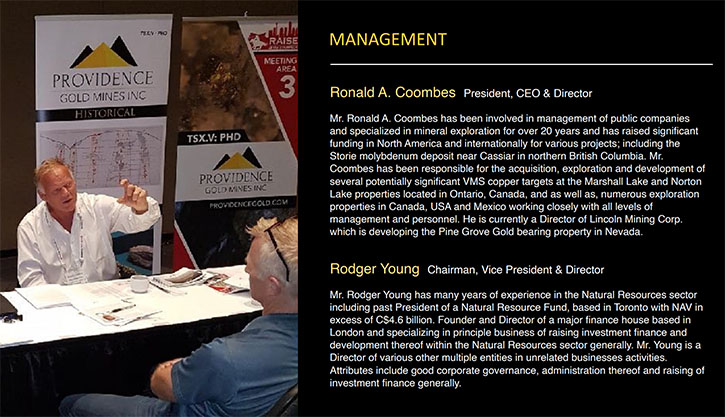

I'm very proud to have the Team that we have. Our qualified person on the project from Canada, is Lee Groat, who is Head of Earth Sciences at the University of British Columbia. He's been extremely helpful in giving us some academic support, with regards to structural geology, etc.

We have a very well renowned expert in California’s Mother Lode Belt, Mark Payne, who has been working in that belt for over 45 years. Mark has been responsible and involved in the development of resources in the California Mother Lode Belt. He's a registered geologist in the state of California, I am bringing this up to go forward with permitting, for which you need to have a registered geologist in the state of California and to have a qualified person with regards to 43-101. We also need to have somebody that's registered here in Canada. We have both of those requirements fulfilled.

As well as the rest of our Team. The fellow that vetted the property to us, Richard Ellers, is a very well-heeled lawyer from the State of California. He has been involved with some of the majors, with regards to permitting in his career, so he's very familiar with the permitting requirements, etc.

We have a couple of very significant people with us, on our Board. We have Rodger Young, who has a very rich history, in our industry. He used to be a significant fund manager. He lives in the Isle of Jersey and really is very helpful, with a lot of the legal, and has a wealth of history, in our business, going back all the way to the 70s, 80s and 90s. He was responsible for a very large pension fund in his career. Rodger is the Chairman of our Board and he's my right-hand man, with our operations.

We have a pretty well-heeled group of Directors on the Board. Scott Davis is our CFO. He has a wealth of experience in the mining business. He’s an accountant and works in the resource sector itself. He's very familiar with all of our obligations from the accounting side.

We also have Tom Kennedy, who is a lawyer. Tom has helped us and continues to help us, with that and reducing our costs, when it comes to legal matters. It's really important, when you're a small Company like ours, to try to keep your costs down. Our annual operating budget, for the Company is very low, when you compare it to many of the other companies that are of similar size to ours.

That’s a little bit about our Team and what they're doing with regards to the project itself.

When you bring up the professionals, it brings up a couple of other items that are important. On this property so far, all of our assays and sampling to date have shown us very little in the way of sulfide. For the most part, this is pure gold. There is some iron, but as far as other materials, we haven't seen any. There's minor arsenic present, it's pretty much devoid of arsenic or any other metals that make it a little bit more difficult in the metallurgical processing. The old timers had stamp mills, a sluice box and gravity separation. Those methods weren't the best, and that's probably why there is still as much grade, as there is, present in the stockpile of milled material that's still sitting on the property right now. The best samples that we got out of the stockpile, we did have one whopping eight ouncer, but many of the assays came back in the grams per ton. So that's probably the only reason why the stockpile is sitting there with probably some profitable material.

Dr. Allen Alper:

Could you tell our readers/investors your goals for 2022?

We have exciting goals for 2022, our experts have modeled the previous historically mined deposits to 3,000 ft. We have excellent targets, especially near the Mexican and Consuela mines, where they only mined to 150ft. Those developed near surface targets appear similar to the Bonita and the Goodenough. There are a total of seven deposits on the property, two of them the Providence and Fairplay were developed to the 1,200ft level. In 1916 they reportedly were mining ore on the 1,100ft level when operations were shut down.

We plan to dewater from the 600ft level down to the 1,200ft level. To do that, we need a water discharge permit, which the Head of the Water Resources Control Board in Sacramento stated could take up to 18 months.

In our sampling protocol that we've done, we don't see anything deleterious, with regards to the water quality. There were some organics in the water, but it looks like the water's drinkable, but you still have to go through the rigorous permitting process, to discharge water from any mine site, so that process will take us 12 months.

We're also now trading on US-OTCQB (PRRVF), which gives us an advantage for Americans that wish to invest in our Company from the United States. That really has opened up the door for people, who wish to invest in our Company, as well as here in Canada on the TSX Venture Exchange (PHD) and Frankfurt Exchange (7RH1.F).

Dr. Allen Alper:

Well, it sounds excellent. Could you also tell us about your own background?

Ronald Allan Coombes:

I've been in the business now for over 20 years, I've been involved in a couple of success stories. When molybdenum was really hot, I was involved in the deposit in northern Canada near the old township of Cassiar, British Columbia. We had five drills spinning on that project for over a year and proved up a deposit that was just over 200 million tons. Our market cap, on that Company, went from 15 cents, by the time we finished drilling it and putting the report out, that Company had shares trading at over $2.50, within a 12-month period. That was a pretty big success. Unfortunately, molybdenum dropped in value, or that project would still be moving forward right now. Currently, it's sitting idle, but we drilled off a very significant deposit there.

We've been involved in a number of other plays that I've been responsible for. We had another one back east in Ontario. Very interesting, large geophysical anomalies. That’s just now being drilled. That was in another Company that I was with. I’ve been involved in looking for resources in British Columbia. The problems that I found were that the permitting process is fragmented in Canada, and then you have the First Nations issues. I found it just way too difficult, with not knowing what my security was in Canada, that's why I chose to leave and go to the United States. And of course, we were looking for a gold project.

If you're looking for gold, the Mother Lode Belt is probably about one of the best jurisdictions you're ever going to find, with regards to potential gold projects they've mined. They've mined over 128 million ounces, out of the Mother Lode Belt, which stretches from one end of the state right to the other, it has a lot of potential still to this day. Where our project is, we're sitting in amongst several million-ounce deposits that were previous producers. Somebody told me a long time ago, gold is where gold is, so this project is definitely sitting in the right address for a significant gold discovery.

Dr. Allen Alper:

It sounds very good. Could you tell our readers/investors what the outlook is for getting permits for your project and being able to mine in California? A lot of people are concerned about that.

Ronald Allan Coombes:

It's interesting you bring that up, because I've worked in a lot of different jurisdictions, I've been in Mexico, I've been in Canada. I must say, so far to date, depending on where you are logistically, it doesn't really matter what country. It really is more dependent on where you are. I certainly wouldn't want to be sitting in the backyard of Los Angeles or San Francisco itself, or many other communities that are not mining friendly. You want to ensure that wherever you are, you're in a resource friendly jurisdiction. Sonora, California is really a great place to work. I mean, everywhere you look, it’s resource this, resource that. They understand the importance of resources. As far as the permitting process, it's no more onerous in California than it is Arizona and Nevada.

I was involved in another project in California and the permitting process on that property was less than desirable. It really depends on where you are. In the permitting process timeline, the government now, in the state of California, has ensured that your permitting gets done in a timely manner and as long as you fulfill all the requirements, you get your permits. I don't know how many are in the pipeline right now, but I know that, two years ago, there were 13 projects in the pipeline, for permitting in the state of California. Only one opted out and that wasn't the fault of the government, it was the fault of the project, in that they didn't have the funds to continue, with the permitting process itself, to complete it.

I don't see any issues. I think California is a great jurisdiction to work in. I think, in my career so far, it’s probably been the best place that I've had the opportunity to work. The community has been very helpful in securing contractors that are local. I found it a real pleasure. I think it's a myth. I think that times have changed. Depending on where you are, California is open for business.

Dr. Allen Alper:

Well, that sounds good. What are your goals for 2022 to run?

Ronald Allan Coombes:

I want to drill this 4,000 meters on this property. My goal is to make this a huge success for 2022. It takes, on average, three to five years from the start to get to where you're actually capable of properly setting up drills to hit your targets. When we picked the project up, it had no geological information, other than longitude cross section, everything else had been burnt in the fires. We’ve done our homework; all the homework’s now being completed. We haven't had anything to date that has discouraged us in any way. Everything that we've completed, so far to date, on the property, has done the opposite actually, given us serious hopefulness for being able to develop something that will be of significance to be able to give our shareholders as much reward as possible. This property has the potential for a bountiful exploitation of gold.

Dr. Allen Alper:

Ron, could you tell us the primary reasons our readers/investors should consider investing in Providence Gold Mines?

Ronald Allan Coombes:

I consider our project to be a ground floor opportunity, for investment purposes. The stock is trading at a low rate now. The high has been 20. Certainly, there's an advantage to purchasing the stock where it is currently. When we start to drill the property and we start to hit what the historical records were, I think this shareholder reward potential is so enormous for shareholders that it couldn’t be a better time to purchase the Providence Gold Mines. Today, would probably be a really good day for somebody that wishes to take that leap of faith and make an investment in a risk/reward resource stock. Providence Gold's probably about as good as it gets.

Dr. Allen Alper:

Well, that sounds like an opportunity for someone who's willing to have a chance to have his money grow, even though here is some risk involved. How would you sum it up?

Ronald Allan Coombes:

We've de-risked this project as much as possible. We've done all the homework that's necessary to make it a success. The drill will tell the truth, at the end of the day, but if the truth is the gold values that we've verified so far, this project will be an enormous win, both size and grade. It's unusual to be in a stable jurisdiction, like the United States of America, in an opportunity where you don't have to worry about political stability. Permitting is logical and timelines are logical. The community at large wants us there. So, I think that we have all the ingredients for success here. The project does require a good drill program, to be successful, and 4,000 meters of drilling should be able to substantiate and verify what we're looking for.

Dr. Allen Alper:

Well, that sounds good. It sounds like it's worth examining and making a speculative investment, for people, who want to have the opportunity to increase their earnings.

Ronald Allan Coombes:

Absolutely. I think the resource sector has always been a risk and reward business. If you're going to pick a risk, take one that’s been de-risked and actually has proven resources from the past. It gives you a better than good chance, of actually being successful. And of course, that means making the shareholders the wealth that they're entitled to.

Dr. Allen Alper:

Well, that sounds very good! We’ll publish your press releases as they come out so our readers/ investors can follow your progress.

https://providencegold.com/

Ronald A. Coombes

President & CEO

Office: (604) 688-8200

Email: info@providencegold.com

|

|