Stan Bharti, Forbes & Manhattan Founder Shares Expertise on State of the Market, Positions Company for Growth

|

Stan Bharti, the Founder and Executive Chairman of Forbes of Manhattan, a private merchant bank, shared his view of the mining sector and the company’s philosophy in a recent interview with Metals News.

Stan Bharti, the Founder and Executive Chairman of Forbes of Manhattan, a private merchant bank, shared his view of the mining sector and the company’s philosophy in a recent interview with Metals News.

Mr. Bharti said, “First of all, when you look at the mining industry, we have had maybe six or seven, maybe ten, very good years. Starting in 2003, other than a tiny dip in 2008, we haven’t looked back. I think we are due for a good correction, a timely correction, and we are seeing that correction now. I think this correction is going to last for a while. We saw a long bull cycle and this correction could last three or four years because here’s what happened: from 2003 to 2012 so much money went into resources. Unfortunately, a lot of money went into speculative resources, but the results haven’t come through. So, the money that was behind the resources is somewhat frustrated.”

In addition to the challenges with the junior mining companies, Mr. Bharti sees a change with the international markets that will lead to a rally. He said, “The second thing is that, like in China, the world is reevaluating. So, I’m looking at a slowdown in the resource sector into 2016 or 2017. I think the second leg of this bull market will be bigger than the first. We think that gold at $2000 was high. I think it is going to go much higher. We saw copper at four dollars. I think we will see copper at six or seven dollars a pound. I see nickel going back to twenty dollars a pound. I see oil getting one hundred forty or one hundred fifty dollars a barrel. We are going to have a huge boom in commodities, I’m guessing from 2016 or 2017 for four or five years. We are going to have a very good cycle.”

To get this cycle started, Mr. Bharti believes growth in certain international sectors will push it forward. He said, “I think the engine that will drive this cycle of growth is not so much China, but it will be India and Africa. Latin America has had its share of investments over the last ten or fifteen years and they have so much money, but Africa is really getting itself together now. I see huge potential there for growth. I see India as the driving force behind that growth. The new Prime Minister seems very pro-business and he is getting rid of corruption and cleaning up the country. These are all very good signs. I see great potential there. That is my view of the resource industry. Within the resource industry, one of the areas that is most exciting is precious metals, which is always exciting.”

Mr. Bharti believes that fiscal issues may drive commodities into higher price brackets. He said, “There is no way we can live in a no interest rate environment or a negative interest environment and imply that we aren’t printing money. It has to imply that. When we are printing money it basically means that we are destroying the wealth of the seniors and their pension plans. Ultimately, that always leads to inflation. We will see precious metals in 2017 and 2018 go really high. I see silver going to over fifty dollars an ounce.”

Another area where Bharti sees upcoming growth is in agriculture. He said, “I also see agriculture soaring. There is only so much arable land left. Today, it is not a possibility to burn trees down to get more land. That means land will get more expensive as well as the nutrients that will help the land, like potash. You will also see that energy for land will get more expensive. Energy will come back because the population will continue to grow. People need energy. Oil is here to stay as a while. Some of the other units will come into play. These areas will empower the next cycle. Africa is still a big player. The problem has always been political issues and corruption, but that is changing.”

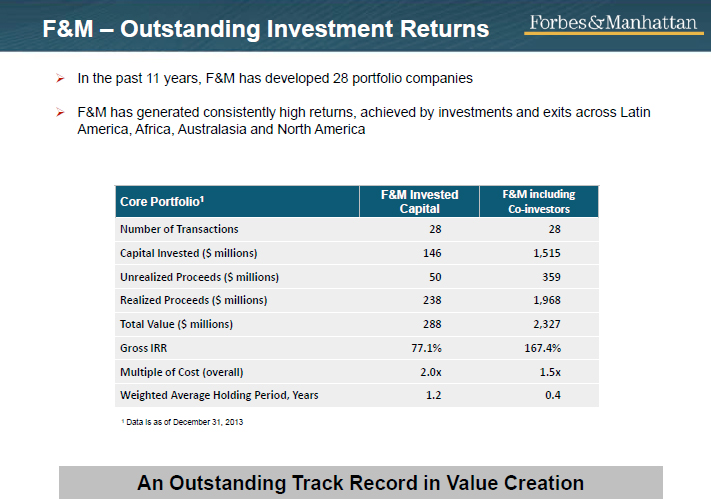

Bharti’s company continues to find options in the markets. Said Bharti, “How does Forbes of Manhattan fit in? In 2001, when we started this business our philosophy was to find good assets and sell them to majors. Two years ago, we sold Avion. We built it and sold it for $500 million dollars in a country where there had been a coup. Before that, we sold Desert Sun and Crocodile Gold. If you look at the track record, we have sold eight to ten billion dollars of assets after building them up from scratch. If you had invested in all Forbes deals at the beginning, the return would have been 50% annually. No one else can boast this type of return.

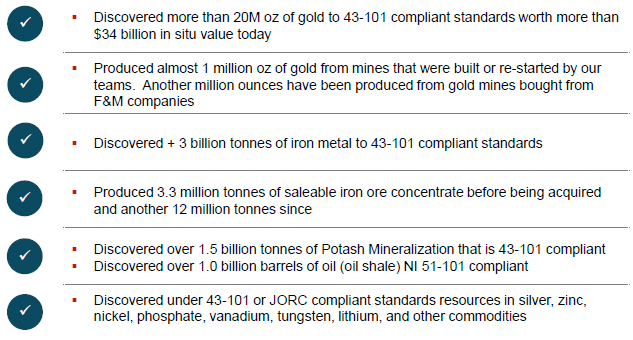

Forbes & Manhattan Accomplishments in the last ten years:

Going forward, we are focused on the following key assets:

- 1. We have a gold asset in Brazil and we have seven million ounces as well as a feasibility that will come out. We have a new management team to run this project through to production.

- 2. In the agricultural space, we have Brazil Potash with two big PE funds that are behind it. It is our plan to keep it private for now.

- 3. We have two companies, Aberdeen and Sullivan that are investment vehicles with close to $60 million in cash and assets.

For more information on Forbes of Manhattan, visit their website at www.forbesmanhattan.com.

|

| More in Leadership Spotlight

|

Interview with Rob McEwen, Chairman & Chief Owner of McEwen Mining (NYSE: MUX, TSX: MUX): Rapidly Growing Gold and Silver Producer in the Americas

McEwen Mining Inc. (NYSE: MUX, TSX: MUX) is a growing gold and silver producer in the Americas, with operations in Argentina, Mexico, Nevada, and Canada. The Company's goal is to qualify for inclusion in the S&P 500. We learned from Mr. Rob McEwen, Chairman & Chief Owner of McEwen Mining, that in 2019 the company will be producing 200,000 ounces gold equivalent. It’s internal growth pipeline could add another 50% to the company's annual production over the next four years, bringing it to 300,000 ozs. According to Mr. McEwen, in order to qualify for the S & P, they need to get to an annual production rate in excess of 600,000 ounces a year and have a credible growth pipeline to 1 million ozs. per year. Plans for 2019 include commencing commercial production at the company's Gold Bar mine in Nevada, as well as cost-reduction and exploration work in Timmins, and innovative in pit tailings disposal in Mexico. McEwen Mining is incorporated in the state of Colorado. |

Leadership Spotlight: Scott Mclean President and CEO of Transition Metals Corp. (XTM -TSX.V) Interview by Allen Alper Jr.

While at the Sprott Natural Resource Symposium in Vancouver, Canada, we met with Scott McLean, HBSc. P.Geo. and President and CEO of Transition Metals Corp. (XTM -TSX.V), a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into discoveries. Mr. McLean won the Prospector of the Year Award, from the Prospectors and Developers Association of Canada (PDAC), back in 2004, and in 2014 the Transition Metals team won The Ontario Discoverers of the Year, for their Sunday Lake platinum palladium discovery in Thunder Bay.

Scott has over 30 years of experience including 23 years with Falconbridge Limited in exploration and management resulting in the discovery of various mineral deposits including the 17 million tonne Nickel Rim South deposit in Sudbury, Ontario. He was also appointed to the transitional board of the Association of Professional Geoscientists of Ontario and has represented the profession as President. In addition to Transition Metals, Mr. McLean sits on the boards of Tesoro Minerals Corp, Sudbury Platinum Corporation (private), Carolina Gold Resources Inc. (private) and Canadian Gold Miner (private).

|

Rob McEwen Chairman and Chief Owner of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) Interview with Dr. Allen Alper

Rob McEwen, Chairman and Chief Owner of McEwen Mining Inc., is the founder and former Chairman and CEO of Goldcorp Inc., which is one of the largest gold producers in the world. During the last thirteen years, when Mr. McEwen was Goldcorp's CEO, the company’s market capitalization grew from $50 million to over $8 billion and its share price grew at a compounded annual rate of 31%. Mr. McEwen was awarded the Order of Canada in 2007 and the Queen Elizabeth's Diamond Jubilee Award in 2013. He holds an Honorary Doctor of Laws and an MBA from York University and a BA from the University of Western Ontario. Also, he received the 2001 PDAC Developer of the Year Award and was inducted into The Canadian Mining Hall of Fame in 2017. Rob and his wife, Cheryl, have donated more than $60 million to encourage excellence and innovation in healthcare and education. |

Joseph Grosso, Executive Chairman, President and CEO of Golden Arrow Resources (TSX-V: GRG, FSE: GAC, WKN: A0B6XQ, OTCQB: GARWF): A Pioneer in the Development of Argentina Mining

Golden Arrow Resources Corporation (TSX-V: GRG, FSE: GAC, WKN: A0B6XQ, OTCQB: GARWF) is an exploration company earning production income. The company has a successful track record of creating value by making precious and base metal discoveries and advancing them into exceptional deposits. Golden Arrow owns a 25% share of Puna Operations Inc., a joint venture operated by SSR Mining, with more than 8 years of forecast production and upside potential at the Pirquitas -Chinchillas silver mining project. We learned from Joseph Grosso, Executive Chairman, President and CEO of Golden Arrow Resources, that he has been the pioneer in Argentina at a very early stage in 1993 and now holds close to 500,000 acres of a lease land, and has made three discoveries. According to Mr. Grosso, the 25% that Golden Arrow owns in Puna Operation has an income potential, for decades to come, and he feels that their shareholders will be drawing great values from this income |

Interview with Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF)

Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF), a Canadian mining exploration and development company, focused on its 100% owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon Territory, Canada. Based on 2015 PEA, the Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit producer of platinum, palladium, gold, nickel and copper. Dr. Diane Garrett, President and CEO of Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF), a Canadian mining exploration and development company, focused on its 100% owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon Territory, Canada. Based on 2015 PEA, the Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit producer of platinum, palladium, gold, nickel and copper. |

Click here for all Leadership Spotlight articles...

|

|